Cartes Bancaires begins rollout of new contactless payment card limit

NFCW

JUNE 27, 2024

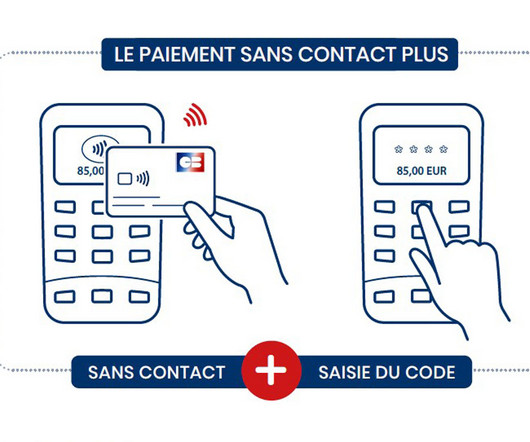

To use the service, the merchant enters the transaction amount in the usual way and the customer then taps their contactless card to the merchant’s payment terminal. If the amount is over €50, they will then be prompted to enter their PIN so that the transaction can then be authorized.

Let's personalize your content