Cartes Bancaires begins rollout of new contactless payment card limit

NFCW

JUNE 27, 2024

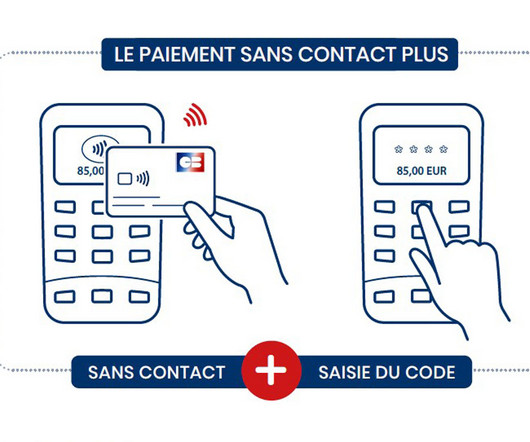

To use the service, the merchant enters the transaction amount in the usual way and the customer then taps their contactless card to the merchant’s payment terminal. . Cartes Bancaires begins rollout of new contactless payment card limit was written by Sarah Clark and published by NFCW.

Let's personalize your content