Introducing Journal Entry Management: Adding Controls and Streamlining Accounting

FloQast

DECEMBER 4, 2024

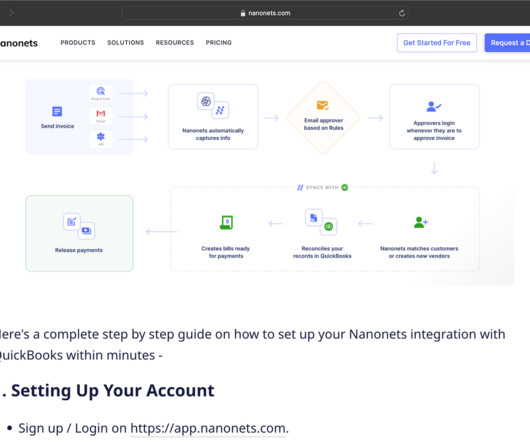

The Challenges of Journal Entry Management The manual preparation and management of journal entries are often riddled with challenges that waste time and increase the risk of errors: High Volume & Complexity : As financial transactions increase in complexity and volume, so does the difficulty in tracking and managing accurate journal entries.

Let's personalize your content