How to Use AI in Bank Statement Processing

Nanonets

SEPTEMBER 25, 2024

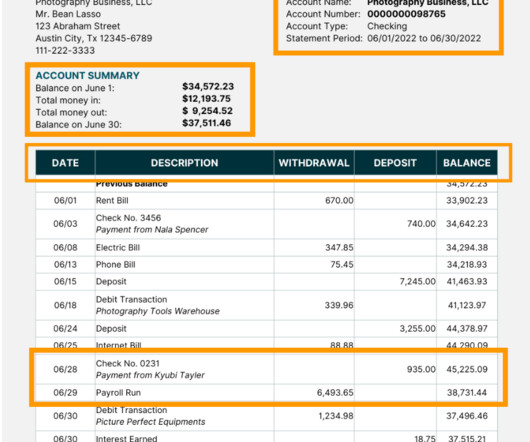

Set up rule-based workflows to identify and remove any duplicate entries and human review for complex or ambiguous transactions. For instance, if the bank statement shows a $1,000 deposit on a specific date, it matches the corresponding entry in the accounting records. Use advanced matching engines to create customizable match rules.

Let's personalize your content