What is document capture?

Nanonets

NOVEMBER 14, 2023

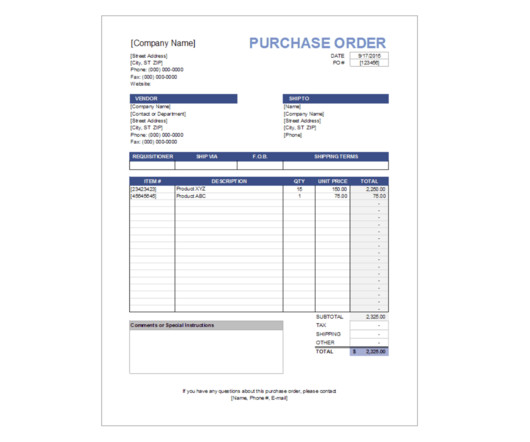

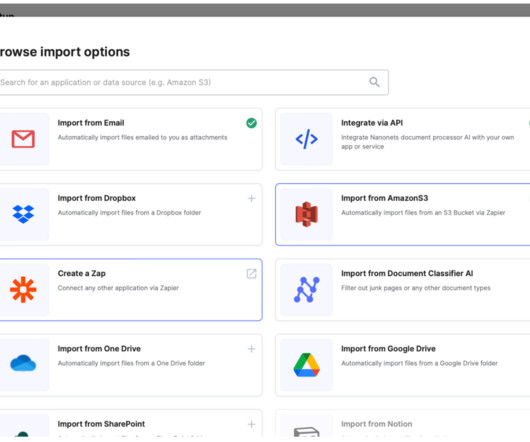

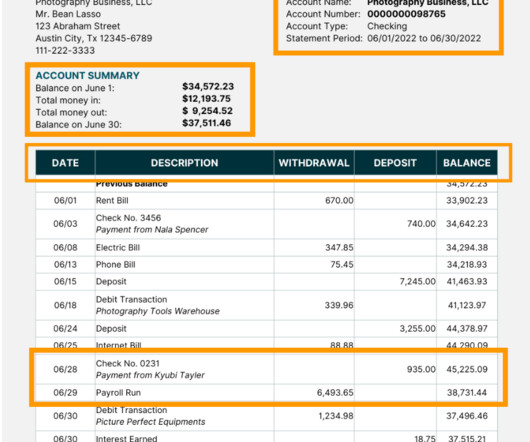

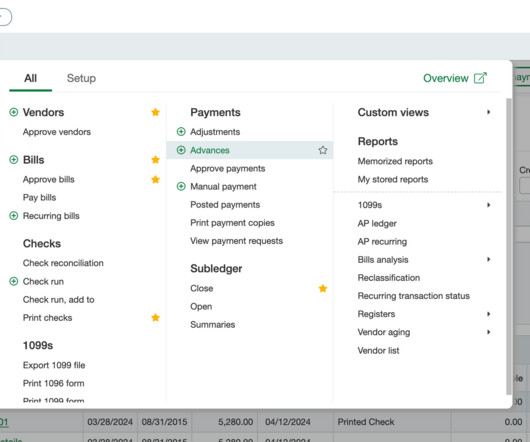

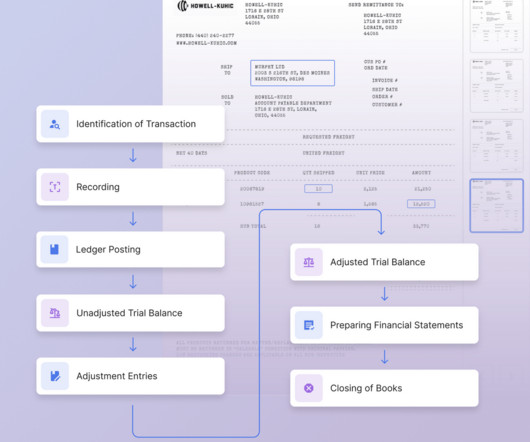

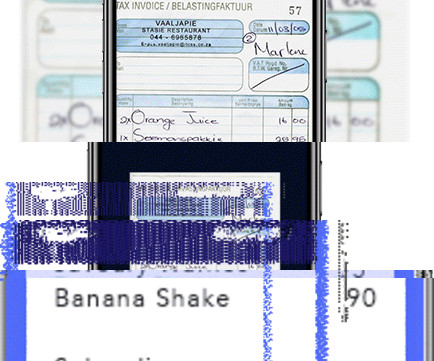

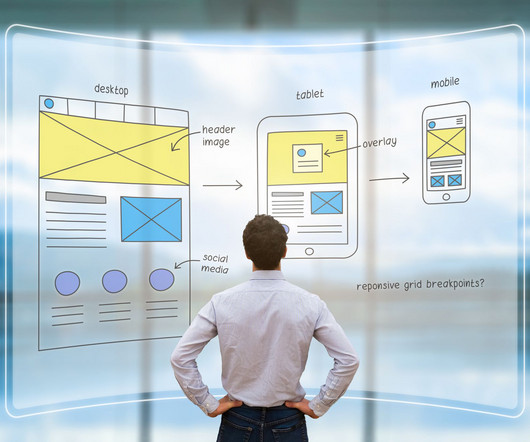

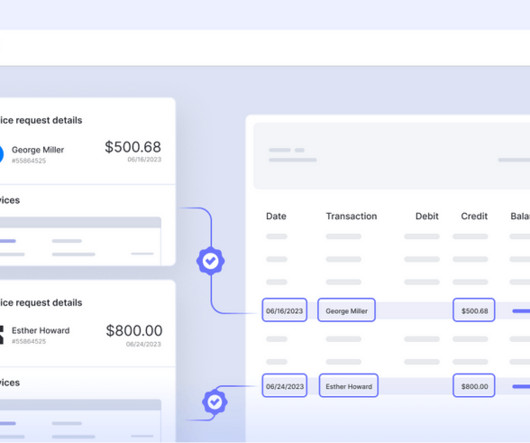

All organizations, irrespective of size, deal with a myriad of documents that contain vital information and data required for its functioning. Daily inundated with data in varied forms, manual management of documents and data can easily overwhelm teams, leading to confusion and inefficiency. How does Document Capture Work?

Let's personalize your content