Exploring The Different Types of Reconciliation

EBizCharge

NOVEMBER 11, 2024

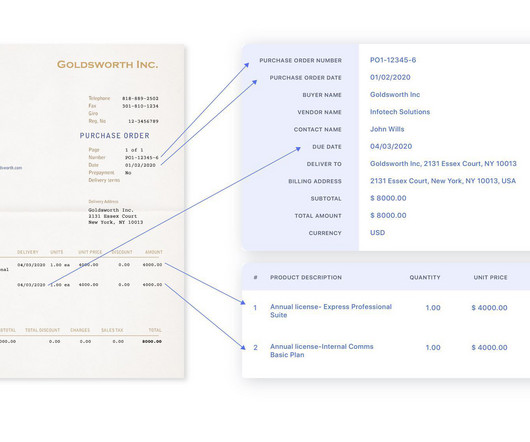

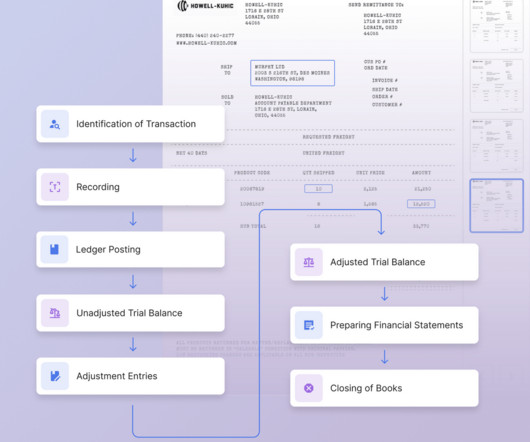

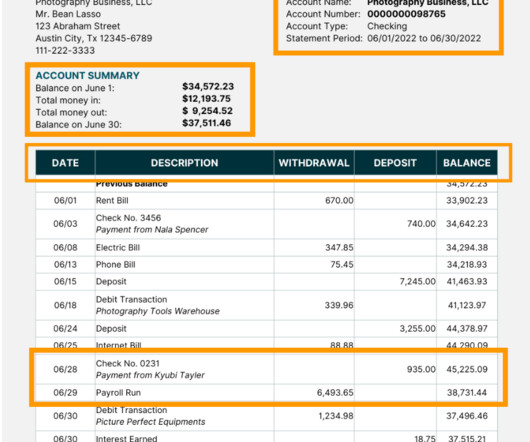

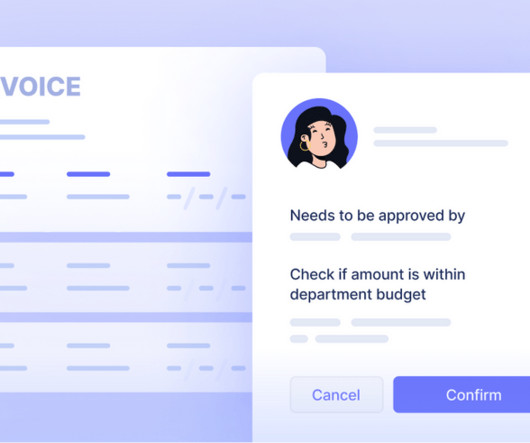

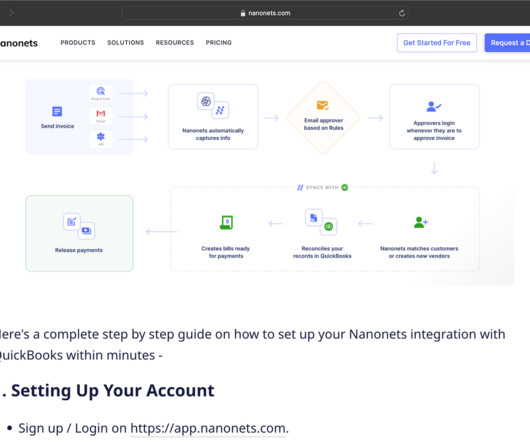

With several types of accounting reconciliation, each serves a distinct purpose, whether it be cash-based methods or more intricate multi-step processes. What is reconciliation? Reconciliation is a financial process that ensures that two sets of records align accurately, such as internal financial records and external statements.

Let's personalize your content