Guide to Vendor Account Reconciliation Process

Nanonets

APRIL 3, 2024

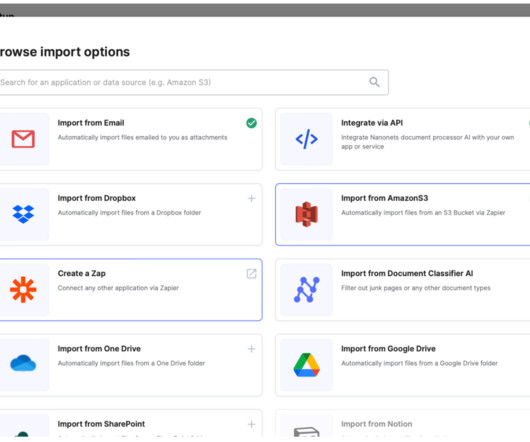

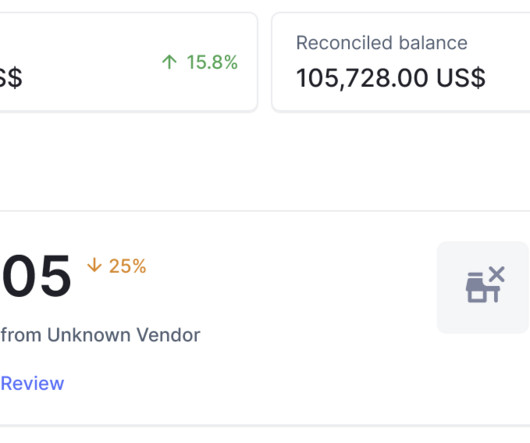

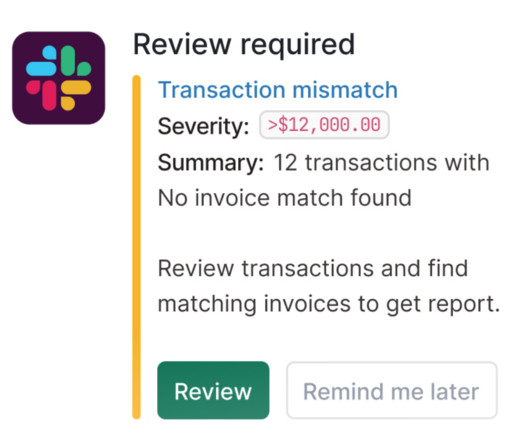

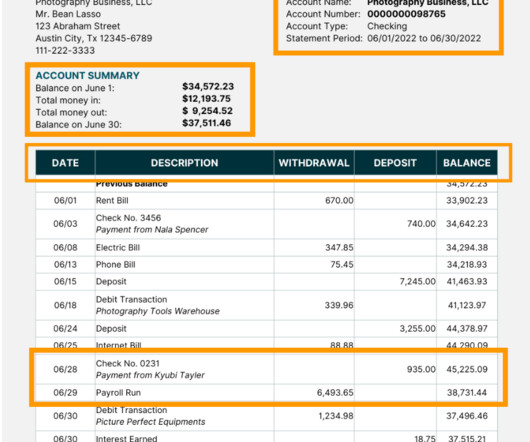

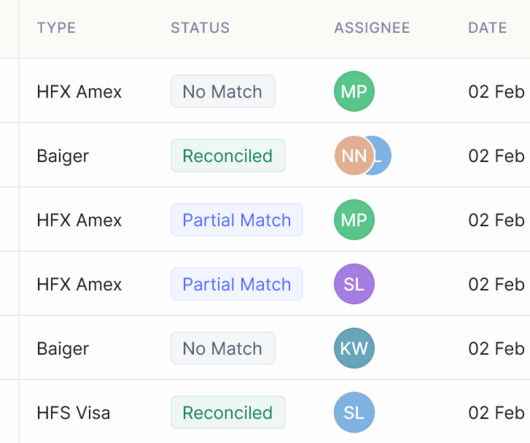

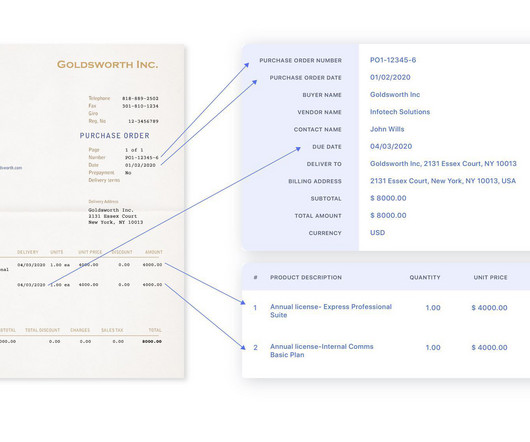

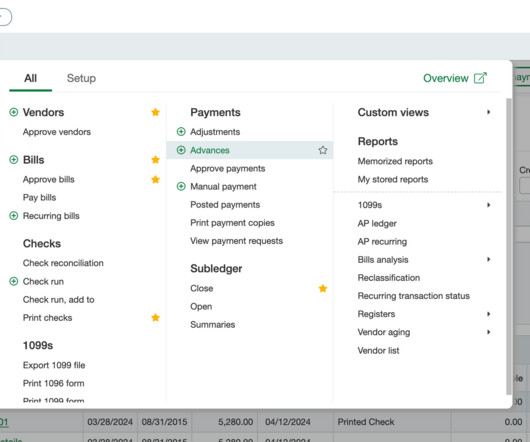

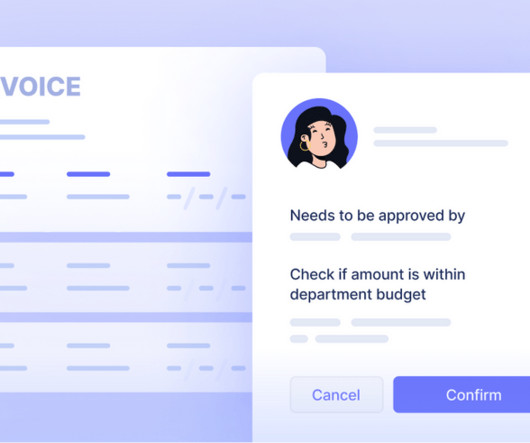

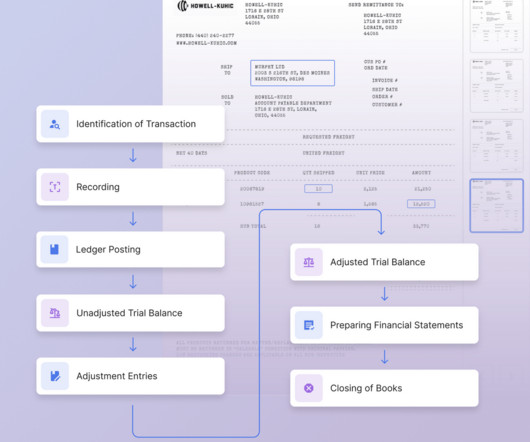

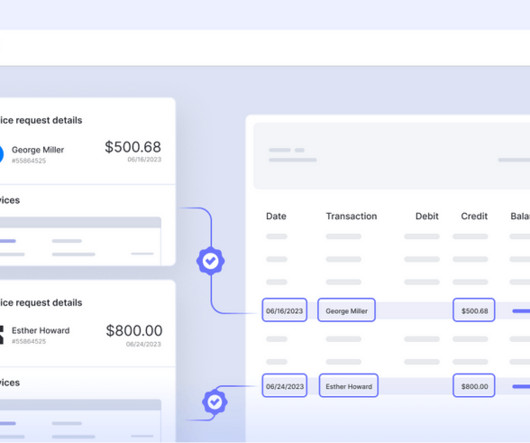

This process involves comparing the company's accounts payable data, which includes invoices, purchase orders, receipts, and statements, with the corresponding records maintained by the vendors. Any discrepancies, such as duplicate payments or missing entries, must be identified. Why is Vendor Reconciliation Important?

Let's personalize your content