Guide to Vendor Account Reconciliation Process

Nanonets

APRIL 3, 2024

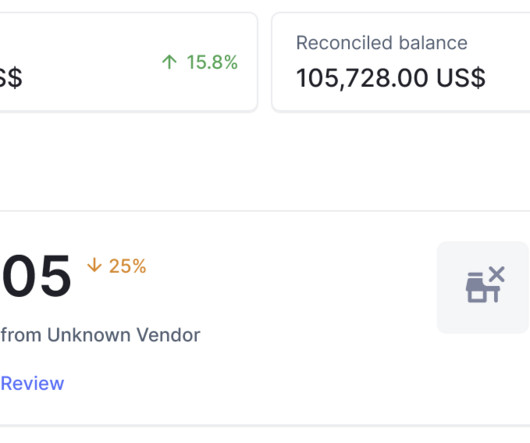

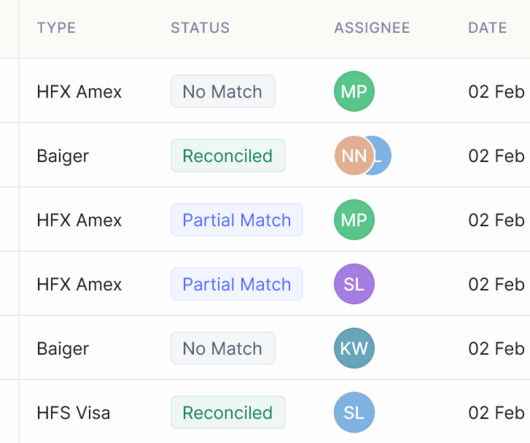

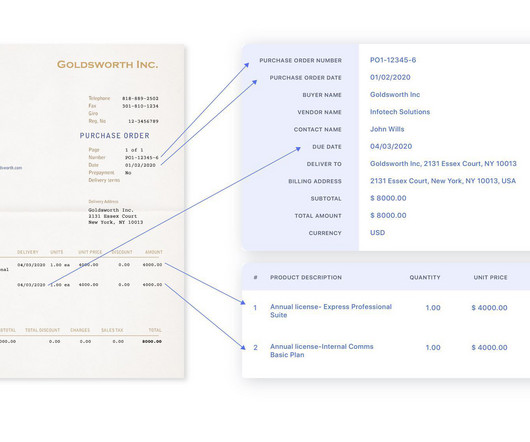

This process involves comparing the company's accounts payable data, which includes invoices, purchase orders, receipts, and statements, with the corresponding records maintained by the vendors. This ensures consistency and facilitates data organization and management. Why is Vendor Reconciliation Important?

Let's personalize your content