Guide to Vendor Account Reconciliation Process

Nanonets

APRIL 3, 2024

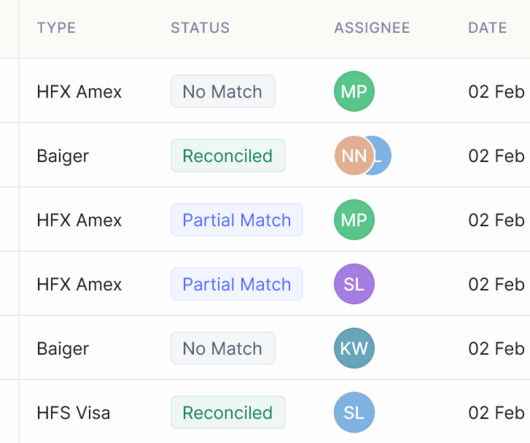

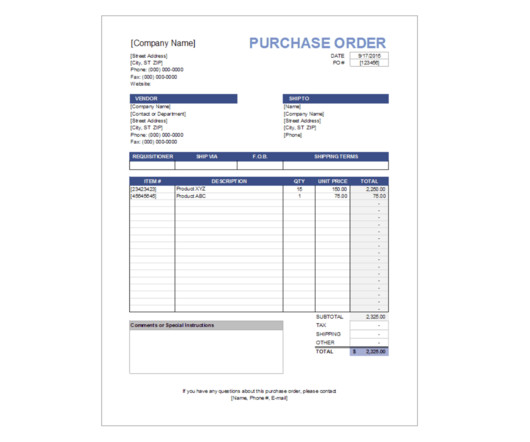

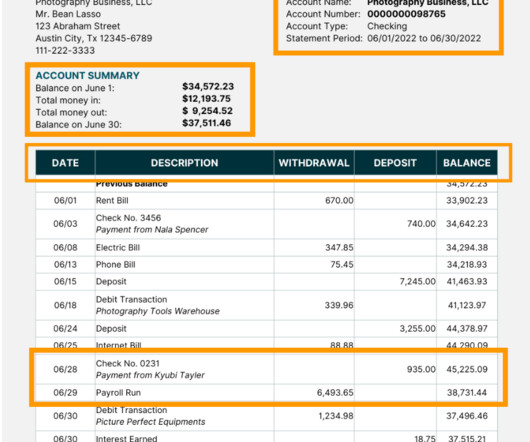

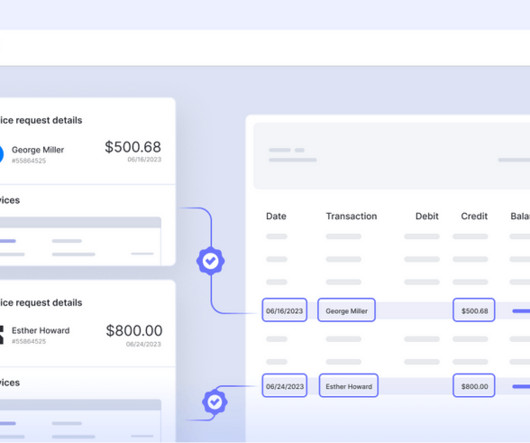

The vendor reconciliation process is the systematic procedure of verifying and aligning the financial records of a company with those of its vendors. Verification of Payment Records: Payment records, such as checks or electronic confirmations, need to be compared with corresponding vendor invoices and entries in the accounts payable system.

Let's personalize your content