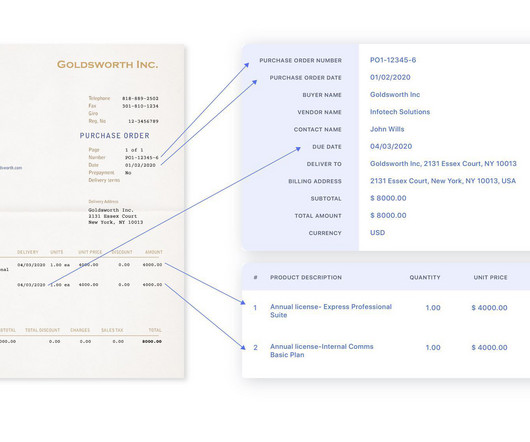

Automating Invoice Processing with OCR and Deep Learning

Nanonets

JULY 14, 2023

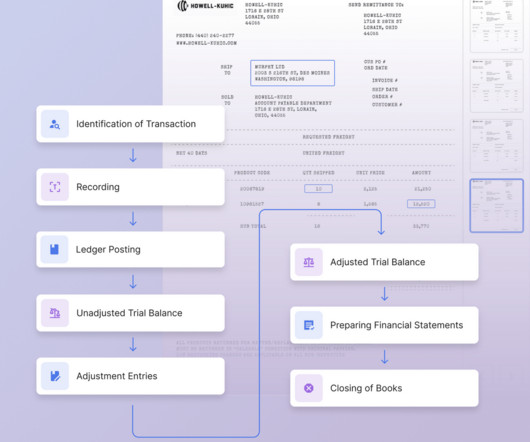

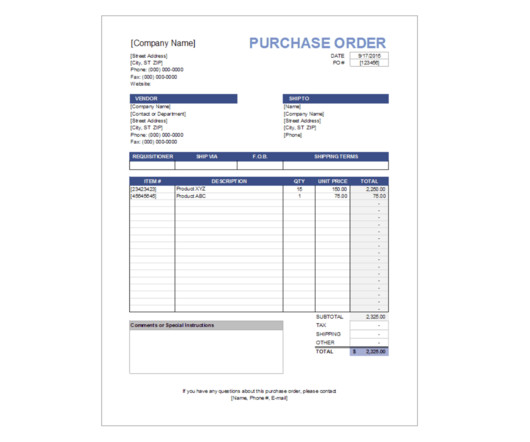

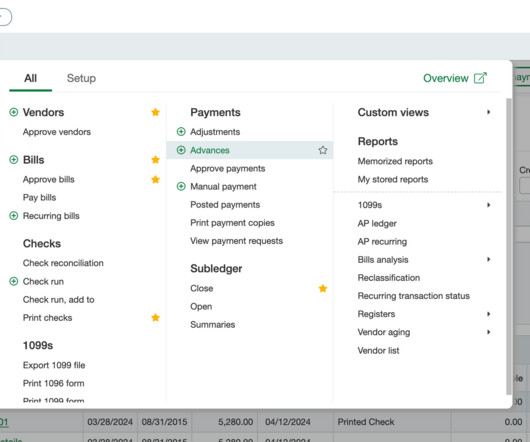

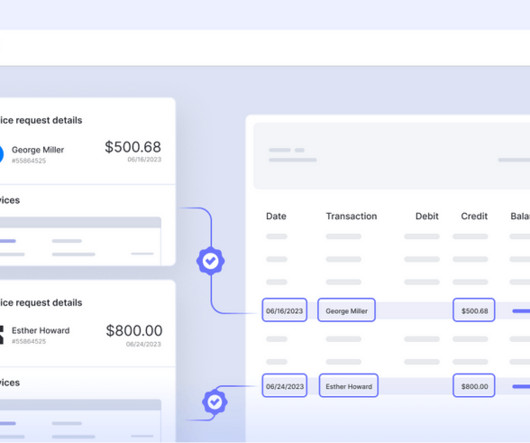

We will also touch upon what is wrong with the current state of invoice recognition OCR and information extraction in invoice processing. For a long time, we have relied on paper invoices to process payments and maintain accounts. But can this process be done better, more efficiently, with less wastage of paper, human labor and time?

Let's personalize your content