RAKBANK Completes International CBDC Transaction Using eCNY and Digital Dirham

The Fintech Times

SEPTEMBER 11, 2024

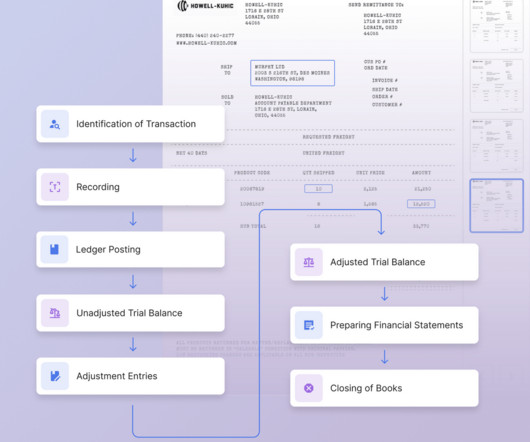

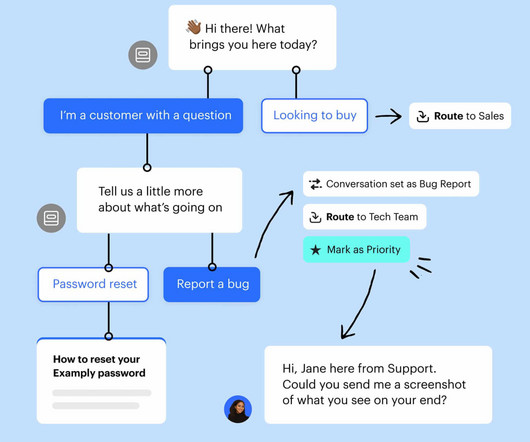

This includes high costs, slow processing times, and operational complexities. Additionally, this platform allows participating central and commercial banks to conduct real-time, peer-to-peer cross-border payments and foreign exchange transactions.

Let's personalize your content