Data Breaches 101: What They Are And How To Prevent Them

VISTA InfoSec

FEBRUARY 25, 2024

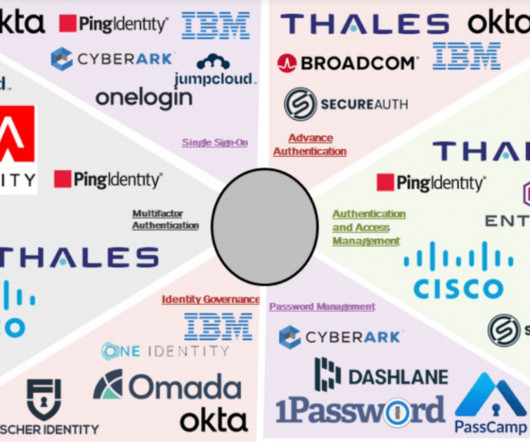

They take advantage of vulnerable software, stolen credentials, tricked employees, business partner access, unencrypted transfers, and even insider threats to penetrate networks. For customers exposed to breaches, identity theft risks skyrocket, leading to bank/credit card fraud plus medical/tax/employment fraud.

Let's personalize your content