Credit card delinquencies rise even as credit limits are extended

Payments Dive

AUGUST 6, 2024

The two developments stem from greater use of credit cards, and could have implications for some businesses, says a Bain & Company analyst.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Payments Dive

AUGUST 6, 2024

The two developments stem from greater use of credit cards, and could have implications for some businesses, says a Bain & Company analyst.

EBizCharge

NOVEMBER 22, 2024

Have you ever had a transaction that didn’t go through due to a temporary hold on your credit card? A temporary hold on a credit card is more common than you might think, often triggered by various factors ranging from overdue payments to suspicious transactions. What is a credit card hold?

Payments Dive

SEPTEMBER 16, 2024

The agency says Horizon Card Services violated the Truth in Lending Act by charging fees as high as 60% of a customer’s credit limit, and all but refusing to cancel their cards.

Fintech News

OCTOBER 7, 2024

Digital bank GXS has launched the GXS FlexiCard , a credit card that charges flat fees on outstanding balances rather than traditional revolving interest. With the GXS FlexiCard, these consumers now have the opportunity to start building their credit history.

EBizCharge

AUGUST 22, 2024

As consumers increasingly rely on digital transactions, they may face the frustrating experience of a declined credit cards. What are credit card decline codes? Credit card decline codes are specific error messages issued by a card issuer or bank when a credit card transaction can’t be processed.

EBizCharge

JULY 10, 2024

Understanding the nuances of a business charge card versus a credit card is essential for any company looking to optimize its purchasing power and financial management. Charge cards, often overshadowed by their credit card cousins, offer unique benefits for businesses.

PYMNTS

MAY 4, 2020

Nearly 50 million credit card customers in the U.S. said they have had their credit limit slashed or their card closed in the past month as lenders move to minimize their risk amid the COVID-19 shutdown, a new study revealed. The sample size was 2,552 adults, including 1,230 adults with personal credit card debt.

PYMNTS

DECEMBER 23, 2020

In the wake of the collapse of its initial public offering of stock (IPO), China’s Ant Group is scaling back the borrowing limits for some of the young users of Huabei. That arm of the financial technology (FinTech) giant offers a virtual credit card. The company did not elaborate.

The Fintech Times

FEBRUARY 14, 2024

TotallyMoney , the personal finance app, has introduced a new feature aimed at improving the credit card application process. With millions of UK adults experiencing credit rejection and facing potential downselling practices by lenders, the introduction of this feature aims to address these challenges.

FICO

FEBRUARY 7, 2022

Credit limit management is regarded as a key driver to profitable portfolios. Credit limit increase optimization (CLI) is a powerful tool to achieve portfolio goals. Credit limit increase optimization (CLI) is a powerful tool to achieve portfolio goals. The Power of FICO Credit Limit Increase Optimization.

M2P Fintech

AUGUST 8, 2023

The credit card industry in India is booming. crore* credit cards in circulation, a substantial jump from 7.5 But only 5%** of the population has a formal credit card. This is a huge opportunity for credit card issuers. Currently, there are 8.5 crore just a year ago.

FICO

JUNE 21, 2022

Credit Card Limit Optimization: Akbank Wins with FICO Analytics. Leading Turkish retail bank wins FICO ® Decisions Award for AI, machine learning & optimization using FICO decision optimization technology for credit limits. However, credit loss is also affected by the assigned limits. by Nikhil Behl.

Payments Source

FEBRUARY 24, 2021

Capital One Financial has begun to lift borrowing limits for certain customers as it seeks to restart growth in its sprawling credit card business.

Fintech Finance

JANUARY 9, 2024

In a significant move towards modernising business-to-business (B2B) payment processes, PayMate India SPC, a leading B2B digital payments company, has signed a Memoranda of Understanding (MoU) with the National Bank of Oman (NBO) to digitise, automate, and streamline B2B payments using Visa Business Credit Cards.

The Paypers

JULY 20, 2022

US-based fintech X1 has set to roll out its income-based credit card to the public, with a reportedly 5x higher credit limit than traditional card providers.

Payments Source

FEBRUARY 12, 2019

Norway stepped in to limit the growth of high interest rate consumer loans and credit card debt to protect the economy from ballooning household leverage amid rising interest rates.

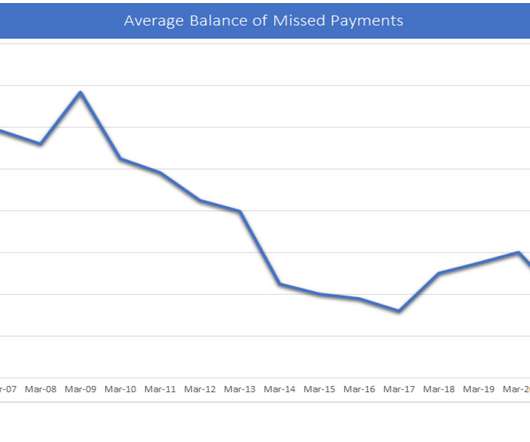

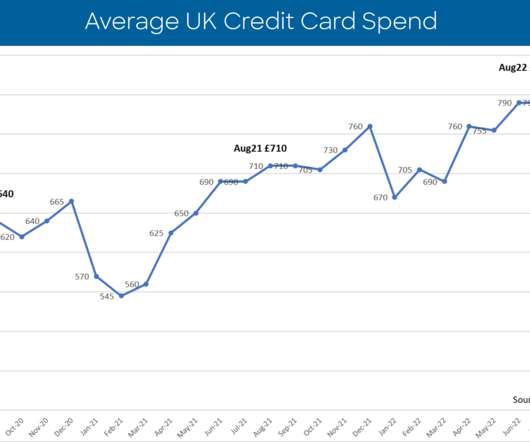

FICO

SEPTEMBER 13, 2022

UK Credit Card Trends: From 2008 Crash to Cost-of-Living Crisis. Changes in card management, customer behaviour and regulations make card delinquencies and other trends very different from the crash of 2008. How FICO Can Help You Manage Credit Card Risk and Performance. Read more posts on UK cards.

PYMNTS

DECEMBER 23, 2020

Ant Group Curbs Credit Limits Of Some Users Of Virtual Credit Cards. Ant Group of China is scaling back the borrowing limits for some of Huabei's young customers. That arm of the FinTech company provides a virtual credit card.

Fintech News

MAY 29, 2024

It is a new feature embedded in the company’s virtual credit card solution. JULO, which has been in the fintech industry for seven years, aims to promote financial inclusion in Indonesia through its virtual credit card. The entire process can be managed through the JULO app.

Fintech Finance

JULY 25, 2024

alt.bank , whose novücard is Brazil’s only credit card with automatically increasing limits, migrated its legacy credit card infrastructure to Pismo in just five months. “To enable the delivery of the services we are creating, we need flexible, up-to-date, and reliable technology. .

Fintech Finance

JANUARY 15, 2024

Capital on Tap, a global FinTech providing an all-in-one business credit card and spend management platform, today introduced Preloading. This first-of-its-kind functionality allows customers to extend their spending capabilities beyond their existing credit limit.

PYMNTS

SEPTEMBER 23, 2016

Americans are carrying more debt than ever before and paying some of the highest credit card rates every recorded, according to new data. The national average annual percentage rate (APR) for credit card debt is 15.22 percent, according to CreditCards.com’s weekly Credit Card Rate Report. percent was in Dec.

PYMNTS

MAY 5, 2020

However, credit card balances have dropped compared to before the coronavirus pandemic. That decrease in credit card balances comes even as the credit limits have been increased by $34 billion, leaving $3 trillion available in credit card lines.

FICO

MARCH 19, 2018

In our proprietary P&L Insight Benchmark Reporting Service , FICO has seen some worrying signs for UK credit card accounts 1-5 years on book ; these accounts are showing high lines, high spend and increasing delinquency. First, avoid opening credit that you don’t actually need.

Fintech Finance

JULY 25, 2024

Kasheesh , the first digital payment platform that allows anyone to split payment for online purchases anyway they want across multiple credit cards, today announces the launch of the Multi Use Card. The Multi Use Card is now available to all Kasheesh customers any place where Mastercard debit cards are accepted in the U.S.

Fintech News

JANUARY 17, 2024

Customers can select their repayment dates, choose loan tenures in months, and adjust credit limits via the app. Hasan Khan Hasan Khan, Head of Credit Card & Lending at Trust said, “Flexible finance is something that makes a big difference to our customers.

PYMNTS

APRIL 23, 2020

Hard times are hitting many people where it hurts – right in the credit cards they carry in their wallets or eWallets. Customer spending limits are being cut by top credit card companies. Discover Financial Services said in a regulatory filing that more of its customers are asking to skip payments.

PYMNTS

OCTOBER 20, 2020

This shift in buying behavior is likely here to stay, too, leading more customers to use card-based payments to complete their purchases when shopping online. This is the focus of Understanding Frictions In Credit Card Transactions: How Transaction Disputes And Declines Impact Merchants’ Reputations, a PYMNTS and PAAY collaboration.

PYMNTS

JANUARY 14, 2021

Silicon Valley credit card startup X1 raised $12 million in a funding round led by Spark Capital, a backer of Twitter, Plaid, Slack and Affirm. 14) press release that the company has received a positive response to the credit card’s debut, with almost 300,000 users signing up for the waiting list.

Finovate

OCTOBER 15, 2024

By combining Brex’s multi-faceted financial infrastructure with Navan’s travel management system, companies benefit from higher credit limits, local currency options, and automated reconciliation, making it easier to scale travel programs globally while saving time and reducing costs.

PYMNTS

DECEMBER 21, 2020

21) from its latest Survey of Consumer Expectations (SCE) Credit Access Survey , which showed most credit applications and acceptance rates falling sharply after February this year. The largest declines were from credit card and credit limit requests, with auto loans in second place.

Fintech News

SEPTEMBER 4, 2024

Through partnerships with credit bureaus, the app also provides access to users’ credit scores, enabling them to explore opportunities for credit cards, loans, and other financial products. It also includes a marketplace where users can compare credit cards and insurance plans tailored to their needs.

PYMNTS

APRIL 4, 2018

For the 47 percent of Americans with prime credit scores, getting and using a credit card isn’t much of a problem. The problem, Petal co-founder and CEO Jason Gross told Karen Webster, is that it leaves around half of all Americans with only a few options: a credit card with expensive strings or no credit at all.

FICO

MAY 30, 2017

As the UK’s Financial Conduct Authority proposes that issuers reduce or waive interest rate charges for persistent credit card debt, it raises the question: Just how much credit card debt do Britons carry? The card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service.

FICO

OCTOBER 19, 2022

Analysis of the largest consortium of UK cards data and trends shows the percentage of consumers using their credit card to take out cash steadily increasing over the three months – a clear indicator of financial stress and future risk as the interest charged for cash on credit cards is always higher than standard purchases.

FICO

SEPTEMBER 8, 2021

Paying off credit cards. By reducing their revolving debt, they lowered their credit utilization ratio (credit card balances divided by credit limits), which is an important factor in this category. Another observation of note, fewer consumers in lower score ranges were actively seeking credit.

Fi911

JULY 8, 2024

Fraudsters exploit vulnerabilities in online payment systems and often use stolen credit card information or create fake accounts to make unauthorized purchases. Bust Out Fraud Bust out fraud is a method where fraudsters build up a credit profile over time, only to max out the credit limits on various accounts before disappearing.

PYMNTS

NOVEMBER 11, 2019

Apple Co-founder Steve Wozniak said Apple gave him a credit limit 10 times higher than they gave his wife after they both applied for an Apple Card, which is a credit card the tech giant recently released with the help of Goldman Sachs, according to a report by CNN. Apple launched the Apple Card in August.

PYMNTS

JUNE 8, 2020

All in, consumer credit took a $68.8 billion hit in April, with revolving debts like credit cards taking the hardest hit — falling by a steep 64.9 Non-revolving credit — including student loans and auto loans — fell as well, but only by 4 percent. Second, they have on average much higher credit lines to begin with.

Fi911

SEPTEMBER 12, 2024

An issuer decline code is provided by an issuing bank to a merchant, indicating the rejection of a credit card transaction. Decline codes are valuable for understanding credit card processing. This means that the issuer has halted or blocked the transaction. There are many reasons for an issuer to decline a transaction.

PYMNTS

NOVEMBER 9, 2020

In addition, consumer loan categories, including credit cards, auto loans and other items, saw the tightening standards. Major net fractions of banks also tightened important terms on credit card loans, including credit limits and minimum credit scores required.".

PYMNTS

OCTOBER 7, 2020

Wyndham Unveils Credit Card For Small Business Travelers. Wyndham Hotels & Resorts and Barclays debuted the first Wyndham credit card designed for small business travelers, according to an announcement. Furthermore, businesses can institute a credit limit and date of expiration for the card.

PYMNTS

SEPTEMBER 18, 2019

18) that it is releasing new developer tools to combat credit card debt. In addition to student loans, developers can retrieve real-time information about credit card accounts to help borrowers understand their financial obligations, consolidate debt across accounts for more favorable terms, and pay down balances faster.

PYMNTS

NOVEMBER 21, 2019

David Solomon, the CEO of Goldman Sachs , is denying claims that gender bias is apparent in the algorithm it uses to determine credit limits for applicants, according to a report by Bloomberg. There’s no gender bias in our process for extending credit,” Solomon said. He said he plans to address the issue fully.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content