As Pandemic Reshapes Consumer Behavior And Credit Risk: In AI We Trust?

PYMNTS

MAY 1, 2020

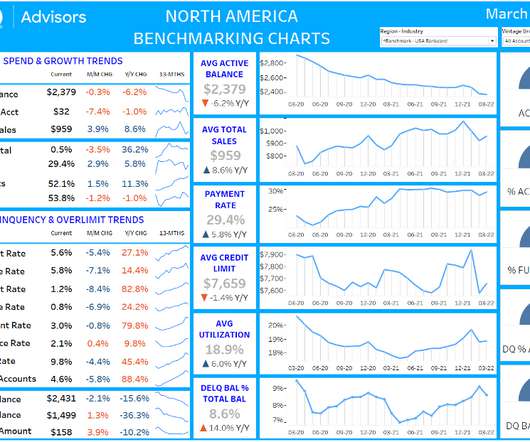

Banks are reserving tens of billions of dollars against potential credit card and loan defaults. They’re eyeing risk exposure while at the same time trying to help consumers get back on their feet. Amid job losses and reduced wages, they’re pulling back on credit card spending and embracing debit transactions.

Let's personalize your content