Is First-Party Fraud a Credit Risk Problem?

FICO

AUGUST 16, 2019

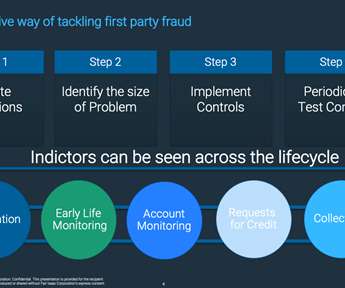

It’s difficult to define the problem and many banking professionals debate the merits of who “owns” the first-party fraud problem — the credit risk group or the fraud group. The Relationship Between Credit Risk and First-Party Fraud. Credit Risk and Fraud Across the Customer Lifecycle.

Let's personalize your content