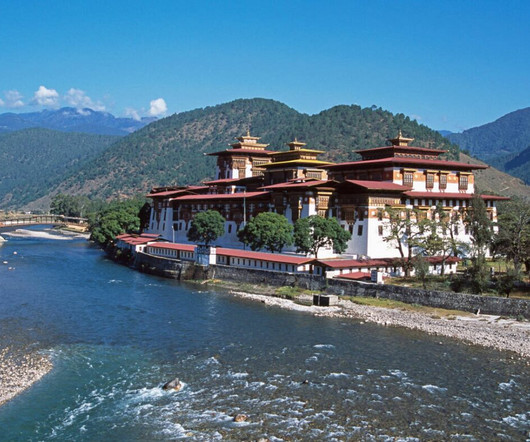

Tracking Credit Risk in a Challenging Economy - South Africa

FICO

JANUARY 21, 2020

The Empirica Score was developed by predictive analytics software company FICO with the aim of equipping organisations that offer credit to their customers with solid risk assessment when determining an applicant’s eligibility for a credit. FICO is a world leader in credit scoring, with credit scores in some 30 countries.

Let's personalize your content