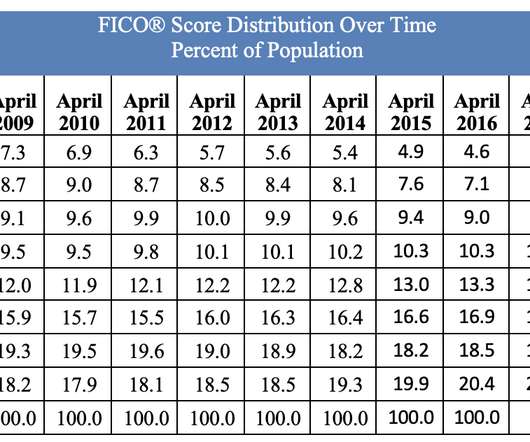

Using Alternative Data in Credit Risk Modelling

FICO

AUGUST 29, 2017

This comment from a participant in our recent EMEA Risk Leadership Forum caused a lot of chuckles and nodding heads. When it comes to evaluating credit risk, everyone wants to know if, when and how lenders will start probing their Facebook account. How Much Value?

Let's personalize your content