PSR Provisionally Proposes to Cap Cross-Border Interchange Fees on Credit and Debit Cards to Protect UK Businesses

Fintech Finance

DECEMBER 13, 2023

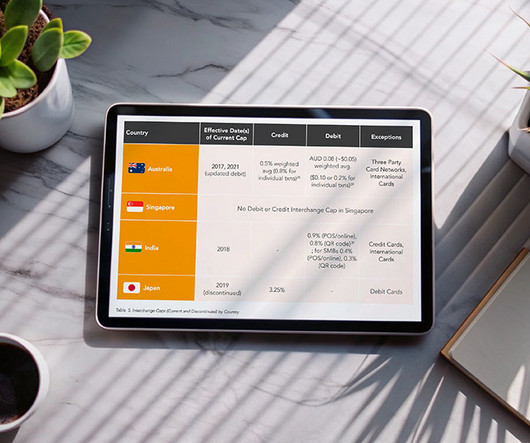

for UK-European Economic Area (EEA) consumer debit transactions and 0.3% for consumer credit transactions (where the transactions are made online[1] at UK businesses) A lasting cap on these interchange fees in the future, once further analysis has been carried out to establish an appropriate level.

Let's personalize your content