APAC Regulators Tackle Rising Card Fees

Fintech News

SEPTEMBER 17, 2024

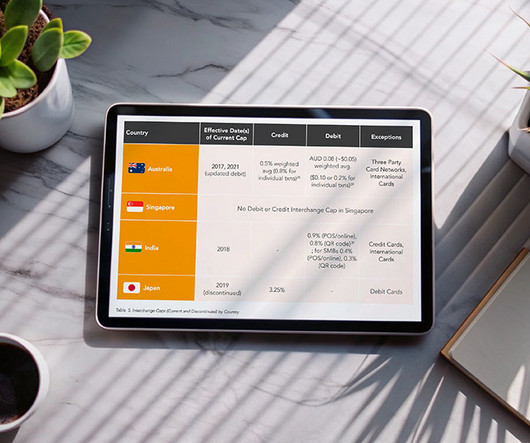

It also explores the increasing adoption of real-time payments, which many countries are embracing as a more efficient and cost-effective alternative to traditional card payments. Australia, for example, introduced caps on interchange fees in 2003 for both credit and debit transactions.

Let's personalize your content