4 Trends Shaping How We Combat Money Laundering In Asia Pacific

Fintech News

JUNE 3, 2024

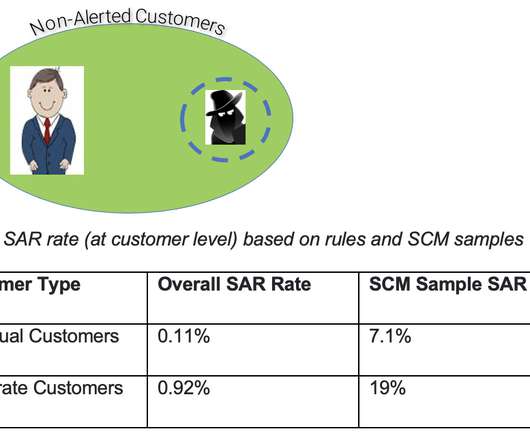

The Asia-Pacific (APAC) region faces significant challenges in combating money laundering due to its diverse economies, large volume of cross-border trade, and varying levels of regulatory enforcement across different countries — the trends of money laundering in Asia Pacific are constantly evolving.

Let's personalize your content