Challenges in Countering Trade-Based Money Laundering

FICO

MARCH 24, 2021

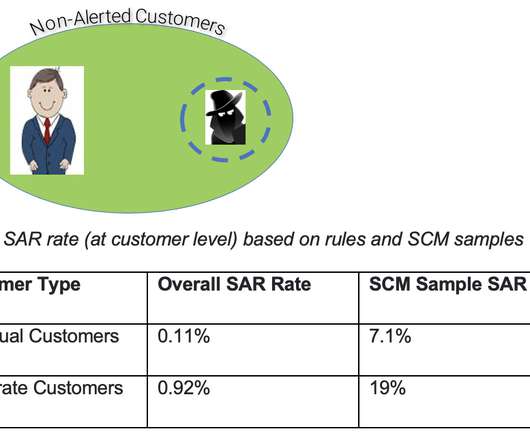

In part 1 of the series on trade-based money laundering (TBML) , we established a definition of the term, explored some recent studies and highlighted some typical techniques employed by the criminals. The graph below shows the trend of TBML-related SARs filed with FinCEN between 2014 and 2018. Financial institutions in the U.S.

Let's personalize your content