Cracking the Code of White-Collar Crime with Sumsub

Fintech News

FEBRUARY 6, 2024

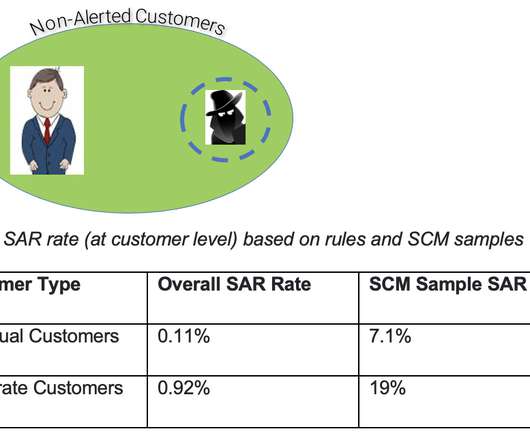

The battle against financial crime is an ever-evolving challenge requiring expert knowledge, cutting-edge technology, and continuous learning. As white-collar criminals tirelessly innovate their methods to commit financial crimes, the question arises: How can one step ahead in this high-stakes game?

Let's personalize your content