Cross-border payment plays rev up

Payments Dive

OCTOBER 10, 2022

The Clearing House, Swift and rivals are jostling to speed up cross-border payments, with collaboration and competition likely to emerge at an international conference this week.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Cross-Border Payments Related Topics

Cross-Border Payments Related Topics

Payments Dive

OCTOBER 10, 2022

The Clearing House, Swift and rivals are jostling to speed up cross-border payments, with collaboration and competition likely to emerge at an international conference this week.

Payments Dive

MARCH 6, 2024

The card network and the cross-border payments company are developing an international payment system that could be used in disaster situations.

Fintech News

NOVEMBER 21, 2024

India is advancing efforts to establish cross-border payment linkages with multiple countries, as reported by Bloomberg, citing an official from the Reserve Bank of India (RBI). T Rabi Sankar Deputy Governor T.

Fintech Finance

NOVEMBER 18, 2024

The current cross-border payment system imposes high costs on businesses and economies worldwide, stifling economic potential and limiting financial inclusivity. Any improvement in the efficiency of cross-border transactions would, therefore, lead to considerable benefits for businesses and individuals globally.

Fintech News

OCTOBER 31, 2024

FXC Intelligence, a data platform specializing in the cross-border payment and e-commerce sectors, has released its annual selection of the world’s most promising cross-border payments companies in 2024. Another company from Singapore featured on the list is Tazapay.

Fintech News

AUGUST 13, 2024

In a recent webinar hosted by the Fintech News Network, experts from the Bank for International Settlements (BIS), Wise, Airwallex, and LexisNexis Risk Solutions explored the latest trends and developments in cross-border payments, emphasizing the pioneering role of Southeast Asia in this rapidly evolving landscape.

Fintech News

OCTOBER 20, 2024

This eliminates the need for complex and costly API integrations, making cross-border payments faster and more affordable. ISO 20022 is also the new industry standard in the process of migration, further streamlining cross-border payment processes. said Alex Johnson, Chief Payments Officer at Nium.

Fintech News

NOVEMBER 12, 2024

Looking ahead, he highlighted Thailand’s efforts to strengthen cross-border payment connectivity through projects like Nexus and mBridge. The post Thai Governor Highlights Data, Cross-Border Payment Initiatives at SFF 2024 appeared first on Fintech Singapore.

Fintech News

APRIL 11, 2024

This burgeoning sector, characterised by its complexity and diversity, demands payment solutions that are efficient and adaptable to the nuanced dynamics of cross-border trade. Amidst the APAC region’s rapid economic ascent and the explosion of digital commerce, cross-border payment practices have noticed an evolution.

Fintech News

MAY 15, 2024

The project aims to explore how tokenisation can improve wholesale cross-border payments. Featured image credit: Edited from Freepik The post BIS’ Project Agorá Opens to Private Sector for Tokenised Cross-Border Payments appeared first on Fintech Singapore.

Fintech News

JULY 15, 2024

Bank Indonesia (BI) and the Bank of Korea (BoK) have signed a memorandum of understanding (MOU) on cross-border payments. The agreement aims to enhance cooperation on the interoperability of cross-border payments and establish a framework for seamless connectivity between Indonesia and South Korea.

Fintech News

DECEMBER 8, 2024

Ant International has joined Swift ‘s “Network Interoperability Reference Implementation” programme, a pre-pilot initiative designed to improve cross-border payment experiences.

The Fintech Times

FEBRUARY 22, 2024

As a result, we set out to investigate the impact the popular technology is going to have on the cross-border payments sector – specifically looking at security. “Artificial Intelligence (AI) will play a pivotal role in elevating security within the cross-border payments space.

Fintech News

JUNE 2, 2024

Swift, the global financial messaging cooperative, has announced two AI-driven experiments in collaboration with member banks to combat cross-border payments fraud which could potentially save the industry billions in fraud-related costs. Fraud cost the financial industry US$485 billion in 2023.

Fintech News

NOVEMBER 5, 2024

This collaboration makes Nium the first fintech payment service provider to join the Partior network, unlocking new capabilities such as programmable enterprise liquidity management and Just-in-Time multi-bank payments for financial institutions.

Fintech News

OCTOBER 16, 2024

Siam Commercial Bank ( SCB ), alongside its venture arm SCB 10X and Lightnet , has launched Thailand’s first cross-border payment system utilising stablecoins, according to CoinGape.

Fintech News

NOVEMBER 6, 2024

Global payments infrastructure provider Nium has expanded its partnership with Kinexys by J.P. Morgan (formerly Onyx) to enhance cross-border payment accuracy in Malaysia, Thailand, and Hong Kong, This makes Nium the first fintech to provide data for validating bank account details in these markets.

Fintech News

JUNE 12, 2024

Rapid globalisation and available technological advancements have spurred the demand for more efficient, transparent, and accessible cross-border payment systems. The G20 Roadmap for Enhancing Cross-border Payments of the Financial Stability Board (FSB) also lists them as a key priority for enhancing such payments.

Fintech News

NOVEMBER 7, 2024

XTransfer, a B2B cross-border payment platform, made its debut at the Singapore Fintech Festival (SFF) 2024 as a Gold Sponsor. The company aims to expand its presence in Southeast Asia, offering secure and efficient payment solutions to SMEs in the region. ” said Bill Deng, Founder and CEO of XTransfer.

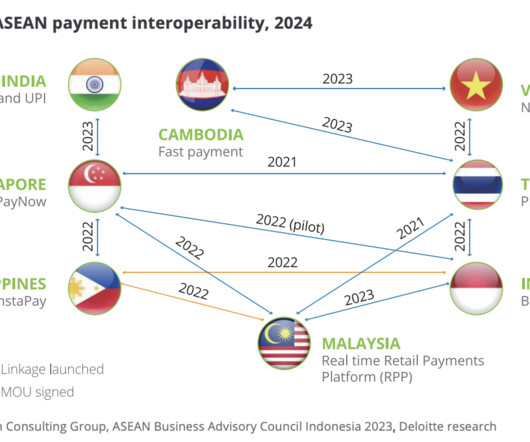

Fintech News

APRIL 3, 2024

The initiative, which began in late 2022, aims to make cross-border payments faster, more affordable, transparent, and inclusive, leveraging technologies like QR code-based and fast payment modalities to improve payment connectivity across the region.

Fintech News

APRIL 24, 2024

Morgan, has introduced Project Carina, a new initiative aimed at accelerating cross-border payments through blockchain technology, according to RYT9. Morgan Set to Reduce Cross-Border Payment Times to Minutes appeared first on Fintech Singapore. Thailand’s KASIKORNBANK , in partnership with J.P.

Fintech News

OCTOBER 23, 2024

Emirates NBD has entered a strategic agreement with Singapore-based blockchain platform Partior to improve its cross-border payment capabilities. The partnership will allow Emirates NBD to offer clients faster, around-the-clock payment processing through Partior’s blockchain-based platform for clearing and settlement.

Fintech News

JULY 16, 2024

Banking software provider Temenos and global payments leader Visa have announced a collaboration to simplify and streamline cross-border payments for banks and their customers. Visa Direct facilitates real-time cross-border and domestic payments, reaching billions of endpoints in over 190 markets and 160 currencies.

Fintech News

JULY 3, 2024

The Bank for International Settlements (BIS) and its partners have revealed the comprehensive blueprint for phase three of Project Nexus, which seeks to address longstanding challenges in international money transfers by leveraging the power of domestic instant payment systems (IPS). How Does Project Nexus Work?

Fintech News

JULY 14, 2024

Ant International and BNP Paribas have entered a strategic partnership to enhance cross-border payment solutions for European merchants and consumers. BNP Paribas will sponsor WorldFirst’s integration into SEPA, allowing WorldFirst’s clients to access real-time payment schemes under SEPA and automate treasury payments.

Fintech Finance

OCTOBER 18, 2024

Nium , the leading global infrastructure for real-time cross-border payments, is thrilled to announce a partnership with Bank Rakyat Indonesia (BRI) to provide Indonesian customers with real-time international money transfer capabilities.

Fintech News

APRIL 3, 2024

This initiative, named after the Greek word for marketplace, aims to delve into the potential benefits of tokenising cross-border payments to enhance the global monetary system’s efficiency. Being a member of the IIF is not a requirement to participate.

Fintech News

APRIL 22, 2024

Global payments company Nium has announced a new partnership with Artajasa, a prominent Indonesian payment infrastructure provider. Featured image credit: Edited from Freepik The post Nium Partners with Artajasa to Enhance Cross-Border Payments in Indonesia appeared first on Fintech Singapore.

Fintech Finance

OCTOBER 21, 2024

Mastercard introduced a new product innovation, Mastercard Move Commercial Payments, that will enable banks to facilitate near real-time, predictable and transparent commercial cross-border payments.

Fintech News

SEPTEMBER 10, 2024

A new report by Deloitte delves into the latest developments in the cross-border payment sector in Asia-Pacific (APAC), identifying four major trends reshaping the landscape and offering significant opportunities for merchants. billion grams of carbon emissions.

Fintech News

JUNE 11, 2024

Licensed as a Major Payment Institution (MPI) by the Monetary Authority of Singapore (MAS), OPAL offers domestic and cross-border payments, payment accounts, and e-money services. Find out how Currencycloud can help you build your payments infrastructure by speaking to one of their experts today.

Fintech News

OCTOBER 29, 2024

Global payments network Thunes has announced a collaboration with Circle , the issuer of regulated stablecoins USDC and EURC. This partnership aims to enhance stablecoin liquidity management in cross-border payments. said Jeremy Allaire, Co-founder and CEO of Circle.

Fintech News

NOVEMBER 20, 2024

Featured image credit: PayPal The post Xoom Enables Partners to Use PayPal USD for Faster Cross-Border Payments appeared first on Fintech Singapore. .” said Jose Fernandez da Ponte, Senior Vice President of Blockchain, Cryptocurrency, and Digital Currencies, PayPal.

Fintech News

AUGUST 7, 2024

Deputy Prime Minister and Minister for Trade and Industry Gan Kim Yong has reiterated the Monetary Authority of Singapore’s (MAS) ongoing efforts to combat cross-border payments scams. The post MAS Reiterates Robust Controls on Cross-Border Payments to Combat Scams appeared first on Fintech Singapore.

Fintech Finance

OCTOBER 22, 2024

Temenos today launched a SaaS enterprise service for cross border payments, empowering Payment Service Providers (PSPs), including banks, electronic money institutions (EMIs) and fintechs, to swiftly launch and lower the cost of cross border payment services.

Fintech Finance

AUGUST 22, 2024

Through a new cross-border payments collaboration between Commonwealth Bank of Australia (CBA) and The Bank of New York Mellon ( BNY ), Australian businesses and individuals who receive international payments from BNY’s customers may now be paid in as little as 60 seconds1 regardless of who they bank with.

Fintech News

DECEMBER 6, 2023

This could lead to more secure, convenient, and cost-effective cross-border payments and remittances. The post Singapore and China to Begin e-CNY Pilot, Explore Cross-Border Payment Linkage appeared first on Fintech Singapore.

The Payments Association

JUNE 25, 2024

Banks are de-banking payment providers, causing major disruptions in cross-border transactions and impacting financial inclusion

Fintech Finance

OCTOBER 8, 2024

billion digital wallets across 145 countries and by leveraging Fabrick’s Banking-as-a Service platform model, the two are creating a unified platform with tailored offerings that streamline payment processes, enhance security, and elevate the customer experience for businesses and financial institutions.

Fintech Finance

OCTOBER 17, 2024

Swift today published new data which reveals continued progress towards meeting the G20’s goal for the speed of cross-border payments, reporting that 90% of cross-border payments made over the Swift network reach the destination bank within an hour. Swift is committed to continuing to support these efforts.”

The Paypers

OCTOBER 22, 2024

dLocal has announced its partnership with USI Money in order to streamline cross-border payments for customers and clients in the region of Asia and Africa.

Fintech Finance

OCTOBER 22, 2024

dLocal , the leading cross-border payment platform specializing in emerging markets, today announced its strategic partnership with USI Money , a prominent foreign exchange provider and money transfer operator.

Fintech Finance

OCTOBER 11, 2024

Today, Citi and Mastercard announced a collaboration to offer cross-border payments to Mastercard debit cards in 14 receiving markets [1] worldwide, with plans for further expansion. Mastercard is one of the largest payment networks, with over 3.4 billion debit, prepaid and credit cards issued globally as of Q2 2024.

Fintech Finance

DECEMBER 17, 2024

Bitso Business the B2B arm of Bitso that provides the infrastructure for the future of cross-border payments releases its 2024 results. The global cross-border payments market, currently valued at $44 trillion, is projected to reach $65 trillion by 2030. trillion by 2030.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content