Nium Offers Swift Connectivity for Faster Cross-Border Payments

Fintech News

OCTOBER 20, 2024

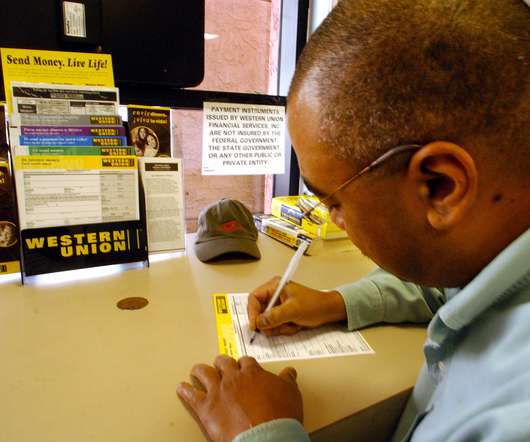

Nium, a global payments infrastructure provider, announced that financial institutions can now connect to its real-time payments network using their existing Swift infrastructure. This eliminates the need for complex and costly API integrations, making cross-border payments faster and more affordable.

Let's personalize your content