Cross-Border Payments in Numbers: Global Corporations Lost $120 Billion in Transaction Fees

Fintech Finance

NOVEMBER 18, 2024

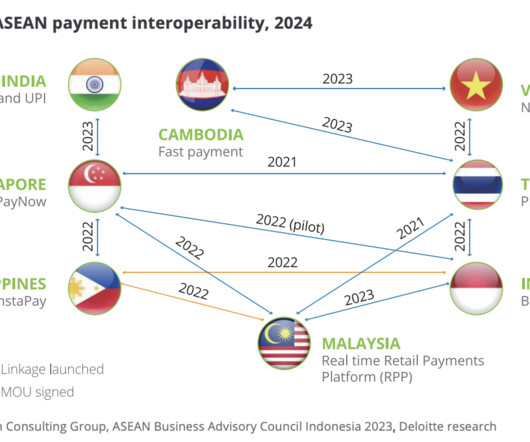

The current cross-border payment system imposes high costs on businesses and economies worldwide, stifling economic potential and limiting financial inclusivity. Any improvement in the efficiency of cross-border transactions would, therefore, lead to considerable benefits for businesses and individuals globally.

Let's personalize your content