Cross-border payment plays rev up

Payments Dive

OCTOBER 10, 2022

The Clearing House, Swift and rivals are jostling to speed up cross-border payments, with collaboration and competition likely to emerge at an international conference this week.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

OCTOBER 10, 2022

The Clearing House, Swift and rivals are jostling to speed up cross-border payments, with collaboration and competition likely to emerge at an international conference this week.

Payments Dive

MARCH 6, 2024

The card network and the cross-border payments company are developing an international payment system that could be used in disaster situations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Fintech News

NOVEMBER 21, 2024

India is advancing efforts to establish cross-border payment linkages with multiple countries, as reported by Bloomberg, citing an official from the Reserve Bank of India (RBI). T Rabi Sankar Deputy Governor T. These developments build on existing arrangements with Sri Lanka, Bhutan, and Nepal.

Fintech Finance

NOVEMBER 18, 2024

The current cross-border payment system imposes high costs on businesses and economies worldwide, stifling economic potential and limiting financial inclusivity. Any improvement in the efficiency of cross-border transactions would, therefore, lead to considerable benefits for businesses and individuals globally.

Fintech News

OCTOBER 31, 2024

FXC Intelligence, a data platform specializing in the cross-border payment and e-commerce sectors, has released its annual selection of the world’s most promising cross-border payments companies in 2024. One of Singapore’s entries is Partior. Another company from Singapore featured on the list is Tazapay.

Fintech News

OCTOBER 20, 2024

Nium, a global payments infrastructure provider, announced that financial institutions can now connect to its real-time payments network using their existing Swift infrastructure. This eliminates the need for complex and costly API integrations, making cross-border payments faster and more affordable.

The Payments Association

JUNE 25, 2024

Banks are de-banking payment providers, causing major disruptions in cross-border transactions and impacting financial inclusion

Fintech News

MAY 15, 2024

The project aims to explore how tokenisation can improve wholesale cross-border payments. This partnership aims to tackle inefficiencies in current payment systems, particularly in cross-border transactions, which face various legal, regulatory, and technical challenges, as well as different operating hours and time zones.

Fintech News

APRIL 3, 2024

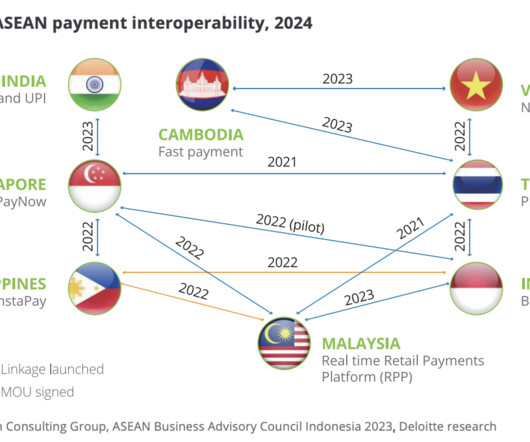

The Central Bank of Brunei Darussalam (BDCB) and the Bank of the Lao PDR (BOL) have formally joined the Regional Payment Connectivity (RPC) initiative. predicts explosive growth in ASEAN’s digital payment market, reaching US$2 trillion by 2030. A report by Google, Temasek, and Bain & Co.

Fintech News

AUGUST 13, 2024

In a recent webinar hosted by the Fintech News Network, experts from the Bank for International Settlements (BIS), Wise, Airwallex, and LexisNexis Risk Solutions explored the latest trends and developments in cross-border payments, emphasizing the pioneering role of Southeast Asia in this rapidly evolving landscape.

Fintech News

NOVEMBER 12, 2024

He emphasized the country’s successful implementation of the PromptPay system and QR code standards, which have significantly broadened access to digital payments while prioritizing security. Looking ahead, he highlighted Thailand’s efforts to strengthen cross-border payment connectivity through projects like Nexus and mBridge.

The Fintech Times

FEBRUARY 22, 2024

Payments are arguably the face of fintech. When you think about financial technology, it is easy to think about solutions which are making payments faster, easier and more accessible. It will play a big part in ensuring the new payment rails are well protected.

Fintech News

NOVEMBER 5, 2024

Nium, a global payments infrastructure provider, announced a partnership with Partior , a blockchain-based clearing and settlement network, at the Singapore Fintech Festival 2024. The partnership allows financial institutions to connect with Nium for faster, more transparent cross-border payments.

Fintech News

JANUARY 14, 2025

Vietnam and Laos have officially launched a new framework for settling payments in their local currencies and a cross-border QR code payment system. The post Cross-Border QR Payments Now Live Between Vietnam and Laos appeared first on Fintech Singapore.

Fintech News

JULY 15, 2024

Bank Indonesia (BI) and the Bank of Korea (BoK) have signed a memorandum of understanding (MOU) on cross-border payments. The agreement aims to enhance cooperation on the interoperability of cross-border payments and establish a framework for seamless connectivity between Indonesia and South Korea.

Fintech News

OCTOBER 23, 2024

Emirates NBD has entered a strategic agreement with Singapore-based blockchain platform Partior to improve its cross-border payment capabilities. The partnership will allow Emirates NBD to offer clients faster, around-the-clock payment processing through Partior’s blockchain-based platform for clearing and settlement.

Fintech News

OCTOBER 16, 2024

Siam Commercial Bank ( SCB ), alongside its venture arm SCB 10X and Lightnet , has launched Thailand’s first cross-border payment system utilising stablecoins, according to CoinGape.

Fintech News

NOVEMBER 6, 2024

Global payments infrastructure provider Nium has expanded its partnership with Kinexys by J.P. Morgan (formerly Onyx) to enhance cross-border payment accuracy in Malaysia, Thailand, and Hong Kong, This makes Nium the first fintech to provide data for validating bank account details in these markets.

Fintech Finance

JANUARY 22, 2025

Mesta , a fintech platform reshaping global payment networks with hybrid fiat and stablecoin payment rails, unveiled its cross-border payment platform. It combines real-time fiat payment rails with blockchain-powered stablecoin rails, addressing inefficiencies in global payments and trade.

Fintech News

NOVEMBER 7, 2024

XTransfer, a B2B cross-border payment platform, made its debut at the Singapore Fintech Festival (SFF) 2024 as a Gold Sponsor. The company aims to expand its presence in Southeast Asia, offering secure and efficient payment solutions to SMEs in the region. ” said Bill Deng, Founder and CEO of XTransfer.

Fintech News

NOVEMBER 20, 2024

PayPal has announced that its disbursement partners can now use PayPal USD (PYUSD) to settle cross-border money transfers via Xoom, its digital remittance platform. Yellow Card CEO Chris Maurice highlighted the transformative potential of stablecoin-based payment rails in optimising cross-border transactions.

Fintech News

OCTOBER 29, 2024

Global payments network Thunes has announced a collaboration with Circle , the issuer of regulated stablecoins USDC and EURC. This partnership aims to enhance stablecoin liquidity management in cross-border payments. said Jeremy Allaire, Co-founder and CEO of Circle.

Fintech News

DECEMBER 8, 2024

Ant International has joined Swift ‘s “Network Interoperability Reference Implementation” programme, a pre-pilot initiative designed to improve cross-border payment experiences.

Fintech News

JANUARY 7, 2025

The Bank for International Settlements ‘ (BIS) Committee on Payments and Market Infrastructures (CPMI) has announced new measures to promote the adoption of its harmonised ISO 20022 data requirements. BIS aims to improve the efficiency of cross-border payments.

Fintech Finance

OCTOBER 18, 2024

Nium , the leading global infrastructure for real-time cross-border payments, is thrilled to announce a partnership with Bank Rakyat Indonesia (BRI) to provide Indonesian customers with real-time international money transfer capabilities.

Fintech News

APRIL 24, 2024

Morgan, has introduced Project Carina, a new initiative aimed at accelerating cross-border payments through blockchain technology, according to RYT9. Morgan Set to Reduce Cross-Border Payment Times to Minutes appeared first on Fintech Singapore. Thailand’s KASIKORNBANK , in partnership with J.P.

Fintech News

JULY 3, 2024

The Bank for International Settlements (BIS) and its partners have revealed the comprehensive blueprint for phase three of Project Nexus, which seeks to address longstanding challenges in international money transfers by leveraging the power of domestic instant payment systems (IPS). How Does Project Nexus Work? trillion by 2025.

Fintech News

SEPTEMBER 10, 2024

A new report by Deloitte delves into the latest developments in the cross-border payment sector in Asia-Pacific (APAC), identifying four major trends reshaping the landscape and offering significant opportunities for merchants. trillion in consumer spending across channels in 2023.

Fintech News

JULY 16, 2024

Banking software provider Temenos and global payments leader Visa have announced a collaboration to simplify and streamline cross-border payments for banks and their customers. Visa Direct facilitates real-time cross-border and domestic payments, reaching billions of endpoints in over 190 markets and 160 currencies.

Fintech News

JULY 14, 2024

Ant International and BNP Paribas have entered a strategic partnership to enhance cross-border payment solutions for European merchants and consumers. This collaboration aims to streamline cross-border transactions, making them more efficient and accessible for businesses and consumers.

Fintech Finance

JANUARY 17, 2025

In a significant milestone for the fintech industry, Paysend , the UK-based global payments platform, has announced reaching 10 million consumer customers worldwide. As the largest global digital network with over 25 billion endpoints, our mission is to simplify international payments for everyone.

Fintech Finance

OCTOBER 21, 2024

Mastercard introduced a new product innovation, Mastercard Move Commercial Payments, that will enable banks to facilitate near real-time, predictable and transparent commercial cross-border payments.

Fintech Finance

FEBRUARY 6, 2025

FXellence , a provider of fast, simple, and secure international business payments, has announced the launch of its new cross-border payment platform for businesses, FXellence International Payments, powered by Currencycloud , a Visa Direct offering.

Fintech News

DECEMBER 6, 2023

Singapore and China have agreed to collaborate on a pilot programme that uses the e-CNY, China’s central bank digital currency (CBDC), for cross-border transactions. This programme is designed to ease payments for travelers from both countries during their overseas visits.

The Payments Association

FEBRUARY 7, 2025

TerraPay, a global money movement company, and PYMNTS, a global leader in payments and fintech insights, have released a detailed report on the future of cross-border payments. While digital wallets are rapidly growing in popularity, there are still key areas to address to ensure a seamless experience across borders.

Fintech News

NOVEMBER 20, 2024

Cross-border payment firm XTransfer is leveraging its success in China to fuel an ambitious global expansion plan. Bill Deng “In Singapore, we have received in-principle approval for a major payment institution (MPI) license, and we will have the full license soon. XTransfer was founded to address these gaps.

Fintech Finance

JANUARY 8, 2025

The BIS Committee on Payments and Market Infrastructures (CPMI) announced further steps to promote the adoption of its harmonised ISO 20022 data requirements for more efficient processing of cross-border payments. The data requirements were published in a report to the G20 in October 2023.

Fintech Finance

OCTOBER 22, 2024

Temenos today launched a SaaS enterprise service for cross border payments, empowering Payment Service Providers (PSPs), including banks, electronic money institutions (EMIs) and fintechs, to swiftly launch and lower the cost of cross border payment services.

Fintech News

AUGUST 7, 2024

Deputy Prime Minister and Minister for Trade and Industry Gan Kim Yong has reiterated the Monetary Authority of Singapore’s (MAS) ongoing efforts to combat cross-border payments scams. He noted that MAS has established real-time payment linkages with India, Malaysia, and Thailand for low-value payments.

Fintech Finance

JULY 12, 2024

Cross-border payments are becoming increasingly important to international economies. The G20 roadmap for enhanced cross-border payments aims to improve the speed, access, transparency, and cost of international payments by 2030.

Fintech News

DECEMBER 17, 2024

Morgan Stanley has partnered with Wise Platform to enhance its cross-border payment capabilities for corporate and institutional clients. Wise Platform, the global payments infrastructure for banks, enables financial institutions to offer international payments using Wises network.

Fintech Finance

DECEMBER 17, 2024

Card Corporation, a leading privately-owned financial services technology company specializing in mobile banking and card payments, is pleased to announce a new collaboration with Visa to introduce Visa Direct Cross-Border payments.

Fintech Finance

JANUARY 17, 2025

We aim to address existing challenges in cross-border payments and seize opportunities through innovative solutions. The collaboration with Mastercard will empower us to elevate our payment capabilities and reinforce our position in Jordans financial sector, said Dr. Kamal Al-Bakri, CEO, Cairo Amman Bank. billion in 2022.

Fintech News

OCTOBER 28, 2024

The Bank for International Settlements (BIS) and a group of central banks have successfully completed Project Mandala demonstrating automated compliance for cross-border transactions. We are optimistic about the potential of these early results to enhance cross border payments.”

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content