Optimizing Expense Workflows by Detecting Duplicate Receipts

Nanonets

JULY 13, 2023

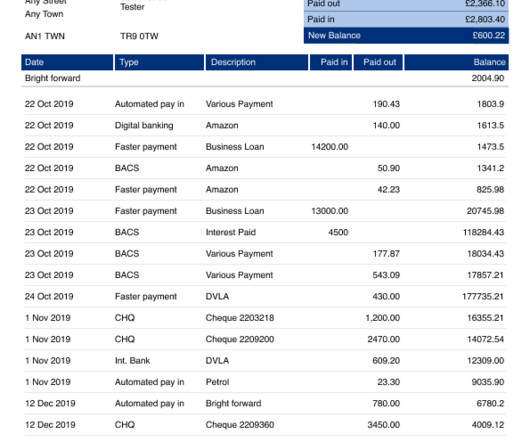

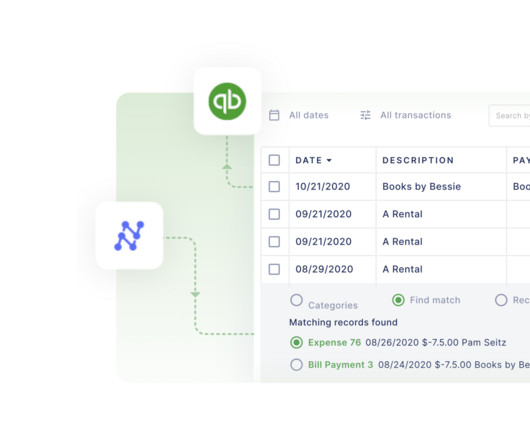

However, one challenge that organizations often encounter is the presence of duplicate receipts. These duplicates can lead to errors in reimbursement calculations, compliance concerns, and inefficient use of resources. What are Duplicate Receipts? How to Prevent Receipt Duplication?

Let's personalize your content