Rivero Advises Banks to Brace for Spike in Cardholder Disputes as Black Friday and Cyber Monday Near

Fintech Finance

NOVEMBER 19, 2024

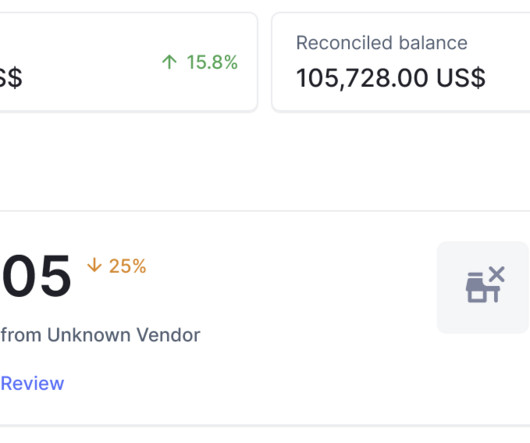

In anticipation of Black Friday and Cyber Monday, European Visa Fintech Partner, Rivero is urging banks, neobanks, and financial institutions to prepare for a potential spike in cardholder disputes. An analysis of the company’s internal data has highlighted a 25% rise in reported disputes over the past year.

Let's personalize your content