Paperless accounts payable: An implementation guide

Nanonets

NOVEMBER 15, 2023

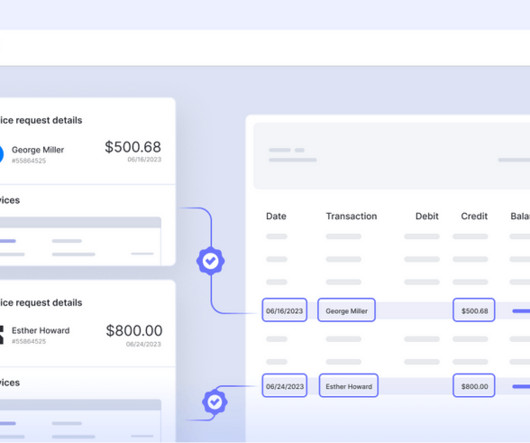

Additionally, the invoices must be matched with the corresponding purchase orders and goods receipts to avoid duplicate invoices, fraud, and errors. In case of a mismatch or discrepancy, it raises an alert, allowing you to catch errors early and avoid payment delays or disputes. Increase transparency? Reduce costs?

Let's personalize your content