Mobile Banking Malware on the Rise Amid Rapid Adoption

Fintech News

MARCH 25, 2024

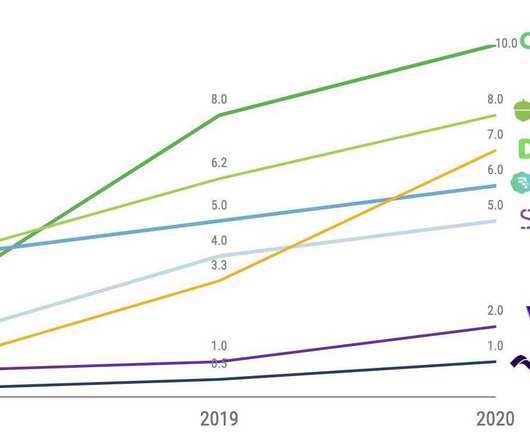

Mobile banking is a rapidly growing market that’s projected to hit a value of US$7 billion by 2032. The 2023 study, which analyzed malware targeting banking apps, uncovered that 29 malware families targeted 1,800 banking applications across 61 countries last year.

Let's personalize your content