Singapore Ramps Up Anti-Money Laundering Measures After S$3 Billion Bust

Fintech News

OCTOBER 6, 2024

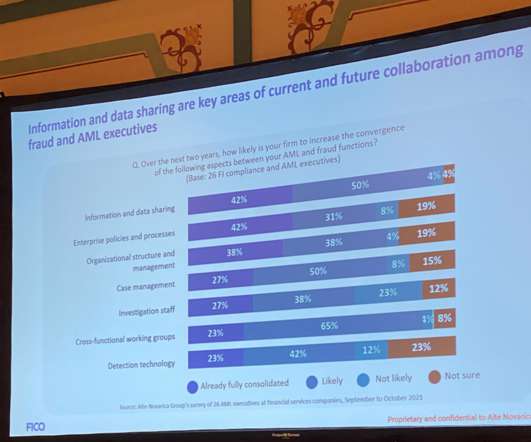

The IMC’s report outlines strategies aimed at strengthening prevention, improving detection, and enforcing tougher penalties to better protect the integrity of Singapore’s financial system against increasingly sophisticated financial crimes.

Let's personalize your content