Credit card delinquencies mount, Fed says

Payments Dive

NOVEMBER 27, 2024

Consumers’ credit card delinquencies have risen this year, along with their balances, according to an annual Federal Reserve Board report.

Payments Dive

NOVEMBER 27, 2024

Consumers’ credit card delinquencies have risen this year, along with their balances, according to an annual Federal Reserve Board report.

The Payments Association

NOVEMBER 27, 2024

Garanti BBVA Kripto has collaborated with Ripple and IBM to provide a secure environment for its crypto asset trading platform. Following a successful pilot in 2023, the bank is now rolling out the service to its entire customer base, leveraging technology collaborations to continue to deliver the highest standards of performance, security, and customer trust.

Payments Dive

NOVEMBER 27, 2024

With credit card interest rates at a historic high, consumers are likely to gravitate to lower-cost alternatives, including potentially buy now, pay later options, industry consultants say.

The Payments Association

NOVEMBER 27, 2024

Let’s face it—traditional payment systems are generally as flexible as a brick wall. They’re clunky, slow, and about as inspiring as a spreadsheet on a Friday afternoon. At Monavate, we believe payments deserve better. That’s why we’re leading the charge with an API-first approach. (Also, you can’t spell hAPpiness without API – so that must make it even more important, right?

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Fintech Review

NOVEMBER 27, 2024

Small and medium enterprises (SMEs) are the backbone of emerging economies. In many regions, they create jobs, drive innovation, and stimulate local economies. Yet, they often face financial challenges, struggling to access credit, manage cash flow, and navigate complex financial systems. Fintech solutions are changing this landscape, offering SMEs tailored tools to overcome these barriers.

The Payments Association

NOVEMBER 27, 2024

The Central Bank of Bahrain (CBB) has updated its open banking framework, mandating all licensed banks to expose APIs for corporate accounts. The amendments also require obtaining customer consent and authentication, licensee disclosures, and reporting API performance by service providers. Bahrain, the first country in the Middle East to introduce open banking, launched its open banking framework (OBF) in October 2020, following the initial set of rules released in December 2018.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

The Payments Association

NOVEMBER 27, 2024

Dialect , a BPO customer experience, service optimisation and solution expert that provides frictionless customer support solutions within the payments industry, is delighted to provide a fully integrated front-line solution to Caxton , a dual FCA-regulated payment service provider specialising in international payments, travel money, expense management, accounts payable, and faster payroll payments.

Fintech News

NOVEMBER 27, 2024

Indonesian peer-to-peer (P2P) lending platform Amartha has completed the acquisition of PT Bosowa Multi Finance, a leasing company previously part of the Bosowa Group conglomerate, according to DealStreetAsia. The deal was carried out through PT Amartha Nusantara Raya (ANR), the holding company that oversees Amartha’s operations, including its P2P lending platform and credit scoring unit, Ascore.

Fintech Finance

NOVEMBER 27, 2024

Adyen and Doctolib join forces to modernise consultation payments Adyen , the global financial technology platform of choice for leading businesses , and Doctolib, the European leader in digital healthcare services, are joining forces to offer medical professionals innovative and secure financial services. The partnership, which was recently launched in France and Italy, allows Doctolib to offer its users online payment solutions, as well as broader financial services to simplify their daily liv

Fintech News

NOVEMBER 27, 2024

Global verification provider Sumsub has partnered Elliptic, a cryptoasset risk management firm, to bolster its crypto transaction monitoring and Travel Rule solutions. This collaboration integrates Elliptic’s blockchain analytics into Sumsub’s platform, providing clients with enhanced tools to screen cryptocurrency wallets, identify fraudulent activity, and assess risk in transactions.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Fintech Finance

NOVEMBER 27, 2024

interactive investor (ii) has rolled out NatWest’s multi award-winning open banking payments solution Payit , to enable their customers to deposit funds onto the investment platform immediately to allow investments to be made. Customers can now use Payit by NatWest to make a payment/a fund deposit online through the ii website and app. Powered by open banking technology through payments initiation and Account Information Services (AIS), Payit by NatWest provides investors with an additional digi

Fintech News

NOVEMBER 27, 2024

Maybank Singapore has introduced a new feature in its myimpact SME programme , SMEs to calculate carbon emissions and report core environmental, social, and governance (ESG) metrics. The initiative, which leverages ESGpedia ’s online enabler tool, is designed to help SMEs navigate sustainability reporting requirements and gain a competitive edge in securing sustainable financing and business opportunities.

Fintech Finance

NOVEMBER 27, 2024

Worldpay ® has launched a first-of-its-kind service that delivers near instant refunds, depending on the receiving financial institution. This helps to close the gap between consumer expectations and merchant capabilities. The faster refund capability is available to the vast majority of UK shoppers using Mastercard and Visa cards when making purchases at participating retailers, including HMV.

Fintech News

NOVEMBER 27, 2024

Deutsche Bank has joined the extended Series B funding round for blockchain-based fintech firm Partior , bringing the total raised to US$80 million and marking the close of the round. The Series B initially secured US$60 million in July 2024, led by Peak XV Partners, with participation from J.P. Morgan, Jump Trading Group, Standard Chartered, Temasek, and Valor Capital Group.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Fintech Finance

NOVEMBER 27, 2024

Spendesk , the complete spend management platform for mid-sized businesses, has officially launched Spendesk Financial Services, its payment institution. Regulated by the ACPR (Autorité de contrôle prudentiel et de résolution), and including a strategic collaboration with VISA, Spendesk Financial Services enables the company to deliver innovative and secure payment solutions to its clients across France and the European Union.

Fintech News

NOVEMBER 27, 2024

DBS and Japan Finance Corporation (JFC), a government-owned financial institution, have signed a MoU to help Japanese SMEs expand into Asia. This first-of-its-kind partnership allows SMEs to access six key markets—China, Hong Kong, India, Indonesia, Singapore, and Taiwan—through a single banking partner. The collaboration leverages DBS ’ regional expertise and services, including digital cross-border payments, trade financing, and connections to professional service providers offering legal, acc

The Fintech Times

NOVEMBER 27, 2024

In the UAE, generation Alpha (those aged between eight and 15 years old), are already showing signs of spending independently in the digital economy and are offering insight into where the future of e-commerce may be headed, according to a new study from digital payments provider Checkout.com. In fact, apart from generation Alpha being the beneficiaries of their parents’ spending, 75 per cent of eight-year-olds and 92 per cent of 15-year-olds make payments themselves, rather than via a parent or

Fintech News

NOVEMBER 27, 2024

The Monetary Authority of Singapore (MAS) and the Chinese National Financial Regulatory Administration (NFRA) convened in Suzhou, China, to reaffirm their commitment to strengthening supervisory cooperation. The MAS-NFRA Supervisory Roundtable, held in person for the first time since 2020, took place on the sidelines of the 30th anniversary commemoration of the Suzhou Industrial Park.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

The Fintech Times

NOVEMBER 27, 2024

Mashreq , the MENA-based financial institution, has announced a $50million trade finance partnership with British International Investment (BII), the UK’s development finance institution and impact investor, to boost cross-border trade finance in key emerging markets across South Asia and Africa. Mashreq says that this trade finance collaboration is critical in providing much-needed US dollar liquidity to support the import of critical goods to countries across South Asia and Africa amidst chall

Finextra

NOVEMBER 27, 2024

Join FinextraTV as Romain Mialane, Direct to Corporate Lead, Visa, and Ritesh Jain, Business Head - UK and Europe Commercial Cards, Citi, explore Visa's recently commissioned market research on B2B procurement in Europe and the challenges and opportunities for innovation in this broader context of treasury. Further, the pair discuss how notable trends and patterns can lead to strategies to address emerging needs, such as Procure-to-Pay capabilities to streamline existing processes and reduce cos

Fintech Finance

NOVEMBER 27, 2024

Telr , the award-winning online payment gateway, has partnered with Samsung Gulf Electronics to redefine the digital payment landscape in the UAE. This collaboration integrates Samsung Pay into Telr’s comprehensive suite of payment solutions, marking a significant leap forward in the country’s e-commerce capabilities. By merging Telr’s expertise in online transactions with Samsung’s innovative technology, this collaboration is poised to accelerate the adoption of mobile p

Finextra

NOVEMBER 27, 2024

French spend management platform Spendesk has launched a financial services division operating under a licence from Autorité de contrôle prudentiel et de résolution, giving the firm end-to-end control over its payment services infrastructure.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Finovate

NOVEMBER 27, 2024

Digital identity solutions provider Signicat has teamed up with data specialist AsiaVerify. The strategic partnership will help businesses looking to expand from Europe to Asia, and vice versa, meet local regulatory compliance requirements with regards to KYC, KYB, and UBO. Headquartered in Norway, Signicat made its Finovate debut at FinovateEurope 2017 in London.

Finextra

NOVEMBER 27, 2024

German banking-as-a-Service platform Solaris is reportedly seeking an emergency cash injection of £100 million and will put the business up for sale if it fails to raise fresh funds.

Finovate

NOVEMBER 27, 2024

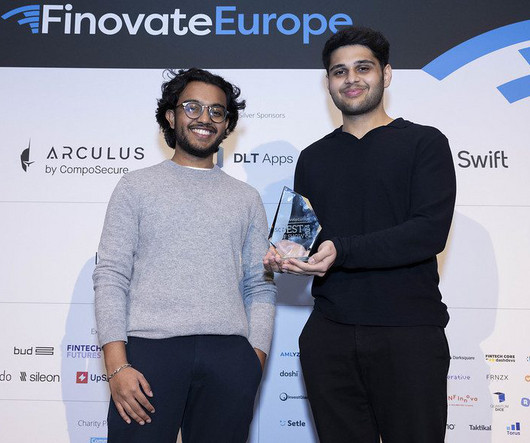

FinovateEurope 2025 takes place in London on February 25 and 26. Register to attend and save up to £600. Fintech headlines often highlight big funding rounds and valuations — but we know the real story goes deeper. At Finovate, it’s all about the technology and the impact it creates. At FinovateEurope , 30+ leading fintech innovators will showcase their tech to an audience of 1,000+ senior-level decision-makers from across the fintech ecosystem: Banks, payment processors, tech giants, investors,

Finextra

NOVEMBER 27, 2024

Partior, the bank-backed fintech behind a ledger-based interbank system for real-time clearing and settlement, has secured a $20 million investment from Deutsche Bank, bringing its toal Series B funding round to $80 million

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

The Fintech Times

NOVEMBER 27, 2024

Consumers want to be more green but the initial cost to install green technology is putting them off from making the change. However, a partnership between OVO , the energy supplier, and European bank, HSBC aims to make green tech more accessible through new financing options. Although a high proportion (74 per cent) of consumers are interested in installing green tech, an equally high amount (75 per cent) are put off by costs.

Fintech Finance

NOVEMBER 27, 2024

Primer , the unified infrastructure for global payments, today sets out its plans for 2025 growth and new markets across the EU, US and APAC as it approaches its fifth anniversary. Leading on building an open and interoperable future for merchants worldwide, Primer has achieved significant milestones in product innovation and senior team hires in 2024 to meet the evolving needs of global enterprises.

The Fintech Times

NOVEMBER 27, 2024

The Financial Conduct Authority (FCA) has unveiled a roadmap outlining key dates for the development of its ‘crypto regime’, as it aims to introduce a clear regulatory framework for the UK’s crypto industry. As of August 2024, around 12 per cent of UK adults own some sort of crypto asset – equivalent to around seven million people – while around 93 per cent have at least heard of them, according to new FCA research revealed on Tuesday.

Finextra

NOVEMBER 27, 2024

Australia bank ANZ has teamed up with vendor DataCo on a platform that uses de-identified customer and transactional data to provide businesses with useful insights

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Let's personalize your content