Pomelo stacks $40M to scale its payments infra business in LatAm

TechCrunch Fintech

JANUARY 17, 2024

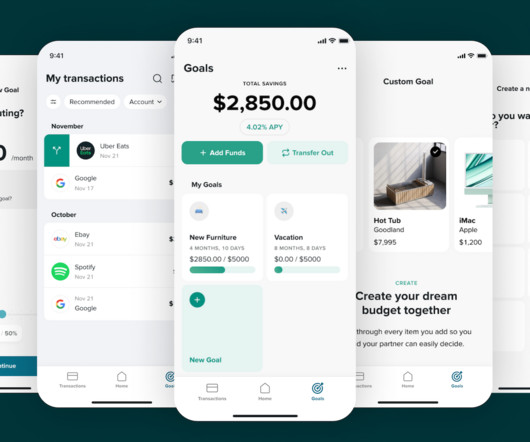

Argentinian payments infrastructure startup Pomelo has raised $40 million in a Series B round of funding. The Buenos Aires-based company started in 2021 with the goal of giving fintechs and embedded finance players a way to launch virtual accounts and issue prepaid and credit cards via compliant onboarding processes. Pomelo went live with its first customer […] © 2023 TechCrunch.

Let's personalize your content