Fiserv exec opens up on Walmart, DoorDash partnerships

Payments Dive

NOVEMBER 6, 2024

Sunil Sachdev, Fiserv’s head of embedded finance, shed light on his company’s latest high-profile collaborations.

Payments Dive

NOVEMBER 6, 2024

Sunil Sachdev, Fiserv’s head of embedded finance, shed light on his company’s latest high-profile collaborations.

PCI Security Standards

NOVEMBER 6, 2024

The PCI Security Standards Council (PCI SSC) is developing guidance to help stakeholders understand and implement the new e-commerce security requirements included in PCI Data Security Standard (PCI DSS) v4.x. Stakeholders have indicated that these requirements are complex for many entities to implement (including merchants validating to Self-Assessment Questionnaire (SAQ) A).

Fintech News

NOVEMBER 6, 2024

Deutsche Bank’s multi-chain asset servicing pilot, Project DAMA 2, has taken a huge step forward with technical contributions from Memento Blockchain and Interop Labs. This initiative, part of the Monetary Authority of Singapore’s (MAS) Project Guardian , aims to advance operating models for digital asset management, fund distribution, and servicing through blockchain technology.

Fintech Review

NOVEMBER 6, 2024

Financial inclusion remains a global priority. Across emerging markets , millions of people lack access to essential banking services. Traditional banks, often limited by infrastructure costs, struggle to reach remote populations. In response, fintech companies are stepping up, using digital innovation to provide banking solutions to the unbanked and underbanked.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Fintech News

NOVEMBER 6, 2024

OCBC Bank has launched a new service allowing customers to send money instantly to users of WeChat Pay and Alipay in China. This makes OCBC the first bank in the Asia Pacific region to offer this capability. The service, available through the OCBC mobile banking app, uses Visa Direct to facilitate these peer-to-peer transfers, which now take mere seconds compared to the previous 2-5 days needed for traditional methods.

TechCrunch Fintech

NOVEMBER 6, 2024

The Federal Trade Commission (FTC) announced on Tuesday it will be taking action against the online cash app and neobank Dave, which it says used “misleading marketing to deceive consumers.” At issue is how Dave marketed $500 cash advances to consumers that it rarely offered, and the “Express Fee” it charged if customers wanted their […] © 2024 TechCrunch.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Fintech Finance

NOVEMBER 6, 2024

Visa , a global leader in digital payments, today announced collaborations with QR payment providers to allow consumers to use their digital wallets to scan and pay at point-of-sale QR when they travel abroad. The pilot program will begin in Singapore, with more to be rolled out across the region in the coming year. Utilising its network expertise, Visa will enable consumers to use their everyday payment apps to scan and pay at QR merchants whether at home or abroad.

Fintech News

NOVEMBER 6, 2024

BCA Syariah, the Islamic banking arm of Bank Central Asia (BCA), has partnered with Thought Machine to modernise its services in Indonesia. Using Thought Machine’s cloud-based platform, Vault Core , BCA Syariah has launched new products like Wadiah savings accounts, e-wallet top-up, and a Hajj Fee Deposit service. The bank also plans to introduce term deposit products and gold financing in the near future.

Fintech Finance

NOVEMBER 6, 2024

NatWest has partnered with Capco , the global management and technology consultancy, to ensure a smooth transition for its systems and clients as the financial industry moves to adopt ISO 20022 for payments and reporting. The collaboration facilitates customer, operational and infrastructure opportunities through the development of Bankline Direct Digital, the new strategic ISO 20022 compliant cloud-based architecture behind Bankline Direct.

Fintech News

NOVEMBER 6, 2024

Maya, a Filipino financial services and digital payments company, has partnered with Fexco to introduce Dynamic Currency Conversion (DCC) across its network of 112,000 in-store terminals. This new feature allows international customers to pay in their home currency, offering convenience and transparency while contributing to the growth of the tourism sector.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Clearly Payments

NOVEMBER 6, 2024

The payment processing market in the United States has demonstrated robust growth, driven by rising consumer demand for digital payments, advancements in financial technology, and the expansion of e-commerce. This report provides a comprehensive analysis of the U.S. payment processing landscape, covering market size, merchant demographics, transaction volumes, major players, and key trends shaping the industry.

Fintech News

NOVEMBER 6, 2024

Ant International is employing advanced artificial intelligence (AI) technologies to streamline and secure cross-border transactions for nearly 100 million SMEs across over 200 markets. One of its key innovations is an AI-powered foreign exchange (FX) model capable of predicting currency exchange rates hourly. This enhanced precision helps reduce transaction costs for merchants, offering them greater financial flexibility.

Fintech Finance

NOVEMBER 6, 2024

The UK’s largest independent payments broker Accept Cards has today launched an innovative cash payments solution to respond to SME demand for instant, affordable cash deposits which underpin cash flow stability. Accept Cash will utilise Smart Safe technology so that businesses can deposit into a smart safe and settle to their bank account the same day, creating the most convenient way to bank when bank branches are closing and the Post Office fight with the growing demand – helping to su

Fintech News

NOVEMBER 6, 2024

Ant International is teaming up with industry partners to create a new tool to help small businesses in Asia become more sustainable. Called the “MSME Sustainability Impact Scorecard” (MSME S-Card), this digital solution will make it easier for these businesses to track their environmental and social impact. The scorecard is part of Ant International ‘s broader Programme Sirius initiative, which focuses on helping MSMEs adopt sustainability practices in line with global standar

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Fintech Finance

NOVEMBER 6, 2024

XMDS Holding , renowned for its flagship company Ximedes, a pioneer in software solutions for FinTech and FareTech, proudly announces the launch of XPP. XPP becomes the umbrella organisation under which the specialised payment solutions Vayapay, Ginger Payments, KUARIO, and Pecunda operate. This strategic combination strengthens these proven solutions in their specific markets, from education and public facilities to public transport and financial services.

Fintech News

NOVEMBER 6, 2024

Global payments infrastructure provider Nium has expanded its partnership with Kinexys by J.P. Morgan (formerly Onyx) to enhance cross-border payment accuracy in Malaysia, Thailand, and Hong Kong, This makes Nium the first fintech to provide data for validating bank account details in these markets. Nium Verify, a service offering insights into account beneficiaries, now integrates with Confirm, Kinexys’ global account validation platform.

Fintech Finance

NOVEMBER 6, 2024

Checkout.com , a leading global digital payments provider, today announced a new partnership with insurance technology leader, Sure , to improve the digital experience for consumers accessing insurance products, by boosting payments performance. The move is set to transform Sure’s digital payments strategy and support its Fortune 500 partners, enabling them to grow in the digital economy.

Fintech News

NOVEMBER 6, 2024

Chia Der Jiun, Managing Director of the Monetary Authority of Singapore (MAS) , addressed the Singapore Fintech Festival 2024 , emphasizing the importance of community, collaboration, and capabilities in shaping the future of fintech. Speaking at a fireside chat, Chia highlighted the vibrancy of Singapore’s fintech community and its global reach, supported by initiatives like the Global Fintech Network (GFTN) , which aims to strengthen international collaboration.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Fintech Finance

NOVEMBER 6, 2024

Maya , a leader in the payments sector in the Philippines, has announced the rollout of Fexco ’s Dynamic Currency Conversion (DCC) across its extensive network of merchants via Maya Business. This collaboration marks a significant step in Maya’s strategy to respond to the rising demands of international customers and the growing tourism sector in the Philippines.

Fintech News

NOVEMBER 6, 2024

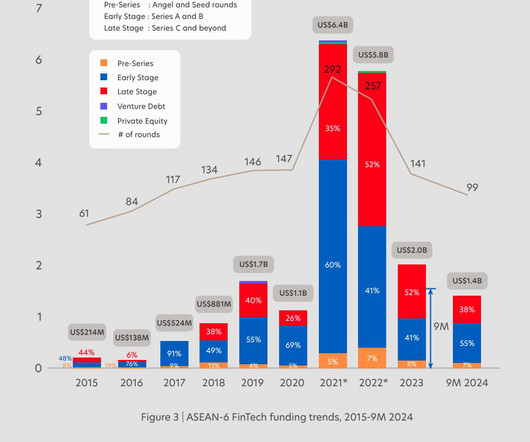

ASEAN’s fintech sector has seen remarkable growth, with funding rising more than tenfold since 2015, according to the Fintech in ASEAN 2024 report launched today by UOB , PwC Singapore, and the Singapore Fintech Association. This growth, largely seen in payments and alternative lending, is set to advance further with the integration of Generative AI and quantum computing.

Fintech Finance

NOVEMBER 6, 2024

Businesses and consumers paying into and out of the Middle East and North Africa (MENA) region will benefit from faster, cheaper and more transparent cross-border payments through a first-of-its-kind public-private collaboration between Mastercard and the Arab Regional Payment System, Buna. The collaboration will see Mastercard join Buna’s cross-border payment systems as a direct participant.

Fintech News

NOVEMBER 6, 2024

The Global Finance & Technology Network ( GFTN ) has announced a partnership with Ecosystm to develop its global research, learning, and advisory platform. This marks Ecosystm as GFTN’s first structural partner in its goal to strengthen financial services in emerging markets. Over the past eight months, GFTN has collaborated with Ecosystm’s Amit Gupta and Ullrich Loeffler to address key challenges in the financial sector.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Fintech Finance

NOVEMBER 6, 2024

At the Singapore FinTech Festival 2024 , PayPay , Japan’s top QR payment operator, today announced an expanded partnership with Alipay+ , Ant International’s cross-border mobile payment and digitalisation technology solution, broadening its merchant coverage network across Japan. By working with local partners including PayPay, Alipay+ will now connect over 3 million local merchants to the global payment ecosystem, enabling local businesses and payment partners to provide global visitors s

Fintech News

NOVEMBER 6, 2024

Network for Electronic Transfers ( NETS ) has announced the islandwide rollout of SGQR+, an enhanced version of Singapore’s national QR code standard. Following a successful proof of concept (POC) conducted in November 2023 during the Singapore Fintech Festival , SGQR+ simplifies digital payments by enabling businesses to accept multiple payment schemes through a single QR code.

Fintech Finance

NOVEMBER 6, 2024

A new nationwide survey conducted by research firm Insight Intelligence in partnership with Trustly , Adyen , Swedbank , and PostNord Strålfors , reveals significant changes in the payment habits of Swedes over the past decade. The survey highlights that more than 98% of Swedes now rely on direct payment solutions from the three leading brands in the space.

Fintech News

NOVEMBER 6, 2024

Jeel, the digital innovation arm of Riyad Bank, and audax Financial Technology , backed by Standard Chartered, have announced a strategic partnership to modernise Saudi Arabia’s banking sector. This collaboration combines Jeel’s technological expertise with audax’s digital banking solutions, aiming to enable digital transformation for financial institutions that operate in Saudi.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Fintech Finance

NOVEMBER 6, 2024

Finseta , a leading international payments and foreign exchange (FX) business, has announced the launch of their new Confirmation of Payee (CoP) service powered by tell.money. This enhanced service is designed to upgrade payment security, reduce the risk of fraud, and ensure the accuracy of transactions. With the increasing concern over Authorised Push Payment (APP) fraud, which resulted in 252,626 reported cases in 2023, Finseta recognizes the critical importance of providing a solution that sa

Fintech News

NOVEMBER 6, 2024

Crypto.com announced that it will soon offer banking access, credit cards, and stock trading services through its network of companies. This expansion is bolstered by its new “Level Up” rewards programme, designed to provide comprehensive benefits across its growing suite of financial services. The Level Up programme introduces a multi-tiered rewards system that enhances benefits for users of both Crypto.com ’s current offerings and its new ventures.

Fintech Finance

NOVEMBER 6, 2024

As payments become more intricate, Mastercard today announced the latest enhancement to its new Mastercard Payment Passkey Service which enables secure, on-device biometric authentication through facial scans or fingerprints, the same way consumers unlock their phones every day. By combining the fraud-busting powers of tokenization, convenience of payment passkeys, and the addition of streamlined guest checkout capability courtesy of Click to Pay, consumers can now enjoy seamless, one-click chec

Fintech News

NOVEMBER 6, 2024

The Singapore Fintech Association (SFA) and Accenture have released the sixth edition of the Singapore Tech Talent Report 2024. This paints a picture of a fintech sector rapidly adopting generative AI (Gen AI) and grappling with a shifting talent landscape. The report reveals a staggering 89% of financial institutions (FIs) are exploring or have already implemented Gen AI in 2024, with 65% actively using it in their operations – a significant jump of 27% from 2023.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Let's personalize your content