PayPal tapping Google AI tool

Payments Dive

NOVEMBER 1, 2023

Google CEO Sundar Pichai did not provide details on how PayPal used the tool, saying only that it helped “boost developer productivity.

Payments Dive

NOVEMBER 1, 2023

Google CEO Sundar Pichai did not provide details on how PayPal used the tool, saying only that it helped “boost developer productivity.

The Payments Association

NOVEMBER 1, 2023

Sumsub, a full-cycle verification platform, releases its 'State of Verification and Monitoring in the Crypto Industry 2023' report. Polina Uzhva, partner marketing manager, Sumsub, provides a summary, focusing on the regulations and verification practices for crypto companies, with highlights from verification performance and identity fraud statistics.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

NOVEMBER 1, 2023

The payments processor’s new point-of-sale software for retail and restaurant customers will launch in early 2024, not this year.

The Payments Association

NOVEMBER 1, 2023

The Payment Systems Regulator (PSR) has published its report detailing the latest data on the pressing issue of APP fraud scams.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is evolving fast, and brands relying on rigid, one-size-fits-all solutions risk losing agility. But modernization doesn’t have to mean disruption. In this webinar, we’ll explore how an extensible, modular approach empowers brands to integrate new capabilities, enhance performance, and scale efficiently—all while leveraging Shopify’s strengths.

Payments Dive

NOVEMBER 1, 2023

The cross-border payments company plans to revamp its loyalty program early next year as part of a plan to jump-start growth.

The Paypers

NOVEMBER 1, 2023

The government of Kenya has revealed its plans to introduce a digital identification system in December 2023 following a testing period.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Currencycloud

NOVEMBER 1, 2023

A recent report from Juniper Research 1 predicts that the total number of digital Buy Now Pay Later (BNPL) users will reach 935 million in 2027, rising from 364 million in 2022. Here we explore how and why lendtechs are using embedded lending products such as BNPL to offer their customers compelling services, and deliver value not normally found in traditional banks.

Cardknox

NOVEMBER 1, 2023

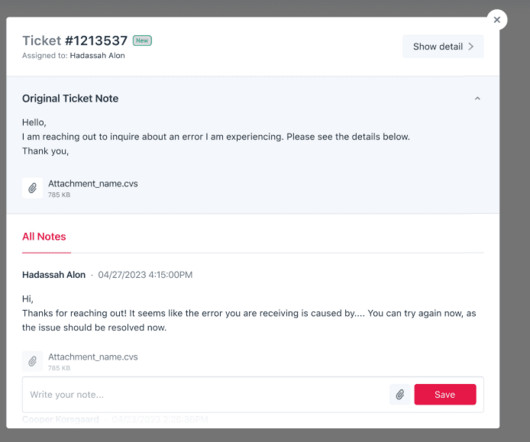

November 2023 Partner Portal Updates We are pleased to announce the release of the following Partner Portal updates. What’s new New Ticket System Design: We are thrilled to introduce a […] The post Partner Portal Release November 2023 appeared first on Cardknox.

FloQast

NOVEMBER 1, 2023

Question: Do you like CPE? I mean, who doesn’t enjoy spending their evenings diving deep into riveting subjects like “Advanced Forensic Auditing Techniques” or “ACRS and MACRS: Approaches to Depreciation?” Undoubtedly, we accountants have a gift for bringing fun, and CPE is our pièce de résistance. In all seriousness, CPE is one of those necessary evils for CPAs.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Cardknox

NOVEMBER 1, 2023

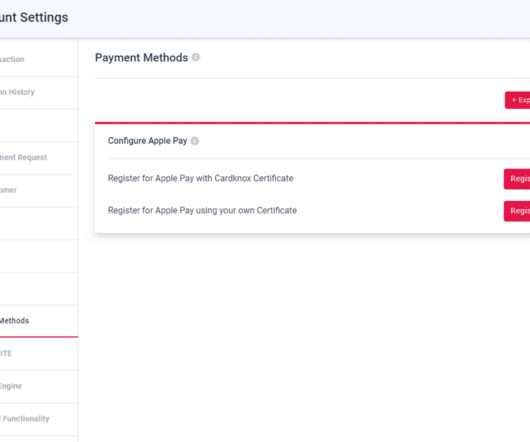

November 2023 Merchant Portal Updates We are pleased to announce the release of the following Merchant Portal updates. Merchant Portal Updates Customer Upload Tool: This tool gives users the ability […] The post Merchant Portal Release November 2023 appeared first on Cardknox.

TechCrunch Fintech

NOVEMBER 1, 2023

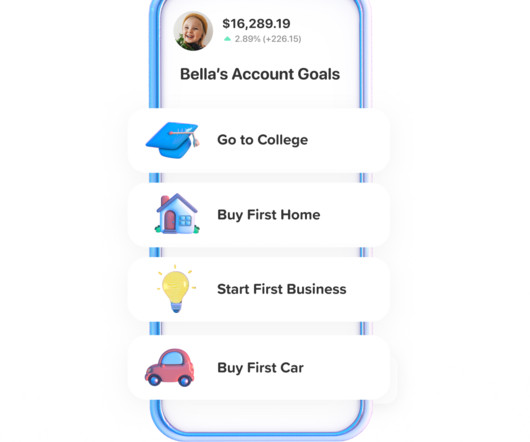

EarlyBird, an app that lets families and friends gift investments to children, has raised $4.5 million in a seed extension round that was partially funded by its user base. The app lets parents create a custodial account, also known as a UGMA (Uniform Gifts to Minors Act) account, which allows them to invest in stocks, […] © 2023 TechCrunch. All rights reserved.

EBizCharge

NOVEMBER 1, 2023

Nowadays, online marketplaces have become a reigning platform for facilitating transactions since most consumers purchase via private sellers and third-party platforms for a more efficient experience. To maintain a healthy cash flow, most marketplaces will charge fees for their services in the form of take rates. Whether you’re a consumer, seller, or an intermediary, it’s essential to understand how take rates work, as these fees can affect your buying and selling decisions.

DeckCommerce

NOVEMBER 1, 2023

What is Composable Commerce and Why Does it Matter? Composable commerce is a flexible approach to e-commerce, allowing brands to build a custom commerce solution using modular, interchangeable components.

Speaker: Becky Parisotto and John Vurdelja

Fulfillment is no longer just about getting products from point A to point B – it's about crafting seamless, scalable, customer first experiences. Flexible fulfillment strategies are more important than ever for those aiming to stay ahead and build resilience as retail enters a new era in 2025. Learn how to optimize fulfillment processes, tackle complex, multi-vendor orders, and create seamless customer experiences – from white-glove delivery for high-value items to quick-ship solutions for ever

Paymerang

NOVEMBER 1, 2023

In today’s fast-paced business environment, achieving efficiency and precision is paramount for seamless invoice automation. Many companies turn to data extraction tools to streamline the extraction of invoice data, but not all data extraction tools are created equal. It’s crucial to select a solution that supports your invoice automation goals.

DeckCommerce

NOVEMBER 1, 2023

This post is an in-depth comparison of headless vs. composable commerce, highlighting functionalities and their distinct advantages to retailers.

Finextra

NOVEMBER 1, 2023

Modernisation programmes, digital service proliferation, client demand and advancing technology are all shaping the evolution and the future of financial services. Real time is the order of the day, and while real time payments come more and more to the fore globally, payment providers need to get up to speed in being able to offer them to their clients and end users, but also to ensure they are.

The Paypers

NOVEMBER 1, 2023

Mangopay has received an EMI licence authorised by the FCA in order to deliver its services to UK customers and strengthen its presence in the region.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Global Fintech & Digital Assets

NOVEMBER 1, 2023

As regulatory thinking evolves, firms must ensure that any current or planned use of AI complies with regulatory expectations. By Fiona M. Maclean , Becky Critchley , Gabriel Lakeman , Gary Whitehead , and Charlotte Collins As financial services firms digest FS2/23 , the joint Feedback Statement on Artificial Intelligence and Machine Learning issued by the FCA, Bank of England, and PRA (the regulators), and the UK government hosts the AI Safety Summit, we take stock of the government and the reg

The Paypers

NOVEMBER 1, 2023

Global spend management solution Payhawk has received principal member status from Visa , advancing its mission to simplify business payments.

The Paypers

NOVEMBER 1, 2023

MENA-based BNPL platform Tabby has secured USD 200 million in Series D funding round in order to develop its solutions and expand its offerings.

The Paypers

NOVEMBER 1, 2023

Australia-based Waave has partnered with Merco to provide continuity to POLi -affected merchants by introducing an Open Banking alternative.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

The Paypers

NOVEMBER 1, 2023

Hedron has signed a three-year contract for the recently launched FullCircl + Acturis integration as part of its strategy to build a growth ecosystem for brokers in the UK.

The Paypers

NOVEMBER 1, 2023

HSBC has successfully tested the use of tokenised deposits in partnership with Ant Group , aiming to accelerate the development of corporate treasury management.

The Paypers

NOVEMBER 1, 2023

Token.io and Open Banking Expo have published ‘The future of Dynamic and Variable Recurring Payments’ research, showcasing the benefits of Variable Recurring Payments (VRPs).

The Paypers

NOVEMBER 1, 2023

UK-based payments technology company Zilch has secured an investment from eBay in a deal valuing it at GBP 1.65 billion.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

The Paypers

NOVEMBER 1, 2023

The HKMA has announced the trial launch of its IADS platform, designed for the secure implementation of open APIs and the acceleration of financial inclusion.

The Paypers

NOVEMBER 1, 2023

Global provider of trade finance solutions Surecomp has integrated fintech Semsoft ’s risk intelligence solution LESTR in its trade finance hub RIVO.

The Paypers

NOVEMBER 1, 2023

Brazil-based B3 has signed a partnership to be the technological infrastructure provider for Guru SPOC for the development of Open Insurance, regulated by SUSEP.

The Paypers

NOVEMBER 1, 2023

Belgium-based European Payments Initiative (EPI) has successfully completed the acquisition of iDEAL and Payconiq International.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content