Amazon, Google stake out bigger foothold in payments

Payments Dive

SEPTEMBER 23, 2024

The tech giants are inserting themselves into more retail transactions to build loyalty and harvest customer data.

Payments Dive

SEPTEMBER 23, 2024

The tech giants are inserting themselves into more retail transactions to build loyalty and harvest customer data.

Open Banking Excellence

SEPTEMBER 23, 2024

23-24th October 2024 Live Event Linkedin Twitter ASEAN Symposium Be inspired by women making waves in the ASEAN payments industry and beyond. Join us at the 2024 Symposium! Our theme for this year is “ Leading Through Volatility “ Our keynotes, panels, and break-out sessions will help strengthen your skills while keeping you on top of industry trends.

Finextra

SEPTEMBER 23, 2024

Money transfer fintech Wise has debuted an online invoicing tool targetting small businesses (SMEs).

Open Banking Excellence

SEPTEMBER 23, 2024

21-22nd November 2024 Live Event Linkedin Twitter Australia Symposium Be inspired by women making waves in the Australia payments industry and beyond. Join us at the 2024 Symposium! Our theme for this year is “ Growth Powering Payments “ Our keynotes, panels, and break-out sessions will help strengthen your skills while keeping you on top of industry trends.

Speaker: Becky Parisotto

Fulfillment is no longer just about getting products from point A to point B – it's about crafting seamless, scalable, customer first experiences. Flexible fulfillment strategies are more important than ever for those aiming to stay ahead and build resilience as retail enters a new era in 2025. Learn how to optimize fulfillment processes, tackle complex, multi-vendor orders, and create seamless customer experiences – from white-glove delivery for high-value items to quick-ship solutions for ever

Finovate

SEPTEMBER 23, 2024

You’ve seen the hype around Generative AI (GenAI). And perhaps you even have an AI strategy in place at your organization. But because the development of AI moves faster than any enabling technology we’ve seen in banking in the past, it’s important to think ahead to the next iteration. In this case, the next evolution of GenAI is Agentic AI.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Nanonets

SEPTEMBER 23, 2024

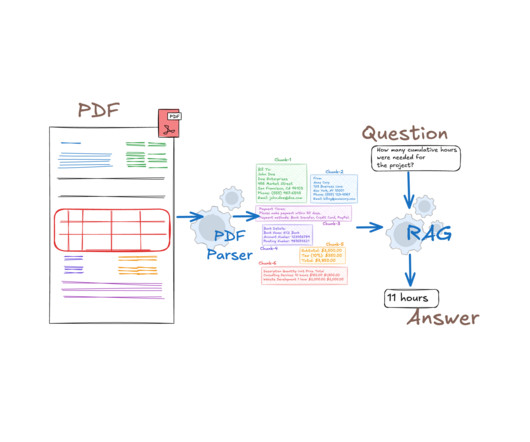

Introduction In the world of AI, where data drives decisions, choosing the right tools can make or break your project. For Retrieval-Augmented Generation systems more commonly known as RAG systems, PDFs are a goldmine of information—if you can unlock their contents. But PDFs are tricky; they’re often packed with complex layouts, embedded images, and hard-to-extract data.

Finovate

SEPTEMBER 23, 2024

Fall is officially here. A favorite season for many, autumn also marks a likely acceleration in fintech and financial services news and activity. Be sure to check Finovate’s Fintech Rundown all week long for the latest in headlines and news updates! Open banking PNC Financial Services and Plaid sign data sharing agreement. Cryptocurrency CheckSig offers Italy’s first crypto staking service that integrates tax management.

Fintech Finance

SEPTEMBER 23, 2024

Wise Business, the international business account for going global, has announced the launch of a brand-new invoicing feature. The free-to-use service simplifies the process of generating invoices, making, and receiving payments, and tracking finances — all within the Wise Business account. Designed with smaller businesses in mind, the service is available free of charge to Wise Business customers, and offers users the ability to: Create and issue professional, well-formatted invoices – wh

The Paypers

SEPTEMBER 23, 2024

Financial services company BNP Paribas has announced its agreement with HSBC to acquire its Private Banking activities in Germany, aiming to further solidify its position in the industry.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Fintech Finance

SEPTEMBER 23, 2024

Raidiam , a leading expert in data sharing technologies, has further expanded its global presence with the appointments of Jim Wadsworth to the role of Head of Advisory and Lauren Jones to the role of Strategic Advisory Partner. Jim brings over 25 years of experience in banking and payments and has worked at the forefront of the Open Banking movement since 2018.

Payments Next

SEPTEMBER 23, 2024

By Michael Wilson, Managing Director at Monex USA The banking-as-a-service model is changing, and fintechs that move money must be prepared. The The post Does Your Bank Partnership Fit Your Fintech? Four Factors to Consider first appeared on Payments NEXT.

Fintech Finance

SEPTEMBER 23, 2024

Marqeta (NASDAQ: MQ), the global modern card issuing platform that enables embedded finance solutions for the world’s innovators, today announced that Fouzi Husaini has joined the company as its Chief Artificial Intelligence Officer. Previously at Capital One and Amazon, Husaini will play a pivotal role in scaling Marqeta’s AI organization to help increase purchasing power for all by reducing risk and improving consumer and commercial rewards, while also helping accelerate our pace of innovation

Finextra

SEPTEMBER 23, 2024

SWIFT: tradition and security in global money transfers SEPA: European ease for business TARGET: bi

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Fintech Finance

SEPTEMBER 23, 2024

Airwallex , a leading global payments and financial platform for modern businesses, today revealed how its global financial technology has improved McLaren Racing’s financial operations throughout the 2024 Formula 1 season. Prior to this partnership, McLaren’s international payments run consisted of 30 payments made one at a time, which was inefficient and time-consuming.

Fintech News

SEPTEMBER 23, 2024

Five applicants have submitted bids for a virtual bank license, according to Somchai Lertlarpwasin, Assistant Governor of the Financial Institutions Policy Group at the Bank of Thailand (BOT). The submission window, which closed on 19 September 2024, followed a call from the Ministry of Finance and the BOT for interested parties to apply. While the BOT has not yet confirmed the names of the applicants, reports suggest that a consortium led by Gulf Energy Development, which includes Krungthai Ban

Fintech Finance

SEPTEMBER 23, 2024

DailyPay, a United States-based worktech company and leading provider of earned wage access (EWA), is expanding globally. Beginning this fall, DailyPay, an award-winning provider of EWA services, will have an EWA offering available in the United Kingdom, marking the company’s first foray outside the U.S. At launch, the program will be offered to DailyPay clients with operations in the U.K.

Fintech News

SEPTEMBER 23, 2024

Singapore-based loan matching platform Lendela has appointed Axel Frändén , its former Chief Marketing Officer, as the new Deputy CEO. Frändén will retain oversight of marketing while expanding his responsibilities to support the company’s growth strategy across Singapore, Hong Kong, and Australia in his new role. With over a decade of experience in marketing and business development, Frändén is set to work closely with CEO Nima Karimi and senior management to drive operational efficiency

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Fintech Finance

SEPTEMBER 23, 2024

Mastercard , a global leader in payments technology, has collaborated with Entreprenelle , a social and business development organization that supports, connects and trains women entrepreneurs. As part of this collaboration, Mastercard and Entreprenelle jointly organized a series of upskilling workshops aimed at equipping female entrepreneurs with the essential tools and knowledge needed to successfully scale and grow their businesses.

Finextra

SEPTEMBER 23, 2024

After years of research, the Bank of Canada says it is "scaling down" its work on a retail central bank digital currency.

Bank Automation

SEPTEMBER 23, 2024

Auto lenders are incorporating artificial intelligence into their processes to improve customer service automation and credit decisioning while eyeing uses for underwriting. Subprime auto lenders can use AI to ensure staff and resources are assigned to tasks that help navigate affordability challenges, operational costs and credit risk, Harvey Singh, chief operating officer at Veros Credit, said during a […] The post Auto lenders lean into AI for customer service appeared first on Bank A

Payments Dive

SEPTEMBER 23, 2024

The convenience store operator turned to Relay Payments to allow truck drivers to pay securely at most of their fueling locations.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Bank Automation

SEPTEMBER 23, 2024

Citizens Bank is training employees on generative AI, engineering, cloud application and development, security and operations. “We have a targeted approach to upskill colleagues in roles that support or use generative AI, with a focus on our use cases that have launched,” Michael Ruttledge, chief information officer and head of technology services at Citizens, told […] The post Citizens invests in gen AI training appeared first on Bank Automation News.

Payments Dive

SEPTEMBER 23, 2024

Earned wage access provider DailyPay plans to begin offering its services outside the U.S. for the first time later this year.

Fintech News

SEPTEMBER 23, 2024

The Monetary Authority of Singapore (MAS) has ordered e-commerce platform Qoo10 to suspend all payment services from 23 September 2024. This follows several customer complaints received between April and August 2024 about delayed payments to merchants on Qoo10’s e-commerce platform. While Qoo10 is not yet licensed by MAS, it was allowed to continue operating while its application was under review under an exemption provided by the PS Act.

Finextra

SEPTEMBER 23, 2024

Digital bank Nubank has selected Nasdaq's regulatory reporting system, AxiomSL, for its Latin American offering.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Fintech News

SEPTEMBER 23, 2024

Singapore’s state investor Temasek has pledged S$100 million towards combating climate change. This initiative, named the Concessional Capital for Climate Action (CCCA), was unveiled by Temasek Chairman Lim Boon Heng during the company’s 50th-anniversary celebration. The CCCA aims to bridge the climate financing gap, particularly in Asia, by providing flexible and favorable financing options for projects that might otherwise struggle to secure funding.

Finextra

SEPTEMBER 23, 2024

JPMorgan Chase is testing a credit card product for customers of its UK digital challenger bank, according to Bloomberg.

The Fintech Times

SEPTEMBER 23, 2024

One in six B2B suppliers now give business customers over two months to pay their invoices, according to a joint report by economic consultancy Cebr and European small business lender iwoca. The Credit Where It’s Due: Trade Credit and Digitisation Report shows a significant jump in the number of suppliers offering repayment terms longer than 60 days – from seven per cent in 2020 to 17 per cent in 2024.

Let's personalize your content