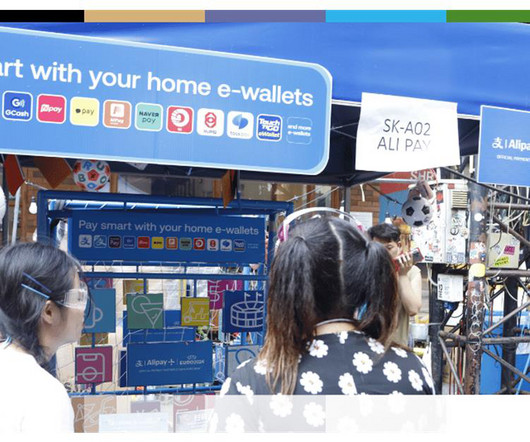

Visa Reveals Digital Products to be Launched Over the Year Catering to Evolving Consumer Demands

The Fintech Times

MAY 17, 2024

Consumer payment preferences are constantly evolving, meaning firms need to adapt to cater to these needs. At the Visa Payments Forum in San Francisco, Visa has unveiled new products which will address the evolving consumer payments demands. Jack Forestell, chief product and strategy officer, Visa “The industry is at a pivotal point – new technologies like Gen AI are rapidly shifting how we shop and manage our finances,” said Jack Forestell , chief product and strategy officer, Visa.

Let's personalize your content