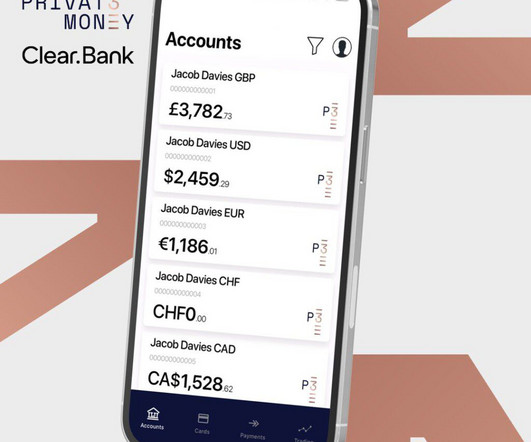

Go Global: Introducing Privat 3 Money’s multi-currency account

The Payments Association

JULY 23, 2024

Privat 3 Money introduces a multi-currency account in collaboration with ClearBank, enabling seamless transactions in EUR, USD, CHF, and CAD under a single IBAN. Key features include simplified international transactions, user-friendly FX solutions, and API-driven technology for enhanced control. This service is ideal for travellers, online shoppers, and businesses navigating global markets.

Let's personalize your content