Credit card delinquencies rise, especially for low-income earners

Payments Dive

JANUARY 24, 2024

Credit cards balances, auto loans and high rents are straining low-income consumers’ limited budgets, the New York Fed details in a new report.

Payments Dive

JANUARY 24, 2024

Credit cards balances, auto loans and high rents are straining low-income consumers’ limited budgets, the New York Fed details in a new report.

PCI Security Standards

JANUARY 24, 2024

The PCI Security Standards Council is now offering sponsorship opportunities for its award-winning podcast series, Coffee with the Council. Established in 2022, Coffee with the Council produces monthly episodes which seek to engage the payment industry by communicating Council news and updates, interviews, panel discussions, and much more. The podcast is syndicated across more than a dozen popular platforms including Spotify, Apple Podcasts, Google Podcasts, Audible, Pandora, iHeartRadio, and ma

TechCrunch Fintech

JANUARY 24, 2024

Alinea Invest, a fintech app offering AI-powered wealth management aimed at Gen Z women, has $3.4 million in seed funding ahead of the launch of a virtual AI assistant that will help users with their investing needs. The fundraising comes on the heels of 225,000 downloads of Alinea’s app, leading to a revenue run-rate of […] © 2023 TechCrunch.

Fintech News

JANUARY 24, 2024

In the global financial landscape, Singapore has carved out a niche for itself as a thriving hub of fintech innovation. The annual list curated by The Straits Times and German research house Statista, showcasing the 100 fastest-growing fintechs in Singapore, indicate how fintech firms have progreessed in an uncertain and volatile funding climate. To compile this meticulous list, Statista sifted through over 2,000 companies based in Singapore.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

TechCrunch Fintech

JANUARY 24, 2024

Bilt Rewards, whose platform aims to allow consumers to earn rewards on rent and daily neighborhood spend, has raised $200 million at a $3.1 valuation, the company announced today. General Catalyst led the financing, which more than doubles the New York-based company’s valuation compared to its $150 million October 2022 raise. Eldridge and existing backers […] © 2023 TechCrunch.

Stax

JANUARY 24, 2024

The phrase “dynamic pricing” often sparks heated debates in eCommerce and retail, and it’s not hard to see why. If you’ve ever booked a hotel, ordered an Uber, or shopped on Amazon, you’ve experienced the effects of dynamic pricing in real-time. Prices may shift down or up at a moment’s notice. But if dynamic pricing adds complexity to the customer experience, why have so many industries embraced it?

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Stax

JANUARY 24, 2024

There’s been a lot of discussion in recent months about the apparent phase-out of QuickBooks Desktop software. Some coverage has not been entirely accurate, which has caused a lot of confusion for Desktop users and questions like: Is QuickBooks Desktop discontinued? Will I still be able to use my existing QuickBooks Desktop software? Do I need to transition to a new system altogether?

Basis Theory

JANUARY 24, 2024

Negative option merchants are merchants that offer an enticing option for customers, like a free trial, that requires a credit card to sign up. The customer, in turn, has opted into paying for a subscription, and will be charged as such, and until cancellation, at the end of the promotional period.

Fintech Review

JANUARY 24, 2024

The landscape of financial lending has undergone significant changes over the past few decades. At the forefront of this evolution is bank lending, a traditional pillar of financial support for individuals and businesses alike. As an integral part of the economy, bank lending has been scrutinized, with questions raised about its effectiveness and efficiency.

Fintech News

JANUARY 24, 2024

On January 14, 2019, the Singapore Parliament passed its comprehensive Payment Services Act (PS Act), replacing the former Payment Systems Oversight Act and Money-Changing and Remittance Businesses Act to broaden the scope of regulated payment activities to include emerging trends and industries like digital assets and cryptocurrencies. The legislation, which aims to provide regulatory certainty and consumer safeguards about payment activities, all the while encouraging innovation and growth of

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Finextra

JANUARY 24, 2024

Open banking platform Tink has launched a rules-based risk engine to protect merchants from fraud on instant payment rails.

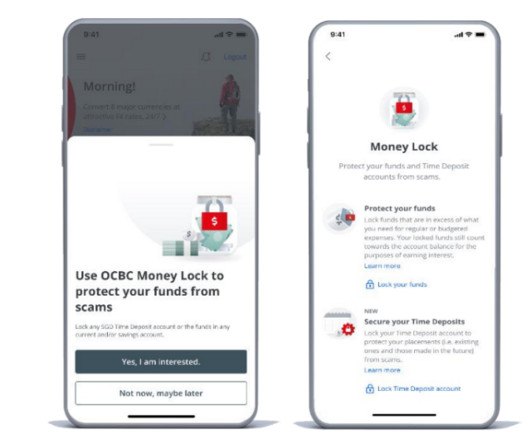

Fintech News

JANUARY 24, 2024

From January 31, OCBC Singapore is set to expand its OCBC Money Lock ‘kill switch’ service to time deposits. This follows its successful implementation for current and savings accounts in November 2023. The enhancement is a response to growing concerns over digital security threats, such as malware and phishing, which have become prevalent in the online banking space.

Payments Dive

JANUARY 24, 2024

“Looking inward, I realized we grew our org too quickly,” founder and co-CEO Pedro Franceschi said in a message to employees.

Fintech News

JANUARY 24, 2024

Global digital asset banking group Sygnum has reported an interim close of its Strategic Growth Round, successfully raising over US$40 million, surpassing its initial target of around US$35 million. This funding has elevated the company’s post-money valuation to US$900 million. The Strategic Growth Round aims to fund Sygnum’s expansion into new markets and the enhancement of its regulated products and services, aligning with the growing trends in the digital asset industry.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Payments Dive

JANUARY 24, 2024

With an IPO on the horizon, the BNPL firm is offering customers a subscription service for $7.99 per month.

Fintech News

JANUARY 24, 2024

F inancial product comparison platform MoneyHero reported substantial unaudited Q4 2023 growth, with approved applications increasing by over 80 percent, driving a revenue surge of more than 50 percent year-on-year to US$17.2 million (SG$23 million). Additionally, Singapore’s revenue for the same period saw a significant climb, doubling to US$6.3 million (SG$8.44 million).

Finextra

JANUARY 24, 2024

The UK's Financial Ombudsman Service is expecting more than 181,000 consumer complaints in the next year, driven in part by an increase in financial fraud and scams.

Bank Automation

JANUARY 24, 2024

Technology leaders from KeyBank will join Bank Automation Summit U.S. 2024 to discuss balancing automation and efficiencies and robotic process automation. KeyBank Chief Transformation Officer Dominic Cugini and domain manager of service digitization Mike Reynolds will join the speaker faculty at the summit. Cugini will speak Tuesday, March 19, at 9:10 a.m.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Finextra

JANUARY 24, 2024

The London innovation hub of the Bank for International Settlements is inviting applications for an expert advisory group on a Bank of England-led project on financial crime fighting.

Bank Automation

JANUARY 24, 2024

Financial institutions are investing in digital and mobile banking offerings, closing out 2023 with an uptick in digital adoption. This trend was prevalent in the fourth quarter of 2023 for large and small financial institutions alike. At Puerto Rico-based, $18.

TechCrunch Fintech

JANUARY 24, 2024

Listen here or wherever you get your podcasts. Hello, and welcome back to Equity, the podcast about the business of startups, where we unpack the numbers and nuance behind the headlines. This is our startup-focused, Wednesday episode, so today we’re counting down important venture rounds, and chatting our way through other startup and VC news.

Bank Automation

JANUARY 24, 2024

Mastercard extended its collaboration with The Clearing House today to allow customers and businesses to use real-time payments. Mastercard will be the exclusive instant payments software provider for The Clearing House’s (TCH) RTP network, according to a news release from Mastercard.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Finextra

JANUARY 24, 2024

Fintech giant Revolut has launched a service, Mobile Wallets, designed to make it easy to send money abroad.

The Fintech Times

JANUARY 24, 2024

Particularly since the release of OpenAI ‘s ChatGPT at the back-end of 2022, the world has sat up and taken notice of the potential of artificial intelligence (AI) to disrupt all industries in countless ways. To kick off 2024, The Fintech Times is exploring how the world of AI may continue to impact the fintech industry and beyond throughout the coming year.

Finextra

JANUARY 24, 2024

Berlin-based B2B buy now, pay later startup Mondu is set to expand across Europe after securing €30 million in debt financing from Vereinigte Volksbank Raiffeisenbank.

The Fintech Times

JANUARY 24, 2024

Global payment processor Mastercard has opened the doors to new applicants for its new initiative aiming to accelerate the development of solutions to support small businesses across Europe: the ‘Strive EU Innovation Fund’ The new Strive EU Innovation Fund will provide equity-free grants of up to €500,000, alongside technical assistance and mentoring to as many as 20 projects from EU member states.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

The Paypers

JANUARY 24, 2024

National Australia Bank (NAB) has partnered with Microsoft to provide a free cyber assessment tool to help Aussie small businesses prepare for and recover from a cyber-attack.

Finovate

JANUARY 24, 2024

Open banking company Tink has launched its new rules-based risk engine, Risk Signals. Risk Signals leverages account, transaction, and payment data to help prevent fraud and lower settlement risk. Tink won Best of Show in its Finovate debut at FinovateEurope 2014. Open banking company Tink launched its new rules-based risk engine, Risk Signals this week.

The Fintech Times

JANUARY 24, 2024

Digital assets and digital currencies continue to grow in popularity and demand. As regulations evolve to meet this demand, firms like R3 , the distributed ledger technology (DLT) and services provider, are looking to make adoption as seamless as possible. The latest way in which it aims to do this is with the launch of R3 Digital Markets. R3 Digital Markets, powered by R3’s Corda , the regulatory-compliant tokenisation platform, is a solution built to connect financial markets.

Finextra

JANUARY 24, 2024

It is "very likely" that Klarna will launch a stock market listing in the US "quite soon", according to CEO Sebastian Siemiatkowski.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Let's personalize your content