Durbin bashes United Airlines in CCCA fight

Payments Dive

DECEMBER 8, 2023

Sen. Dick Durbin took to the Senate floor Thursday to push for a vote on the Credit Card Competition Act, taking a swipe at United Airlines along the way.

Payments Dive

DECEMBER 8, 2023

Sen. Dick Durbin took to the Senate floor Thursday to push for a vote on the Credit Card Competition Act, taking a swipe at United Airlines along the way.

Fintech Finance

DECEMBER 8, 2023

As cash payments in the UK rise for the first time in a decade, payments technology and solutions provider Monavate has worked with e-commerce payments innovator Kasssh and recently launched a trailblazing cash payment solution for online shoppers in the UK. E-commerce operators can now tap the previously unaddressable segment of UK consumers who favour cash payments, by effortlessly plugging Kasssh’s solution, developed with Monavate, in their existing payments infrastructure, using newly avail

Finextra

DECEMBER 8, 2023

Subsequent to a joint discussion paper (3/22 – Operational resilience: Critical third parties to th.

Chargebee

DECEMBER 8, 2023

Customer loyalty is like gold dust in today’s volatile economic landscape. With inflation reaching decades-high levels, customers are adjusting their buying habits and have no qualms about switching to more cost-effective brands to get the deals and benefits that matter to them. Price isn’t the only deciding factor for consumers. The ongoing value exchange makes a brand’s relationship with customers unique.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

DECEMBER 8, 2023

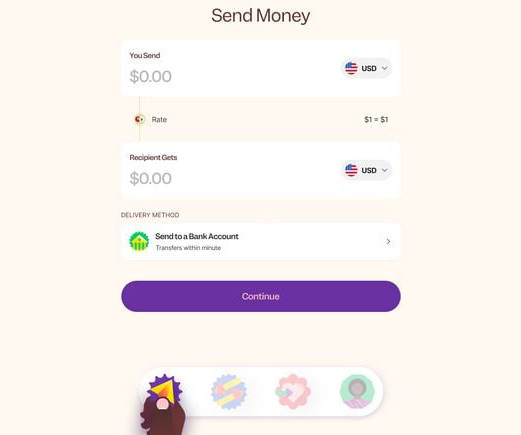

The African payments company launched its remittance app in August as part of a push to facilitate more payments between the U.S. and Africa.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Basis Theory

DECEMBER 8, 2023

This November, Basis Theory introduced several enhancements geared toward expanding our Payment Stack capabilities. With a focus on providing adaptable payment solutions for Merchants and Fintechs, we're excited to unveil significant strides in React Native integration and anti-fraud functionalities.

Finextra

DECEMBER 8, 2023

Artificial intelligence will have a seismic effect on financial services. McKinsey has predicted th.

Chargebee

DECEMBER 8, 2023

The psychology of subscriptions and how to foster customer loyalty Customer loyalty is like gold dust in today’s volatile economic landscape. With inflation reaching decades-high levels, customers are adjusting their buying habits and have no qualms about switching to more cost-effective brands to get the deals and benefits that matter to them. Price isn’t the only deciding factor for consumers.

Bank Automation

DECEMBER 8, 2023

Major banks’ tech spend continued to climb in 2023 as financial institutions invested in AI to add efficiencies, train employees and jump-start innovation.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Chargebee

DECEMBER 8, 2023

Some of us have heard/read/believed (even before 2023) that retaining customers delivers better ROI for our invested capital than spending additional money to acquire new customers. Leaders and investors across various industries and markets are looking more closely than ever into Net Retention Revenue [NRR], voluntary churn [customers wanting to move out of our platform], and involuntary churn [payment failures, disputes].

Bank Automation

DECEMBER 8, 2023

As AI in the banking industry continues to grow, financial institutions must be confident in the accuracy and security of the technology, according to the Bank of England’s Dec. 5 Financial Stability Report.

Chargebee

DECEMBER 8, 2023

How well you retain your customers can make or break your business’s success in the long run. With customer retention rates varying widely across different industries, understanding the average rates can provide valuable insights into how to keep customers coming back. In this article, you’ll see how your company compares to other businesses in the industry and understand if you have room to improve your rates.

The Paypers

DECEMBER 8, 2023

Trovata has announced its partnership with the National Australia Bank in order to provide the latter’s corporate clients with optimised cash management via Liquidity+.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

The Fintech Times

DECEMBER 8, 2023

It’s a time of reflection and anticipation at The Fintech Times throughout December, as we look back at developments and trends over the last 12 months and forward to the year ahead. We’re excited to share the thoughts of fintech CEOs and industry leaders from across the globe to 2023’s key takeaways and what we should expect to be top of the agenda in 2024.

The Paypers

DECEMBER 8, 2023

Digital payments and software services company targeting self-service commerce Cantaloupe has launched new analytics tools in its Seed Pro software platform.

The Fintech Times

DECEMBER 8, 2023

Atom Bank , the UK’s first app-based bank, is supporting the ‘Women in Technology’ programme at Durham University by funding two scholarships for prospective female students from low-income backgrounds. Two Atom-funded scholarships will offer successful applicants £4,000 per annum for all three years of their course at Durham, as Atom and the University seek to inspire future female tech leaders.

Finextra

DECEMBER 8, 2023

In the complex world of commerce, the distinction between B2B and B2C has long been a cornerstone of.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Chargebee

DECEMBER 8, 2023

Based on a benchmark report from PwC, Finance teams continue to spend about 30-40% of their bandwidth on data collection, quality checks, and reporting. While our customers deeply appreciate the efforts and time their Finance teams invest in ensuring everything runs smoothly, we’re always looking for ways to lighten their load. That’s why today, we’re excited to showcase a few recent updates from Chargebee that will help Finance teams gain greater efficiency, wrap up their work more quickly, and

Finextra

DECEMBER 8, 2023

Supporting criminal activity and risking substantial fines from regulators that also damage their re.

The Fintech Times

DECEMBER 8, 2023

FinTech Connect Europe 2023 welcomed a wide range of fintech and finance experts and influencers for a second day, to discuss some of the most important topics for the industry in the build-up to 2024. As FinTech Connect Europe returned for its tenth year, The Fintech Times explored some of the most important discussions had on stage. Using fintech for good remains a hugely important topic for the industry, especially as the political landscape remains difficult for a large proportion of the

Finextra

DECEMBER 8, 2023

Allied Payment Network, Inc. (Allied), the industry leader in real-time, open-network payments solutions to banks and credit unions, today announced the appointment of Jessica Ludvigsen as the new Vice President of Strategic Solutions. This addition marks a significant step in the company's ongoing efforts to bolster its direct sales organization in the $1B and above asset class and deepen its relationships with reseller and integration partners.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

The Nilson Report

DECEMBER 8, 2023

The post Circle and Nubank Partner to Increase Digital Dollar Access in Brazil appeared first on Nilson Report.

Fintech Finance

DECEMBER 8, 2023

FreedomPay , a global leader in Next Level Commerce technologies has collaborated with Citi Retail Services, one of North America’s largest and most experienced retail payments and credit solution providers, to enable Citi Pay® products at the point of purchase for interested merchants. This collaboration provides consumers with flexibility in selecting their preferred lending solutions at the point-of-sale, further enhancing their shopping experience.

The Nilson Report

DECEMBER 8, 2023

The post Russia Launches Mir Payment System in Cuba appeared first on Nilson Report.

Fintech Finance

DECEMBER 8, 2023

In Kano, Nigeria, a student hops on a bus to meet friends after school. In Bangalore, India, a business owner refills a prepaid cell phone. In Belo Horizonte, Brazil, a football fan grabs a quick bite outside the stadium while waiting for the game to kick off. Unbeknownst to them, they are all integral players in the ongoing instant payments revolution.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

The Paypers

DECEMBER 8, 2023

Global asset manager BlackRock has announced it will roll out a suite of new generative AI-supported tools for bot employees and clients in the near future.

Fintech Finance

DECEMBER 8, 2023

Macro-economic headwinds across the globe have resulted in more people shopping for bargains, which has led to the acceleration of online marketplace adoption. This is according to new research from Worldpay from FIS, the merchant solutions business of global financial technology leader FIS® (NYSE: FIS). As online marketplaces grow in popularity and with instances of fraud and disputes typically increasing during the holiday season, merchants need to be extra vigilant this year to minimize the r

The Paypers

DECEMBER 8, 2023

Network International has announced its partnership with Huawei in order to facilitate the digital payments journey for financial services players in the MEA region.

Let's personalize your content