7-Eleven testing financial services in stores

Payments Dive

MAY 14, 2024

The retailer will add terminals to 3,000 of its Speedway locations and test services like cryptocurrency purchases with ATM solution provider FCTI.

Payments Dive

MAY 14, 2024

The retailer will add terminals to 3,000 of its Speedway locations and test services like cryptocurrency purchases with ATM solution provider FCTI.

Finextra

MAY 14, 2024

The Eurosystem has begun the first of a series of trials to test the use of ditributed ledger technology (DLT) for the settlement of wholesale transactions in central bank money.

The Fintech Times

MAY 14, 2024

Temenos , the SaaS cloud banking solution provider, has launched new generative AI solutions as part of its AI-infused banking platform, in a move hoping to change how banks interact with their data, as well as boost productivity and profitability. Leveraging Temenos generative AI, users can engage in natural language queries to generate unique insights and reports, significantly reducing the time it takes for business stakeholders to access and unlock the power of crucial data.

Finextra

MAY 14, 2024

JP Morgan has struck a deal to offer its JPM Coin digital token as a settlement mechanism for Broadridge's DLR (Distributed Ledger Repo) platform.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

The Fintech Times

MAY 14, 2024

Ripple , the global payments and financial solutions provider, is accelerating blockchain education in the US as its University Blockchain Research Initiative (UBRI) renews its $1.05million partnership with Morgan State University to support blockchain innovators across America’s Historically Black Colleges and Universities (HBCUs). Over the last six years, the Ripple UBRI has helped put in place a vital foundation and learning environment for the next generation of blockchain engineers.

Finextra

MAY 14, 2024

In the week that the Australian Federal Government committed $288 million to advance digital ID and tackle identiy theft, CommBank's venture scaler unit x15Ventures has developed Truyu, an app that alerts users when there credentials are at risk of being misused by fraudsters.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Finextra

MAY 14, 2024

Dutch neobank bunq has upgraded its GenAI assistant Finn to make it "fully conversational" and rolled out a travel insurance product.

Fintech Review

MAY 14, 2024

All the signs are pointing in the right direction. Spain could be the next European fintech heavyweight. Spain, historically rich in culture, art, and architecture, is now making its mark in another domain: Fintech. The Spanish ecosystem, although relatively younger compared to hubs like London or New York , is growing at an impressive pace. The numbers speak for themselves: In 2023, deal activity in the Spanish fintech sector outpaced the broader European market.

Finextra

MAY 14, 2024

Deutsche Bank is the latest bank to join the Monetary Authority of Singapore's multi-year Project Guardian project to explore asset tokenisation applications.

Payments Dive

MAY 14, 2024

The Federal Reserve Board said it has received some 2,500 comment letters regarding its Regulation II proposal to cut the fees that merchants are charged when they accept debit cards.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Fintech News

MAY 14, 2024

In the last five years, generative artificial intelligence has had a profound impact on the digital landscape, sparking both incredible interest and deep concern. The convergence of exponential increases in processing power, continuous advancements in deep learning and neural networks, and the democratisation of AI tools has fueled a creative explosion in digital media.

Basis Theory

MAY 14, 2024

Digital payments have thrown open the ability to market and sell to an almost unlimited global audience for merchants. And those businesses who offer subscriptions can realize secure and growing revenue streams when they provide excellent service, and make it easy for customers to maintain an account. Finalizing the payment routing stack , however, can be a challenge for anyone, as every merchant must balance the simplicity of working with a single partner against the cost savings and continuity

BioCatch

MAY 14, 2024

As I’ve previously blogged , the state of scams in Sweden has been a hot topic in the media over the past few months, not least due to a show on Swedish SVT where an investigative journalist followed a criminal gang who used social engineering to convince elderly people to transfer their savings through a hybrid smishing and vishing campaign.

Finextra

MAY 14, 2024

Temenos (SIX: TEMN) today introduced Temenos Positions, a financial processing solution designed to transform banking operations for institutions with complex, multi-core systems across multiple lines of business in both Retail and Corporate banking.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

BioCatch

MAY 14, 2024

The FBI’s Internet Crime Complaint Center (IC3) just released its annual publication on elder fraud, highlighting the growing number of seniors falling victim to scams. In 2023, complaints of elder fraud increased 14% with losses estimated at $3.4 billion, according to the report.

Fintech News

MAY 14, 2024

Direct digital payments are set to overtake cash transactions in the Asia Pacific region by 2028, according to findings from Euromonitor International. Asia Pacific recorded the highest digital payment transaction value in 2023, worth US$ 29,063 billion and accounting for 52% of the global total. With cards being the most popular payment method in the region, credit and debit cards are expected to generate the bulk of new sales over the 2023-2028 period.

Finextra

MAY 14, 2024

Billed as a game-changer for productivity, up to 90% off Klarna staff are now using generative AI daily, with non-technical groups such as Communications, Marketing, and Legal seeing adoption rates of 92.6%, 87.9%, and 86.4% respectively.

Fintech News

MAY 14, 2024

Amazon Web Services (AWS) has announced that Adam Selipsky will be stepping down as CEO after nearly 15 years with the company. Selipsky, who played a key role in growing AWS from its early stages to a US$100 billion annual revenue business shared that he plans to take time off with his family before deciding on his next venture. His tenure as CEO saw AWS navigate the challenges of the pandemic, prioritising long-term customer efficiency and launching several new services, including notable Gene

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

The Paypers

MAY 14, 2024

Global provider of financial software applications Finastra has announced the completion of testing and certification for ISO 20022.

Fintech News

MAY 14, 2024

Homegrown financial services company Singlife has unveiled the Singlife Dementia Cover , an insurance plan in the market offering annual payouts for those living with dementia and other mental health issues. This was made possible through a partnership with Dementia Singapore, which will provide training to Singlife’s financial advisers and employees.

Bank Automation

MAY 14, 2024

Financial institutions are looking to AI to help organize and tap into their structured and unstructured data. Data is “really the operational lifeblood of how FIs operate in modern time,” Abrar Huq, co-founder and chief revenue officer of AI-driven digital documentation tool Arteria AI, tells Bank Automation News on this episode of “The Buzz” podcast.

Fintech News

MAY 14, 2024

Deutsche Bank has announced its participation in the Monetary Authority of Singapore’s (MAS) Project Guardian. This initiative focuses on exploring the potential of asset tokenisation in regulated financial markets. Project Guardian, a multi-year effort, involves collaboration between global policymakers such as the UK’s FCA, Switzerland’s FINMA, and Japan’s FSA, along with representatives from the financial services industry.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Finovate

MAY 14, 2024

Klarna announced that 87% of its staff use its Generative AI engine, Kiki in their daily work activities. Kiki was launched in June 2023 and uses OpenAI’s Large Language Models. Kiki generates responses within one to five seconds and offers answers that are dependent on the user’s role and other context. Global payments network and shopping platform Klarna announced today that 87% of its staff use Generative AI to complete their daily work activities.

Fintech News

MAY 14, 2024

Global issuer-processor Paymentology has announced a strategic partnership with audax Financial Technology , a digital banking solutions provider backed by Standard Chartered Ventures. This collaboration enables financial institutions in Southeast Asia and the Middle East to launch and manage branded card programmes in the span of a few months. The Cards-as-a-Service (CaaS) solution provided by this partnership allows banks and financial institutions to offer seamless payment experiences without

Finextra

MAY 14, 2024

In today’s interconnected economy, efficient cross-border payments are crucial for businesses and in.

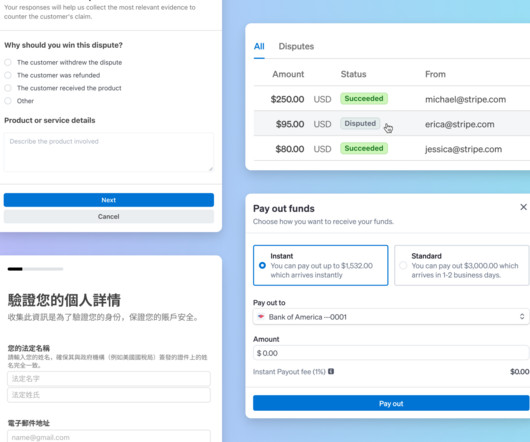

Stripe

MAY 14, 2024

We announced 17 new embedded components that package up our industry-leading payments capabilities and turn what could have been a months-long project for a full team into just a few days of work for one engineer.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Finextra

MAY 14, 2024

Worldline [Euronext: WLN], a global leader in payment services, today announced a strategic partnership with Visa, a global leader in digital payments, to launch a new virtual card issuing solution.

Fintech Finance

MAY 14, 2024

Guavapay and Snowdrop Solutions announced a strategic partnership, in a move that will enhance user experience and financial transparency. The collaboration will further enrich transaction data in the MyGuava App, a product of Guavapay Limited. MyGuava, a global fintech company focused on international money management and payments solutions, will leverage Snowdrop’s transaction enrichment solution, known as the MRS API, in its application, providing customers with details like merchant na

The Fintech Times

MAY 14, 2024

The UK startup scene has often been described as the backbone of the country’s economy. Therefore, it is paramount that new entrants are guided on the right path. One such guide is Nicolai Chamizo , founder and CEO of Swedish-based Incore Invest. Chamizo has had a significant impact on the tech industry, supporting the UK startup scene with valuable insights drawn from his experience launching several companies, each achieving valuations exceeding €100million.

BioCatch

MAY 14, 2024

The topic of scams and fraud has been a recurrent theme in the news over the past years. Recently, the alarming increase in cases, especially the fake contact center scam, has drawn the attention of industry and law enforcement, primarily due to the high amount of money involved in these crimes.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Let's personalize your content