Pot payments players crave federal reforms

Payments Dive

JUNE 5, 2024

The Safer Banking Act and federal rescheduling of marijuana could simplify transactions for payments companies doing business in the arena.

Payments Dive

JUNE 5, 2024

The Safer Banking Act and federal rescheduling of marijuana could simplify transactions for payments companies doing business in the arena.

Finextra

JUNE 5, 2024

The Bank for International Settlements says it multi-central bank CBDC platform, Project mBrige, is ready to accept value added products and new use cases as it reaches minimum viable product stage (MVP).

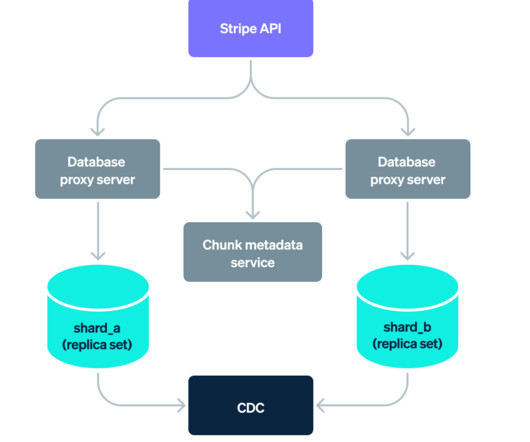

Stripe

JUNE 5, 2024

In this blog post we’ll share an overview of Stripe’s database infrastructure and discuss the design and application of the Data Movement Platform.

Bank Automation

JUNE 5, 2024

AMSTERDAM — ING is using generative AI in its know-your-customer processes to boost productivity for its data analysts and improve the client experience. The generative AI efforts for KYC have both an operational and client benefit, Marnix van Stiphout, chief operating officer and chief technology officer ad interim at 976 billion euros ($1.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Finovate

JUNE 5, 2024

The U.S. Small Business Administration plans to issue a new SBA loan option for small businesses. The new pilot program will extend lines of credit of up to $5 million and will charge an annual fee and a maximum interest rate that is 3% to 6.5% higher than the prime rate. Lenders will receive a 75% guaranty on loans larger than $150,000 and an 85% guaranty on loans smaller than $150,000.

Fintech News

JUNE 5, 2024

ANEXT Bank, a digital wholesale bank based in Singapore and a subsidiary of Ant International, has reported a substantial increase in its micro, small, and medium enterprise (MSME) customer base. Over the past year, the bank’s customer base more than doubled, resulting in a notable rise in regional and global presence among its clients. ANEXT Bank has seen a six-fold increase in the volume of cross-border transactions facilitated for its MSME customers.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Finextra

JUNE 5, 2024

A new stock exchange backed by BlackRock and Citadel Securities is being established to take on the New York Stock Exchange and Nasdaq.

Fintech News

JUNE 5, 2024

Australia will introduce new legislation to amend the Credit Act, requiring Buy Now, Pay Later (BNPL) providers to hold an Australian credit license and comply with existing credit laws regulated by the Australian Securities and Investments Commission (ASIC). Currently, most BNPL products are not covered by the National Consumer Credit Act, leaving consumers without the same protections such as affordability checks that apply to credit cards and loans.

Finextra

JUNE 5, 2024

The global fintech market is growing rapidly with a market size expected to top $608 billion by 202.

Fintech News

JUNE 5, 2024

In this era of technological innovation, companies are increasingly entrusting critical services to external partners. From handling operations to managing human resources and steering application development, the outsourcing landscape is undergoing a significant change. In the financial sector alone, the global outsourcing market is projected to reach a value of US$68.8 billion by 2030.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Payments Dive

JUNE 5, 2024

The parent to payments service Zelle aims to inform seniors about scams as it faces congressional scrutiny over its fraud reimbursement practices.

Fintech News

JUNE 5, 2024

Sumsub, a global verification platform, has announced its partnership with the Mastercard Engage Partner Programme. This collaboration focuses on providing digital first solutions to enhance customer onboarding and compliance processes. By joining the Engage Programme, Sumsub aims to streamline customer onboarding, reduce fraud risks, and foster trust, ultimately improving the digital experience for end-users.

Finextra

JUNE 5, 2024

Remote, the leading global HR platform for distributed companies, has selected Nium, the global leader in real-time cross-border payments, to enhance its international payroll capabilities.

Fintech News

JUNE 5, 2024

Thredd, a growing global payments platform, has announced its partnership with Discover Global Network at the Money20/20 Europe event. This collaboration aims to meet the increasing demand from Thredd’s clients for more flexible card programmes, especially those requiring cross-border card issuance. Discover Global Network, which processes billions of transactions for over 305 million cardholders globally and is accepted at over 70 million merchant locations, will enhance Thredd’s service

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Finextra

JUNE 5, 2024

The Consumer Financial Protection Bureau (CFPB) has taken another step designed to promote open banking in the US, finalising a rule for recognising data sharing standards and preventing incumbents from "squelching" startups.

BlueSnap

JUNE 5, 2024

Every interaction customers have with your brand contributes to their customer experience. From searching your website to speaking with sales or support, each touchpoint impacts whether customers want to start and keep doing business with you. The better the experience, the more likely customers will rely on — and recommend — your company. The post Improve Customer Experience with Better B2B Billing & Payments appeared first on BlueSnap.

Bank Automation

JUNE 5, 2024

Card giant Mastercard and digital bank bunq are teaming up on open banking and AI, the companies announced this week at Money2020 in Amsterdam.

Finextra

JUNE 5, 2024

Australia's government is prepping legislation that would require buy now, pay later providers to carry out basic credit checks on new customers.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Finovate

JUNE 5, 2024

U.K.-based insurtech Eleos has secured $4 million in seed funding. The round was led by Fuel Ventures and Indico Capital. Early-stage investor APX also participated. Eleos made its Finovate debut earlier this year at FinovateEurope in London. Eleos , an insurtech and income protection provider based in the U.K., has raised $4 million in seed funding.

Finextra

JUNE 5, 2024

The former French President, François Hollande, gave a keynote session at Money 20/20 speaking on the current state of French technology investments and about how he turned France into a Fintech hub.

The Fintech Times

JUNE 5, 2024

As many of the world’s largest banks meet at Money2020 in Europe this week, green fintech Cogo asks whether they are responding to climate change at the necessary pace. There is a clear appetite from customers for banks to help tackle the climate crisis. 70 per cent of customers want to see their bank take action to reduce their own environmental impact and 75 per cent of banking customers want to know more about the environmental impact of how they spend their money.

Finextra

JUNE 5, 2024

Join FinextraTV at Money20/20 Europe 2024 as Amanda Gourbault, EVP and Head of Marketing at CompoSecure, discusses the role of credit and debit cards beyond traditional payments. We look to the near future to understand how payment cards can maintain and enhance security while minimizing purchase rejections, and discover how real-time innovations are addressing customer demands and industry needs for secure and seamless transactions.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

The Fintech Times

JUNE 5, 2024

Most consumers in the UAE are confident in managing their finances, although gaps in financial knowledge persist, according to Visa ‘s 2024 Financial Literacy Survey. The survey, which assessed the financial habits and awareness of individuals aged 18 to 55 in Dubai, Abu Dhabi, and Sharjah, highlights both strengths and areas for improvement. More than half of respondents across all age groups report confidence in their financial situation, with a significant majority actively monitoring t

Finextra

JUNE 5, 2024

Founded by a team of former Swift executives, iPiD (International Payment Identity) has raised $5.3 million to roll out a Confirmation of Payee product across Europe.

The Fintech Times

JUNE 5, 2024

TSB and Fintech Scotland invite fintech startups to apply for the fourth Innovation Labs, focusing on open banking, while also announcing a partnership with Doshi for financial education. This year, TSB is looking to work with fintechs that have open banking propositions that will deliver money confidence to customers, offering them a more personalised experience and access to a range of financial products such as savings, insurance, investments and pensions.

Finextra

JUNE 5, 2024

Capital One, Stripe and Adyen have banded together on a free, open source product designed to help reduce fraud losses and false declines for merchants.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

The Fintech Times

JUNE 5, 2024

On day two of Money20/20 Europe 2024 , François Hollande, the former French president, delved into his efforts to position France as a tech leader, highlighting tax incentives, the creation of the French public bank, and a flourishing startup scene with 33 unicorns. There was a full house for Hollande, who sat down on the Exchange Stage for a conversation with Money20/20’s chief strategy and growth officer, Scarlett Sieber , covering everything from fintech-focused policies he implemented betwee

Finextra

JUNE 5, 2024

Join FinextraTV at the Temenos Community Forum 2024 as Tony Coleman, Chief Technology & Innovation Officer at Temenos and Cormac Flanagan, Head of Product Management at Temenos discuss the recently announced launch of Temenos Positions. They cover how real time, single source of truth financial processing is needed, because it provides a critical view across a bank’s complex landscape, particularly benefitting fund authorisation and intraday liquidity.

The Fintech Times

JUNE 5, 2024

EBANX, a global cross-border payments fintech, has teamed up with Ozow , South Africa’s instant EFT payments provider, expanding their strategic partnership to further enhance digital payment solutions in South Africa. The collaboration aims to streamline transactions, support merchants of digital products and services, and cater to the country’s young, tech-savvy population. “Our enhanced collaboration with Ozow is a testament to our belief in the potential of the South Africa

Finextra

JUNE 5, 2024

Peru is the latest country to enlist NPCI International Payments to help build a real-time payments system based on India's UPI.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Let's personalize your content