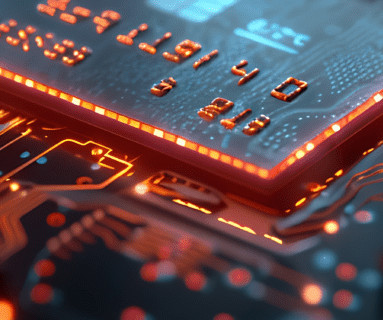

The Role of PCBs in Cybersecurity

VISTA InfoSec

JULY 19, 2024

As fraudsters are continuously finding new ways to strike, we’re continuously finding new ways to prevent them with controls such as encryption, multi-factor authentication, fraud detection software, etc. But not everyone is aware that it all begins with how electronic devices are designed. With the way Printed Circuit Boards (PCBs) are laid out and built, to be precise.

Let's personalize your content