Card debt climbs to record $1.13 trillion

Payments Dive

FEBRUARY 7, 2024

Consumers’ credit card debt rose nearly 5% in the fourth quarter, compared to the third quarter, adding to delinquencies as well.

Payments Dive

FEBRUARY 7, 2024

Consumers’ credit card debt rose nearly 5% in the fourth quarter, compared to the third quarter, adding to delinquencies as well.

PCI Security Standards

FEBRUARY 7, 2024

Welcome PROSA, a new Principal Participating Organization (PPO) at the PCI Security Standards Council! In this special spotlight edition of our PCI Perspectives Blog, PROSA CISO Valther Galván Ponce de León introduces us to his company and how they are helping to shape the future of payment security.

Payments Dive

FEBRUARY 7, 2024

The processing and acquiring company, which seeks a “very specific” special bank charter, doesn’t intend to compete with its financial institution partners, Fiserv CEO Frank Bisignano said Tuesday.

Finextra

FEBRUARY 7, 2024

The metaverse could place new demands on payment services that may be better met by central bank digital currencies and retail faster payment systems than by crypto, according to a Bank for International Settlements report.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Tearsheet

FEBRUARY 7, 2024

The adoption of digital wallets is expected to grow with new use cases this year. McKinsey predicts that more than two-thirds of Americans expect to have a digital wallet within two years, and many will likely hold multiple wallets. This indicates a shift away from physical debit card usage toward using debit cards through digital wallets. “Using digital wallets and mobile payment apps were once emerging trends but are now becoming common practice for both online and in-store purchases,” Christi

Electronic Payments Coalition

FEBRUARY 7, 2024

Since Congress introduced price caps and routing mandates on debit cards in 2011, research from independent and government sources has illuminated their disproportionate negative impact on small businesses. While corporate megastores like Walmart and Target reaped billions in new revenue, small enterprises were largely excluded from the profits-bonanza.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Fintech News

FEBRUARY 7, 2024

Paxos, a regulated blockchain and digital asset solutions provider, now supports Chainlink’s PayPal USD (PYUSD) price feed on the Ethereum mainnet. This collaboration aims to streamline the adoption of PYUSD, a USD-backed stablecoin issued by Paxos under PayPal’s banner. PYUSD is characterised as an open, programmable stablecoin, backed by dollar deposits, US treasuries, and cash equivalents.

Basis Theory

FEBRUARY 7, 2024

Online dating and related services are booming globally, with demand increasing at a rapid pace. The market for online dating and apps was valued at $7.94 billion in 2023 and is projected to nearly double by 2030, according to Grand View Research.

Fintech Review

FEBRUARY 7, 2024

The financial sector is witnessing a paradigm shift with the ascent of the asset-light business model, a change spearheaded by fintech companies worldwide. This model, characterized by minimal physical assets and a heavy reliance on digital technology, offers fintech firms the agility and flexibility necessary to navigate today’s rapidly evolving economic landscape.

The Payments Association

FEBRUARY 7, 2024

PS23/4 policy urges banks to revamp strategies against APP scams, emphasizing prevention, collaboration, and innovative detection Read more

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

FloQast

FEBRUARY 7, 2024

In the fast-paced world of genomic diagnostics, precision and accuracy are paramount. For publicly-held Veracyte , based in San Francisco, maintaining compliance with SEC and SOX reporting standards while managing audit controls posed a significant challenge. Enter FloQast Close and Compliance Management , a solution that revolutionized Veracyte’s approach to compliance.

Fintech News

FEBRUARY 7, 2024

With a highly skilled international workforce, long-established support for innovation and a well-developed reputation as a global finance hub, cross-border payments in Singapore have the makings of a global hub. Moving forward, Singapore’s presence in the global payments landscape will continue to grow to become one of the most important global cities for cross-border payments, both as a source of new companies and as the headquarters for established and rising players in the sector, a new anal

Finextra

FEBRUARY 7, 2024

In the wake of the widespread shift to digital banking and ecommerce, fraud teams have seen a sharp increase in card transaction fraud. Since 2014, card transaction fraud has increased by an average of 8.9% per year and exceeded $32 billion in losses in 2021 alone. In an increasingly complex threat environment, card transaction fraud has devastating consequences for banks and merchants alike.

Fintech News

FEBRUARY 7, 2024

Entrust, known for its secure payments, identities, and data protection solutions, has confirmed that it is in the midst of discussions to acquire Onfido , a London-based firm specialising in artificial intelligence (AI) and machine learning (ML) powered identity verification technologies. According to TechCrunch , this deal could be worth “well above US$400 million” This move could significantly enhance Entrust’s identity verification offerings with Onfido’s advanced biometric

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Fintech Finance

FEBRUARY 7, 2024

Ebury , a fintech specializing in cross-border payments and FX solutions, based in London and present in 25 countries, has introduced to the market a pioneering solution for direct transactions between the Brazilian real and the Chinese yuan. The new solution will facilitate and expedite trade between Brazil and China, which in 2023 alone totaled exports and imports of over US$145 billion, according to Brazilian Government data.

Fintech News

FEBRUARY 7, 2024

When speaking of the fintech ecosystem, Singapore often receives the limelight due in part to its success in establishing itself as a regional fintech hub. The same pattern emerges when looking at funding rounds. When you analyse the top funding rounds in South East Asia, more often than not you end up just looking at the top funded fintech startups in Singapore casting a large shadow over some of the well-deserving startups from other ASEAN countries that also deserve an equal amount of attenti

The Fintech Times

FEBRUARY 7, 2024

Exploring Africa’s blossoming fintech ecosystem, The Fintech Times delves into the success of Visa’s Accelerator Program through the lens of its participants, uncovering the program’s instrumental role in fostering and bolstering startups across the continent. Introduced in July of last year, the Visa Africa Fintech Accelerator is a 12-week virtual initiative designed to aid fintech startups throughout the continent, providing them with the necessary resources to foster growth and make a s

Fintech News

FEBRUARY 7, 2024

Global issuer-processor Paymentology has appointed Nuno Sitima as its Chief Operating Officer (COO), bringing with him a wealth of experience from his previous roles in the tech and financial sectors. In his role as COO, Sitima said that he is set to prioritise operational efficiency while also nurturing innovation at Paymentology. He held leadership positions at companies like MeaWallet AS, where he spearheaded initiatives in digital payments and tokenisation, and Opera Software, playing a cruc

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Fintech Finance

FEBRUARY 7, 2024

Aro , the UK’s go-to embedded finance partner for brands, has today announced a partnership with Equifax Limited to deliver a new credit card and loan solution for Equifax Marketplace. The solution enables consumers to compare credit cards, secured loan and personal loan products simply and find a financial product that suits their needs from the panel of lenders.

Fintech News

FEBRUARY 7, 2024

Google has announced a new pilot programme aimed at protecting Android users from financial fraud in collaboration with the Cyber Security Agency of Singapore (CSA). The pilot will first be launched in Singapore in the coming weeks. The pilot programme in Singapore focuses on preventing the installation of apps that request sensitive permissions commonly abused for financial fraud.

Segpay

FEBRUARY 7, 2024

7 minute read The digital payments landscape continuously evolves, which makes it challenging for merchants to stay ahead of the curve. As technology continues to reshape our world, several trends are emerging that redefine how consumers shop and pay in a secure environment. Let us explore five digital payment trends that are set to shape the future.

Fintech News

FEBRUARY 7, 2024

Canadian fintech firm Nuvei has announced the global roll out of its omnichannel payments solution. This launch introduces Nuvei’s enhanced unified commerce offering to markets outside North America. The solution, designed to cater to a broad spectrum of industries including retail, hospitality, travel, and iGaming, aims to streamline the payment process for both merchants and consumers.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

The Fintech Times

FEBRUARY 7, 2024

Payments are arguably the face of fintech. When you think about financial technology, it is easy to think about solutions which are making payments faster, easier and more accessible. Now, The Fintech Times turns its attention to the perception of BNPL and, more specifically, the various myths surrounding the space and how providers are busting them.

Fintech News

FEBRUARY 7, 2024

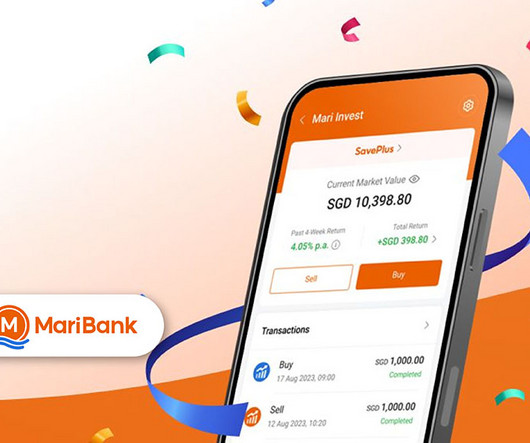

MariBank, a digital bank licensed by the Monetary Authority of Singapore (MAS) and wholly-owned subsidiary of Sea, announced it has surpassed S$200 million in assets under management (AUM) through its investment service, Mari Invest. Mari Invest offers access to a range of investment products, including the Lion-MariBank SavePlus fund, which is managed by Lion Global Investors, a Southeast Asian asset management firm.

The Paypers

FEBRUARY 7, 2024

Elastos has partnered with The Metaverse Bank (TMB) to deliver decentralised digital ID services, to enable users to verify any form of personal credential securely.

Fintech News

FEBRUARY 7, 2024

In a year marked by remarkable financial achievements juxtaposed with significant challenges, DBS Group reported unprecedented earnings for the full year of 2023. However, the bank also made headlines for its decision to reduce compensation for its senior management, a move aimed at accountability for a series of digital disruptions that tarnished its otherwise sterling year.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Bank Automation

FEBRUARY 7, 2024

Maria Mason, enterprise product manager at Citizens Bank, will speak at Bank Automation Summit U.S. 2024 about strategies for automating real-time payments (RTP). Bank Automation Summit U.S. 2024 takes place March 18-19 at the Omni Nashville in Nashville, Tenn., and brings together industry experts to discuss innovation in real-time payments, AI, RPA and more.

Fintech News

FEBRUARY 7, 2024

Thailand’s Finance Ministry has officially removed the 7% value-added tax (VAT) on profits from cryptocurrency and digital token trades. This action, which took effect on 1 January 2024, is intended to propel the nation’s digital asset sector forward, offering an attractive alternative for fundraising endeavors. The Bangkok Post revealed that the VAT exemption, previously slated to end in 2023, will now continue indefinitely.

Clearly Payments

FEBRUARY 7, 2024

Merchants rely heavily on payment processing systems to facilitate seamless transactions and drive revenue growth. To effectively gauge the performance of their payment operations and optimize their strategies, merchants must track and analyze key metrics and key performance indicators (KPIs). These metrics provide valuable insights into various aspects of payment processing, including transaction volume, customer behavior, and financial health.

Fintech News

FEBRUARY 7, 2024

Singaporean sovereign wealth fund GIC has announced updates to its senior management team, effective from 1 April 2024, signaling a shift in leadership roles within the company. Sam Kim, the current Deputy Chief Operating Officer (COO), has been promoted to COO and will also join the Group Executive Committee (GEC), GIC’s top management entity responsible for major decisions regarding investments as well as organisational and personnel matters.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Let's personalize your content