How Google’s settlement will change in-app payments

Payments Dive

DECEMBER 21, 2023

Google’s settlement with attorneys general this week includes a lengthy list of changes the tech titan must make in its approach to in-app payments.

Payments Dive

DECEMBER 21, 2023

Google’s settlement with attorneys general this week includes a lengthy list of changes the tech titan must make in its approach to in-app payments.

BlueSnap

DECEMBER 21, 2023

For many businesses, 2023 has been about making the most of the time, resources and money at hand. Our most read content within our Resource Center says a lot about what businesses are thinking about payments today and their impact on the bottom line. The post The Best of BlueSnap: The Top 10 Payment Content Pieces of 2023 appeared first on BlueSnap.

Finextra

DECEMBER 21, 2023

Eastern Bank in India is launching what it claims is the world's first biometric metal card for premium customers.

The Fintech Times

DECEMBER 21, 2023

It’s a time of reflection and anticipation at The Fintech Times throughout December, as we look back at developments and trends over the last 12 months and forward to the year ahead. We’re excited to share the thoughts of fintech CEOs and industry leaders from across the globe to 2023’s key takeaways and what we should expect to be top of the agenda in 2024.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Fintech News

DECEMBER 21, 2023

Fintech News Singapore would like to take this opportunity to wish all our readers a Merry Christmas and a very Happy New Year. We will be taking a break from the 22nd of December 2023 to the 2nd of January 2024. Until then, you can access some of our year-end articles that may be of interest to you. We look forward to seeing you all again on the 3rd January 2024!

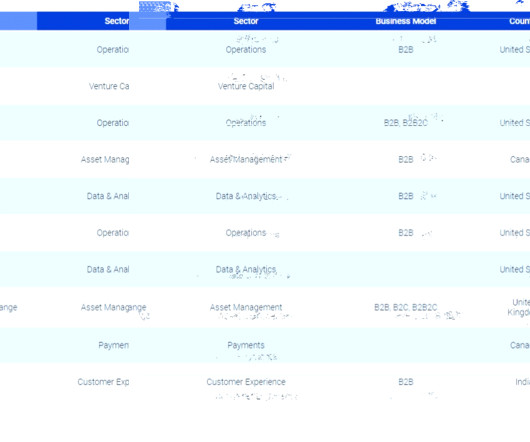

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Finextra

DECEMBER 21, 2023

Eastern Bank in Bangladesh is launching what it claims is the world's first biometric metal card for premium customers.

The Fintech Times

DECEMBER 21, 2023

Digital payments company Visa has teamed up with TECH5, a biometrics and digital identity management company, to focus on the development and enhancement of digital government ecosystems on a global scale. The two organisations will collaborate on creating a comprehensive plan that encompasses various initiatives and projects aimed at establishing a strong foundation for advancing digital payments, digital identity management as well as other services within the ecosystem.

FloQast

DECEMBER 21, 2023

10 years. $700 million. Or, wait. 10 years, $20 million? No. 10 years, $460 million. Whatever the actual figure is, Shohei Ohtani is going to get paid. The newest Los Angeles Dodger might be the best baseball player on the planet — and his last few seasons stack up favorably to some of the best baseball players of all time — and he’s going to be compensated accordingly.

Finextra

DECEMBER 21, 2023

The Payment Systems Regulator issued Specific Requirement 1 on the Faster Payments Scheme Operator (.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

NFCW

DECEMBER 21, 2023

INNOVATION: EBL customers can already use NFC-enabled wearables to make contactless payments INNOVATION: EBL customers can already use NFC-enabled wearables to make contactless payments INNOVATION: EBL customers can already use NFC-enabled wearables to make contactless payments Customers of Eastern Bank (EBL) in Bangladesh will soon be able to apply for a metal biometric payment card that will enable them to authenticate contactless payments at the point of sale with their fingerprint.

Payments Dive

DECEMBER 21, 2023

Spade is tapping its recent funding to try to lure more big U.S. banks to its services, CEO Oban MacTavish said.

Basis Theory

DECEMBER 21, 2023

The terms “payment tokens” and “network tokens” can be found trending as far back as early 2004, but conversation around them has become inescapable in the last few years.

Finovate

DECEMBER 21, 2023

SaveAway is celebrating the season with its “$24 to Ring in ’24 program. The new offering, timed for the New Year, will put $12 in the SaveAway wallet of new sign ups and another $12 for any referral who signs up and completes a SaveAway plan. That’s $24 for new users who bring along a referral now through January 2024. In an email, CEO and founder Om Kundu explained the thinking behind the “$24 to Ring in ’24” plan. “The $24 to ring in 2024 initiative i

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Bank Automation

DECEMBER 21, 2023

Credit Acceptance Corp. went live Dec. 19 with real-time payments for its dealer base through a partnership with Citizens Financial Group. Dealers can receive payments six times per day, Monday through Saturday and on select holidays, Credit Acceptance (CAC) Chief Marketing and Product Officer Andrew Rostami told Auto Finance News, a sister publication to Bank Automation News.

Payments Dive

DECEMBER 21, 2023

In an expanded partnership between the two companies, Walmart is adding Affirm’s buy now, pay later option at its checkout kiosks at most stores.

Bank Automation

DECEMBER 21, 2023

As the global economy faced macroeconomic headwinds coupled with rising rates, fintech funding in 2023 remained subdued compared to prior years. Global fintech funding stood at $30.

The Paypers

DECEMBER 21, 2023

Oman-based Development Bank (DB) has selected Newgen Software to simplify its banking processes and provide enhanced experiences.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Bank Automation

DECEMBER 21, 2023

Fraudsters continue to do damage in the finance industry, evidenced by recent attacks against Fidelity National Financial and Mr. Cooper, and financial institutions must strengthen their systems to avoid hacks and respond to breaches. In 2023, the average cost of a data breach in the financial industry was $5.

Finovate

DECEMBER 21, 2023

Join Finovate VP and host of the Finovate Podcast Greg Palmer as he wraps up 2023 and gets us ready for 2024 with a quartet of conversations about the latest trends in fintech and financial services. From life stories about women and men who became fintech converts, founders, and innovators later in their professional careers to discussions on enabling technologies like Generative AI, the Finovate Podcast is a great place to hear some of the smartest voices in our business talk about what matter

Finextra

DECEMBER 21, 2023

Real-time payments are driving digital transformation and have become a key focus area for financial.

The Fintech Times

DECEMBER 21, 2023

Throughout 2023, a variety of different themes emerged from the Middle East and Africa (MEA) region. From government involvement, to new partnerships and collaborations, to the adoption of new technologies; the region has seen it all. In light of this, what can we expect from fintech in MEA in 2024? MEA following global fintech trends Despite the explosion of fintech growth across the world, the current global economic challenges have hindered fintech’s development.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Finextra

DECEMBER 21, 2023

With 2023 drawing to a close, we take a look back at our most popular news items, videos and community engagement activities over the course of the past year.

The Fintech Times

DECEMBER 21, 2023

The American Fintech Council (AFC), the industry association representing fintech and banks, has given its support for The Fair Audits and Inspections for Regulators’ (FAIR) Exams Act, which aims to enhance transparency and accountability in bank examinations. The bipartisan legislation – introduced by US Senator Jerry Moran ( R-KS) and co-sponsored by US Senators Joe Manchin (D-WV), Bill Hagerty (R-TN), and Thom Tillis (R-NC) – also seeks to create a robust appeals process for legit

Finextra

DECEMBER 21, 2023

The current macroeconomic landscape is marked by exceptional volatility and uncertainty, posing challenges to traditional models in the financial services sector. Despite this new challenging market context, some financial institutions continue to hit pause on using AI and cloud technology, falling behind the curve. Leveraging new technologies can no longer be a zero-sum game.

The Fintech Times

DECEMBER 21, 2023

The payments industry is undergoing a profound transformation, driven by technological advancements and shifting market dynamics. With real-time global payment networks spanning hundreds of currencies and numerous countries, the sector is poised for significant changes. Prajit Nanu, founder and CEO of Nium, the real-time global payments company with a payout network that supports 100 currencies and spans more than 190 countries.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Global Fintech & Digital Assets

DECEMBER 21, 2023

The OCC outlines safety and soundness principles and appropriate risk management processes for its regulated institutions that engage in BNPL lending. By Arthur S. Long , Parag Patel , Barrie VanBrackle , Becky Critchley , Deric Behar , and Charlotte Collins On December 6, 2023, the Office of the Comptroller of the Currency (OCC) issued Bulletin 2023-37 (Guidance), which clarifies the OCC’s policy positions on the risk management of “Buy Now, Pay Later” (BNPL) lending.

The Fintech Times

DECEMBER 21, 2023

Yonder, the rewards credit card provider, has expanded its partnership with GoCardless , the bank payment company. They have introduced variable recurring payments (VRPs) alongside the Direct Debit functionality they already utilise. With GoCardless’ Instant Bank Pay, Yonder members can now settle their credit card balances using VRPs. This collaboration enables Yonder to offer both Direct Debit and instant, recurring open banking payments through a single provider, simplifying payment opt

Finextra

DECEMBER 21, 2023

UAE-based buy now, pay later player Tabby has secured $700 million in debt financing from JPMorgan and extended its series D round to $250 million.

Let's personalize your content