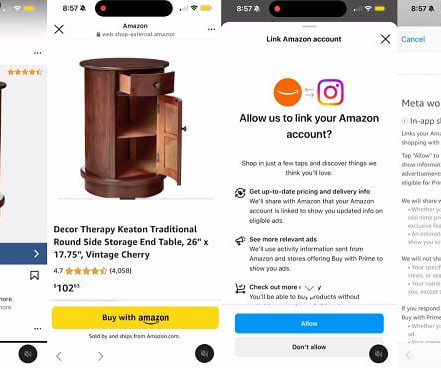

Sociable: Meta inks deal with Amazon to facilitate Facebook, Instagram shopping

Payments Dive

NOVEMBER 13, 2023

The new deal will enable Amazon merchants to connect with Facebook and Instagram users.

Payments Dive

NOVEMBER 13, 2023

The new deal will enable Amazon merchants to connect with Facebook and Instagram users.

PCI Security Standards

NOVEMBER 13, 2023

Welcome Soft Space, a new Principal Participating Organization (PPO) at the PCI Security Standards Council! In this special spotlight edition of our PCI Perspectives Blog, Soft Space Chief Technology Officer Nicholas Lim introduces us to his company and how they are helping to shape the future of payment security.

Payments Dive

NOVEMBER 13, 2023

The EU would require big tech companies, like Apple and Google, to offer their customers payment services through the new digital identity wallet if the regulation is approved.

Basis Theory

NOVEMBER 13, 2023

How Credit and Debit Cards Compare The fundamental difference between a credit and debit card is whose money is being used in the transaction: with a credit card, the consumer is borrowing from the card issuer , while with a debit card they are using their own money, stored with the issuing bank. From a consumer perspective, the credit card has the benefit of providing funds beyond what may currently be available, with the downside of incurring ongoing interest charges and fees; by contrast, the

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

NOVEMBER 13, 2023

Fierce competition, persistent losses and regulatory constraints are likely to push some players out of the buy now, pay later market, Moody’s predicted.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

The Payments Association

NOVEMBER 13, 2023

The financial industry is experiencing a seismic shift, fueled by the advent of artificial intelligence (AI) and open banking.

Payments Dive

NOVEMBER 13, 2023

The holiday season is often a one-two punch of activity for online retailers: First comes the spike in purchases… and then comes the inevitable returns.

The Paypers

NOVEMBER 13, 2023

Xero has launched two new payment features powered by Open Banking and e-invoicing, in order to optimise the way UK-based SMEs manage their cash flow.

Wharton Fintech

NOVEMBER 13, 2023

David Haber, General Partner at a16z— Fintech through the lens of an operator, entrepreneur & investor In today’s episode, Kailee Costello hosts David Haber , General Partner at Andreessen Horowitz. [link] In the episode, Kailee and David discuss: The outlook for FinTech: challenges and opportunities David: There’s still a tremendous amount of opportunity for FinTech across a lot of different categories.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Finezza

NOVEMBER 13, 2023

The proverbial story of the chicken and egg is the ideal when it comes to depicting the reality of the Indian lending landscape. Borrowers require a lending score to borrow money but do not have anything as such since they have never applied for a loan before. Traditionally, borrowers also had to comply with the […] The post 4 Innovative Ways How Fintechs are Transforming Traditional Lending Life Cycle appeared first on Finezza Blog.

Finance Magnates

NOVEMBER 13, 2023

Unveiling My Journey in Global Payment Solutions As a banking and payments specialist, I have always aimed high in my career. However, achieving a billion-dollar deal seemed like a distant dream. My specialization in cross-border transactions and navigating complex regulatory frameworks has been the cornerstone of my journey. I’m excited to share how I transformed this dream into a reality.

Clearly Payments

NOVEMBER 13, 2023

In the HVAC industry, staying ahead of the curve is crucial for success. One such advancement that has revolutionized the way HVAC companies operate is the adoption of credit card payments. Beyond the conventional methods of accepting cash or checks ( which are declining ), integrating credit card payments into your business model can enhance efficiency, customer satisfaction, and overall financial management.

BioCatch

NOVEMBER 13, 2023

The global rise in authorized payment scams has put renewed attention on money laundering and the role of mule accounts as part of the fraud ecosystem. Central to this shift has been the ongoing debate about liability for reimbursing scam victims and who bears financial responsibility. The UK Payment Systems Regulator was the first to put forward policies to require reimbursement for authorized payment scams , and perhaps more significantly, the first to require receiving banks to bear 50/50 res

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Fintech Review

NOVEMBER 13, 2023

In our latest interview, Fintech Review sits down with Andria Evripidou from XDA , a company innovating at the crossroads of payment solutions and cryptocurrency for the gaming world. Andria discusses the hurdles gaming companies face in securing banking services and how XDA offers a vital lifeline for these businesses. She also delves into the growing trend of crypto adoption within gaming operations, an area where XDA is leading the charge in providing seamless integration.

The Paypers

NOVEMBER 13, 2023

Mastercard has collaborated with Dubai Islamic Bank in order to introduce cross-border payment services through digital channels across multiple countries globally.

Finextra

NOVEMBER 13, 2023

Dr Darian McBain, Chief Executive Officer of Outsourced Chief Sustainability Officer Asia, explores the role of technology infrastructure and the need for clearer regulations to advance ESG practices. We evaluate the impact of payment rails and highlight how seamless cross-border transactions in countries like Singapore, India, and Thailand, contribute to social inclusion by addressing challenges faced by migrants.

The Paypers

NOVEMBER 13, 2023

Forty-eight countries have committed to a new tax transparency standard beginning in 2027 to eliminate crypto-related tax evasion.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

The Payments Association

NOVEMBER 13, 2023

ARYZE has launched reForge within its Digital Cash suite, simplifying multi-currency conversions across eUSD, eEUR, and eGBP. This advancement, bolstered by a Chainlink partnership for real-time FX rates, streamlines the exchange process by removing complexities and costs traditionally associated with stablecoin transactions. Additionally, the issuing firm behind Digital Cash, ARYZE BVI, has also recently announced the launch of MAMA - its dedicated Web3 platform for Digital Cash trading.

The Paypers

NOVEMBER 13, 2023

Paytech company payabl. has announced its partnership with GonnaOrde r to provide its payment services and launch a referral scheme for the latter’s global customers.

The Paypers

NOVEMBER 13, 2023

Financial Market Infrastructure (FMI) for cross-border settlements RTGS.global has partnered with Alif Bank , Bank Arvand , and Universal Capital Bank to simplify cross-border payments.

The Paypers

NOVEMBER 13, 2023

UK-based payment orchestration provider BR-DGE has integrated Visa Instalments into Kenwood Travel , for an optimised customer checkout experience.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

The Paypers

NOVEMBER 13, 2023

The Financial Conduct Authority has announced the inclusion of the US-based Metro Bank to its financial crime watchlist, with plans to keep it under supervision.

The Paypers

NOVEMBER 13, 2023

Alternative banking solution Suits Me has partnered with US-based identity proofing and compliance solutions provider Jumio to support the underbanked population in the UK.

The Paypers

NOVEMBER 13, 2023

Fintech company Nuvei has announced the addition of BLIK to its suite of 669 APMs available for ecommerce businesses to provide via a single integration.

The Paypers

NOVEMBER 13, 2023

Saudi Awwal Bank (SAB) has partnered with Mastercard to provide increased access to secure digital transactions across the region.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

The Paypers

NOVEMBER 13, 2023

South Korea-based cryptocurrency exchange Bithumb has revealed its plans to go public in the East Asian country.

The Paypers

NOVEMBER 13, 2023

UK-based money transfer fintech Wise has temporarily stopped onboarding new business clients across the UK and Europe because of ‘high demand’

The Paypers

NOVEMBER 13, 2023

Malta-based Andaria has launched an Embedded Finance solution to help businesses integrate payments services into new and existing platforms.

Let's personalize your content