Stripe, Alaska Airlines to offer in-flight contactless payments

Payments Dive

NOVEMBER 20, 2023

Payments company Stripe said it’s the first time that an airline will use Apple’s contactless payments feature across an entire fleet.

Payments Dive

NOVEMBER 20, 2023

Payments company Stripe said it’s the first time that an airline will use Apple’s contactless payments feature across an entire fleet.

The Finance Weekly

NOVEMBER 20, 2023

AI is , transforming the finance sector, especially in financial planning and analysis (FP&A). Using machine learning algorithms is crucial to make FP&A functions more responsive, insightful, and efficient. Why Should FP&A Leaders Consider to Integrate AI? FP&A leaders experience , significant advantages when they embrace AI. From improved accuracy to gaining a competitive edge.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

NOVEMBER 20, 2023

Adapting to regulation could be a costly endeavor for BNPL companies already facing losses and more expensive funding costs, Moody’s analysts said.

Stax

NOVEMBER 20, 2023

Small Business Saturday, or SBS, is a much-anticipated shopping event that takes place between the Black Friday and Cyber Monday holiday shopping frenzy. This day benefits local businesses since it encourages 72% of shoppers to shop and dine at small, independently-owned retailers and restaurants—not only on SBS—but year-long. This Saturday is always the last one in November, falling somewhere between November 24 and November 30.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is evolving fast, and brands relying on rigid, one-size-fits-all solutions risk losing agility. But modernization doesn’t have to mean disruption. In this webinar, we’ll explore how an extensible, modular approach empowers brands to integrate new capabilities, enhance performance, and scale efficiently—all while leveraging Shopify’s strengths.

Payments Dive

NOVEMBER 20, 2023

The No. 2 U.S. card company now has a means of processing card payments inside China, after years of waiting on Chinese government approvals.

The Payments Association

NOVEMBER 20, 2023

Extended partnership between PXP Financial and Foregenix to include best-in-class eCommerce cyber security monitoring October 31, 2023 – PXP Financial, the experts in global acquiring and payment, services, today announces a new partnership agreement […] Read more

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Bank Automation

NOVEMBER 20, 2023

ConnectOne Bank Senior Vice President and Chief Brand and Innovation Officer Siya Vansia is focused on aligning the bank’s digital and business strategies. During the third quarter, the Englewood Cliffs, N.J.-based, $9.7 billion bank invested in its people and technology, Chief Executive Frank Sorrentino said during the bank’s October Q3 earnings call.

Payments Dive

NOVEMBER 20, 2023

The Fed's vice chair for supervision expressed optimism about FedNow’s benefits and said he expects it to co-exist with the privately owned RTP network.

The Paypers

NOVEMBER 20, 2023

Singapore-based Bitget Wallet has unveiled Task2Get, a Web3 exploration platform aimed at improving user access to the DeFi ecosystem.

Inai

NOVEMBER 20, 2023

In the ever-evolving landscape of e-commerce, payment optimization has emerged as a critical component for merchants seeking to enhance their profitability.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

The Paypers

NOVEMBER 20, 2023

Salt Bank has announced its partnership with Starling Bank in order to use the latter’s Engine platform for the development of digital banking solutions in Romania.

FloQast

NOVEMBER 20, 2023

Internal auditing ensures an organization’s financial integrity, compliance with regulations, and overall operational efficiency. One of the first steps in carrying out an effective internal audit is to perform an internal audit risk assessment. This planning process is the foundation for a successful audit, helping auditors identify and prioritize significant risks and areas of concern within an organization.

The Paypers

NOVEMBER 20, 2023

ThetaRay has partnered with Knox Wire in order to implement its AI-based AML transaction monitoring and sanction screening for the latter’s communication system.

TechCrunch Fintech

NOVEMBER 20, 2023

As more players seek to establish themselves, the competitive landscape grows that much fiercer. Meanwhile, the available funding is finite. © 2023 TechCrunch. All rights reserved. For personal use only.

Speaker: Becky Parisotto and John Vurdelja

Fulfillment is no longer just about getting products from point A to point B – it's about crafting seamless, scalable, customer first experiences. Flexible fulfillment strategies are more important than ever for those aiming to stay ahead and build resilience as retail enters a new era in 2025. Learn how to optimize fulfillment processes, tackle complex, multi-vendor orders, and create seamless customer experiences – from white-glove delivery for high-value items to quick-ship solutions for ever

BlueSnap

NOVEMBER 20, 2023

The global payment processing solutions market is expected to reach more than $192 billion by 2030, and software platforms increasingly have been looking at how they can capitalize on payments. Perhaps your software platform integrates with payment providers today. The post The 6 Benefits of White-Label Payment Processing for Software Platforms appeared first on BlueSnap.

TechCrunch Fintech

NOVEMBER 20, 2023

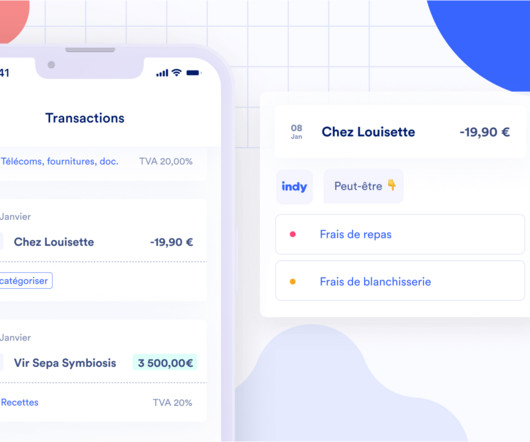

French startup Indy has recently closed a new funding round of $44 million (€40 million), with BlackFin Capital Partners leading the round. Indy started as an automated accounting platform for freelancers and other self-employed people. But the company has been slowly iterating on its product to become an all-in-one platform for freelancers, from accounting to […] © 2023 TechCrunch.

Fraud.net

NOVEMBER 20, 2023

Transaction monitoring has evolved from a rules-based approach to an effective way to mitigate the risks of money-laundering and fraud.

BioCatch

NOVEMBER 20, 2023

Fraudsters are fickle. What’s new is old in the world of cybercrime, with fraudsters often just repackaging up an old attack with a new bow. But it is for this very reason that it is so difficult to predict the next move they’ll make. In addition, fraud trends and attack methods are often regional so what is giving the fraud team a headache at banks in Brazil is probably not what keeps the fraud team at banks in India, Singapore, or the United States up at night.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Open Bank Project Blog

NOVEMBER 20, 2023

Originally published: 11 October 2020 Updated: November 2023 With over 100 countries either implementing or planning an Open Banking framework, the movement is encouraging data-sharing in the global financial services industry. Regulating Open Banking, April 2023 Open Banking promises a wide range of benefits, from financial inclusion to financial education in the community.

BioCatch

NOVEMBER 20, 2023

The UK’s Online Safety Bill has now received Royal Assent, which for those of you unfamiliar with the legislative process in the UK, is when the King formally agrees to make the bill into an Act of Parliament (law).

Nanonets

NOVEMBER 20, 2023

In the ever-evolving landscape of financial operations, the heartbeat of every successful business is a streamlined and error-free invoice approval workflow. As companies navigate the complexities of accounts payable, the demand for efficiency, accuracy, and security has never been more critical. In this blog, we embark on a journey into the world of cutting-edge invoice approval workflows, exploring the challenges faced in manual systems and unveiling the transformative power of innovative solu

The Paypers

NOVEMBER 20, 2023

The Monetary Authority of Singapore and Bank Negara Malaysia have partnered to launch a cross-border real-time payment system connectivity between PayNow and DuitNow.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Finextra

NOVEMBER 20, 2023

Paysafe (NYSE: PSFE), a leading payments platform, announces the extension of its collaboration with Visa, a world leader in digital payments, to integrate Visa Network Tokens, as an alternative to primary credit and debit card account numbers.

The Paypers

NOVEMBER 20, 2023

Payments solutions provider Paysafe has announced that it expanded its partnership with Visa to provide network tokenisation services for merchants.

Finextra

NOVEMBER 20, 2023

Feedzai a financial crime and risk management solution, and Mastercard – a global technology company in the payments industry - are combining technologies to increase crypto fraud protection for hundreds of millions of consumers.

The Paypers

NOVEMBER 20, 2023

Jordan Ahli Bank has partnered with UAE-based Fintech Galaxy to leverage the latter’s FINX platform and become Open Banking compliant.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Finextra

NOVEMBER 20, 2023

Cashfree Payments, India's leading payments and API banking company, announced the launch of ‘KYC Link’ - India’s first no-code verification solution for Indian businesses, marking a significant leap in simplifying digital identity verification for MSMEs, emerging and digitally transitioning sectors.

The Paypers

NOVEMBER 20, 2023

UK-based Hokodo and US-based Balance have released joint research on trends and opinions among Business-to-Business (B2B) sellers about cross-border payment terms.

Finextra

NOVEMBER 20, 2023

In the lead up to Singapore Fintech Festival, Lee Zhu Kuang, Chief Digital, Data and Innovation Officer for Securities Services, HSBC, evaluates the transformative impact of tokenisation and the role of AI standardisation in enhancing scalability and interoperability. We discuss the impact of digital assets and the need to balance financial expertise, regulatory compliance, custody services, and investor security for sustainable industry growth.

The Paypers

NOVEMBER 20, 2023

European Open Finance company Fabrick has partnered with Banque Edel in order to modernise the invoicing procedure for gift cards for the latter’s CSE clients.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content