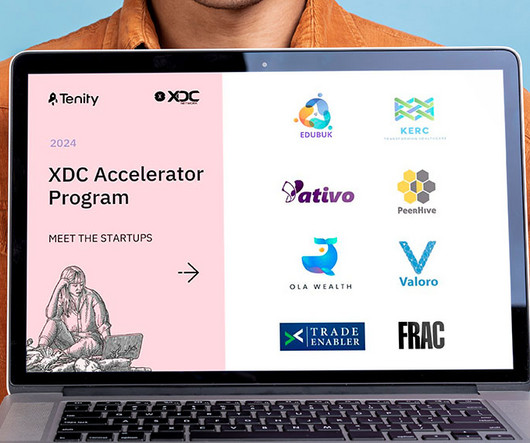

Eight Startups Join XDC Network Accelerator Programme Powered by Tenity

Fintech News

AUGUST 12, 2024

XDC Network has selected eight startups to join its first-ever accelerator programme, powered by Tenity , an innovation ecosystem specialising in early-stage fintech startups. The XDC Accelerator Programme is a significant step for the emerging blockchain platform, which is known for its focus on real-world asset tokenisation and trade finance. The selected startups will gain access to business and technical mentorship, helping them refine their business value propositions and develop a working

Let's personalize your content