Authorized payment scams climb in US

Payments Dive

DECEMBER 14, 2023

Such scams are expected to jump 50-plus percent to $3 billion by 2027, forcing financial institutions to address the rising threat, according to a new report.

Payments Dive

DECEMBER 14, 2023

Such scams are expected to jump 50-plus percent to $3 billion by 2027, forcing financial institutions to address the rising threat, according to a new report.

Finovate

DECEMBER 14, 2023

Much of our behind-the-scenes work at Finovate is determining what’s hot and what’s not in fintech and banking. But given the ever-evolving regulatory landscape, volatile consumer preferences, and fast-changing enabling technologies, it can be hard to keep up on current trends. And while we like to consider ourselves experts on the fintech landscape, it is always important to consult external thought leaders to gauge their thoughts on industry themes.

Finextra

DECEMBER 14, 2023

Just over a year ago, ChatGPT launched. The excitement, anxiety and optimism associated with the new.

PCI Security Standards

DECEMBER 14, 2023

To address stakeholder feedback and questions received since PCI DSS v4.0 was published in March 2022, PCI SSC is planning a limited revision of the standard. Proposed changes include correcting format and typographical errors and clarifying the focus and intent of some of the requirements and guidance. There will not be any new or additional requirements in this revision.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Finezza

DECEMBER 14, 2023

Businesses of all sizes experience cash flow challenges at some time or another. One unique circumstance is when a business receives a sizable order from a client. However, in many cases, they cannot fulfil the order due to a lack of funds to produce the product. For instance, they may be unable to order raw […] The post Evaluating Invoice Financing Options to Improve Cash Flows and Lending Opportunities appeared first on Finezza Blog.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Payments Dive

DECEMBER 14, 2023

“I want that shoe to drop so we can start mitigating that issue,” Bread CEO Ralph Andretta said last week, as the industry awaits the CFPB’s final rule.

TechCrunch Fintech

DECEMBER 14, 2023

Credit Karma co-founder and Chief Revenue Officer Nichole Mustard is leaving the company after 16-and-a-half years, TechCrunch has exclusively learned today. A spokesperson of the consumer fintech, now a subsidiary of Intuit, confirmed Mustard’s departure via email, writing only: “I can confirm she decided to leave the company, her contributions have been significant and we […] © 2023 TechCrunch.

Fintech News

DECEMBER 14, 2023

Oradian, a fintech firm based in Makati, Manila , has notably improved financial sector access, especially in Southeast Asia. They were key contributors in a panel at the Singapore Fintech Festival , discussing the role of profitable scalability in financial inclusion. Antonio Separovic, Co-Founder and CEO of Oradian, speaking at the Singapore Fintech Festival with Lowell Campbell from the IFC The Co-Founder and CEO of Oradian , Antonio Separovic, discussed with Fintech News Singapore regarding

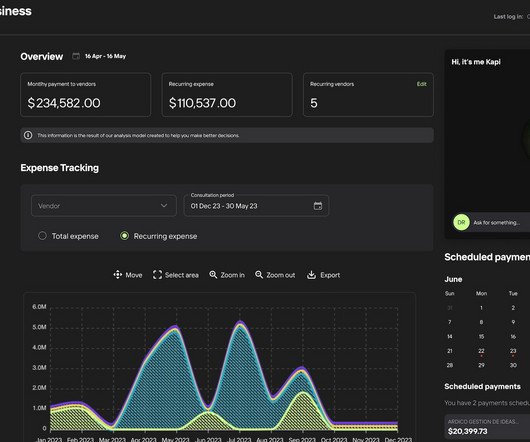

TechCrunch Fintech

DECEMBER 14, 2023

In 2023, Kapital’s customer base grew to 80,000 small businesses in Mexico, Colombia and Peru. It also acquired Banco Autofin Mexico S.A. in September. © 2023 TechCrunch. All rights reserved. For personal use only.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Finextra

DECEMBER 14, 2023

Fnality, the international consortium of global banks focused on building a blockchain-based payment system to support the adoption of tokenised assets and marketplaces, has conducted its first live transactions.

NFCW

DECEMBER 14, 2023

SOFTPOS: Users will be able to use a standard NFC device to transfer digital cash from one person to another Japan-based payments network JCB is to pilot a system that enables users to transfer central bank digital currency (CBDC) from a physical contactless card or their NFC smartphone to another person’s card or mobile device without needing an internet connection.

Basis Theory

DECEMBER 14, 2023

Merchants strive to have a seamlessly integrated payment flow for customers. From the outside looking in, many may assume that this is achievable through a light and simple payment stack that ties together just one or two solutions in total that easily pass information back and forth.

Finextra

DECEMBER 14, 2023

The European Central Bank is inviting expressions of interest from financial market stakeholders in participating in trials of new technologies for wholesale central bank money settlement.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Bank Automation

DECEMBER 14, 2023

As AI becomes pervasive, financial institutions are on the hunt to win AI talent, with the big four U.S. banks commanding a comfortable lead.

Finextra

DECEMBER 14, 2023

Programmable money startup Pave Bank has moved out of stealth with a $5.2 million funding round and a digital commercal banking licence in Georgia.

Bank Automation

DECEMBER 14, 2023

Stephanie Schultz, vice president and head of partnerships at Amex Digital Labs at American Express, is focused on building out digital client experiences as part of her innovation and product development strategy heading into 2024. Throughout 2023, American Express prioritized technology spend, according to the card giant’s third-quarter earnings.

Finextra

DECEMBER 14, 2023

ClearBank has recruited former Starling and Barclays high-flyer Megan Cooper as chief product officer.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

The Fintech Times

DECEMBER 14, 2023

It’s The Fintech Times Bi-Weekly News Roundup on Thursday 14 December 2023. Appointments Fintech Pleo appoints Søren Westh Lonning as its new CFO. He has been working with Pleo in an advisory capacity to bolster its financial planning, capital structure and broader commercial efforts across the business. He joins at a period of high growth for Pleo driven by market expansion and investments to win mid-market customers.

Finextra

DECEMBER 14, 2023

Estonian Regtech Salv has raised €3.9m in new funding to spearhead a launch into the UK.

Fintech Finance

DECEMBER 14, 2023

Alipay+ , a cross-border mobile payment digital platform under Ant International, today announced a year-end campaign to promote sustainable cross-border travel with a series of incentives offered by global partners to users of five leading e-wallets in Asia, including Alipay (the Chinese mainland), AlipayHK (Hong Kong SAR, China), Touch ’n Go eWallet by TNG Digital (Malaysia), GCash (the Philippines), and TrueMoney (Thailand).

The Fintech Times

DECEMBER 14, 2023

The use of AI in finance can bring big changes to how customers experience financial services, manage risks, detect fraud, and more. While London has long established itself as a well-known hub for fintech, the extreme growth of the number of fintech start-ups and scaleups in Northern England (an increase of 263 per cent since 2020) cannot be ignored.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

The Paypers

DECEMBER 14, 2023

Worldcoin has announced it now supports integrations for its World ID with Minecraft , Reddit , Telegram , Shopify, and Mercado Libre.

Finextra

DECEMBER 14, 2023

Visa (NYSE: V), a global leader in payments, today announced the commercial launch of Visa Provisioning Intelligence (VPI), an AI-based product designed to combat token fraud at its source.

The Fintech Times

DECEMBER 14, 2023

Pave Bank has emerged from stealth to give businesses access to new technologies, enabling greater banking efficiency and access to the new digital economy. The emergence of regulated digital assets and programmable money has completely uprooted how money is processed. Opening up channels for businesses, Pave Bank has acquired a digital banking licence from Georgia.

Electronic Payments Coalition

DECEMBER 14, 2023

Today, the Electronic Payments Coalition (EPC) released its 2023 Q4 Data Dashboard, providing a quarterly update on various data related to the credit and debit card system, including interchange and merchant discount rates, holiday spending, and the growing popularity of “Buy Now, Pay Later” options. This quarter’s Dashboard features new data on how younger consumers are satisfied with the data security and rewards offered by their credit card.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

The Fintech Times

DECEMBER 14, 2023

Cogo , the sustainability fintech that partners with financial institutions to help customers lower their carbon footprint, and Moneyhub , the data and payments platform built on open banking and open finance principles, are partnering to help banks and financial institutions develop more ethical and sustainable financial wellness products. In turn, both companies will help support their customers to make better, more ethical financial decisions, improving their lifestyle and the climate.

Segpay

DECEMBER 14, 2023

Key Takeaways Crypto legitimacy is growing globally among merchants and businesses. √ Cryptocurrencies offer privacy, lower fees, faster transactions, no chargeback risks, and global accessibility. √ Trust is still an issue due to cryptocurrency price volatility, regulatory concerns, and fraud risks. √ Segpay incorporates cryptocurrency transactions in our payment solutions package. 5 minute read Cryptocurrencies have become popular with merchants and businesses as an alternate payment method si

The Fintech Times

DECEMBER 14, 2023

Cross-border payments consultancy FYST has revealed the biggest trends in acquiring, including how the sector is tapping into artificial intelligence to boost fraud detection and optimise payment authorisation. According to the company, while consumer and merchant attention are often focused on acceptance, acquiring is the vital link in the payment chain.

Let's personalize your content