Visa cracks down on surcharge programs

Payments Dive

JANUARY 8, 2024

The card network company is boosting efforts to enforce surcharge rules, with non-compliance potentially resulting in fines up to $1 million, according to one card processor.

Payments Dive

JANUARY 8, 2024

The card network company is boosting efforts to enforce surcharge rules, with non-compliance potentially resulting in fines up to $1 million, according to one card processor.

Stax

JANUARY 8, 2024

For SaaS companies, becoming a payment facilitator (or PayFac) offers a ton of advantages—including but not limited to—boosting retention and profitability while exercising greater control over the customer experience. However, several complex types of risks come along with this. Not only must PayFacs safeguard themselves and their clients against potential threats like fraud or cybersecurity breaches but also ensure PCI compliance , customer due diligence, and adherence to card regulations.

Payments Dive

JANUARY 8, 2024

The company, which provides payment and software services to the public sector, is seeing increased client interest in digital disbursements such as prepaid debit cards, said Sloane Wright, Tyler’s president of payments.

Payments Next

JANUARY 8, 2024

By Rodrigo Figueroa, COO, Chargeback Gurus The spike in holiday spending in November and December is always followed by increased chargebacks in The post Top tips for managing the January chargebacks spike first appeared on Payments NEXT.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

The Fintech Times

JANUARY 8, 2024

Digital banking apps have become synonymous with managing personal, and business, finances. The banking sector has witnessed a significant shift that places power in the hands of the consumers. Here, Gaurav Mirral , chief executive officer and executive vice president of Mastercard company Ethoca , explores what customers truly want from their banking apps, and what the future holds in store for them.

Finextra

JANUARY 8, 2024

China's Ant Group is reportedly preparing to acquire Dutch payments firm Multisafepay as it expands further into Western markets.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Fintech News

JANUARY 8, 2024

Global B2B cross-border payment company Thunes has announced the appointment of Floris de Kort as its new CEO to bolster its growth strategy. He will operate from Thunes’ global headquarters in Singapore. In a strategic shift, the company has also promoted Peter De Caluwe to the role of Deputy Chairman, where he will focus on strategy, mergers and acquisitions, and expanding the company’s presence in key markets such as China and the Gulf countries.

Finextra

JANUARY 8, 2024

e& enterprise today announced its strategic partnership with Fils, a groundbreaking fintech platform, establishing a new standard in the digital payments sector by promoting sustainability.

Fintech News

JANUARY 8, 2024

The Indian fintech landscape is undergoing rapid evolution, witnessing a dynamic shift as traditional financial institutions embrace digital transformation at an accelerated pace. The market reflects a harmonious blend of collaboration and competition between conventional financial entities and emerging tech companies. This healthy interplay creates a conducive environment for leaders to spearhead groundbreaking initiatives in the digital transformation realm, particularly within the BFSI segmen

Bank Automation

JANUARY 8, 2024

CaixaBank is deploying AI as a ‘cognitive assistant’ to personalize the bank’s services and streamline back-end processes. The $678 billion CaixaBank developed its own AI-driven assistant that can process direct debit refunds to eliminate the labor-intensive manual task, a spokesperson for the Madrid, Spain-based bank told Bank Automation News.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Fintech News

JANUARY 8, 2024

The Network for Electronic Transfers (NETS) has launched a card exchange programme for holders of the NETS FlashPay Card in response to the Land Transport Authority’s (LTA) decision to phase out the existing card-based ticketing system for adult commuters. Starting 19 January 2024, and continuing until 18 July 2024, users can exchange their FlashPay cards for a new NETS Prepaid Card at any of the 44 SimplyGo ticket offices across Singapore.

Finextra

JANUARY 8, 2024

Fraudsters are fickle. What’s new is old in the world of cybercrime, with fraudsters often just repa.

Bank Automation

JANUARY 8, 2024

Citizens Financial Group’s Citizen Pay is developing a new product offering to further enhance the platform’s ability to facilitate secure transactions as demand for contactless payments and digital wallets continues to tick up for e-commerce.

Finextra

JANUARY 8, 2024

The G20's plan to make cross-border payments faster, cheaper, more transparent and inclusive could increase fraud and money laundering, warns a new report.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

The Fintech Times

JANUARY 8, 2024

In the midst of difficult macroeconomic conditions and increasing pressure on firms in the region, the UK fintech startup ecosystem saw funding drastically decline in 2023, compared to previous recent years; according to the 2023 Tracxn ‘Geo Annual Report’ Research firm Tracxn revealed that the UK fintech startup ecosystem secured $4.2billion in funding throughout 2023 – representing a 63 per cent decline from the $11.2billion raised in 2022, and a 70 per cent fall from the tot

Finovate

JANUARY 8, 2024

Arc Technologies now counts more than $100 billion in committed capital on its venture lending platform. Arc Technologies has closed more than 350 transactions since it was founded in 2021. Last year’s Silicon Valley Bank crisis launched Arc Technologies into a period of growth, with more startups seeking alternative capital sources. Arc Technologies revealed through an exclusive interview with TechCrunch today that it now has more than $100 billion in committed capital on its lending plat

Finextra

JANUARY 8, 2024

Exponent Founders Capital, an early-stage venture capital firm led by former Plaid and Robinhood staffers, has raised $75 million for a fund to invest in startups from a host of sectors, including fintech.

Clearly Payments

JANUARY 8, 2024

In the rapidly advancing world of payments and eCommerce, merchants find themselves navigating a landscape of risk in payment processing. While these technologies bring unparalleled convenience and global reach, they also introduce a plethora of risks that can impact the financial stability and reputation of businesses. In this guide, we go into the topics of risk management in payment processing, equipping merchants with the knowledge and strategies needed to secure their transactions.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

The Paypers

JANUARY 8, 2024

B2B foreign trade financial service provider XTransfer has launched expanded its business to over 200 countries and regions to serve SMEs in cross-border trade.

Payments Dive

JANUARY 8, 2024

From rebates to rewards, CFOs can maximize cash flow by making every dollar work for them.

Finovate

JANUARY 8, 2024

U.K.-based digital identity provider OneID has forged a partnership with credit reference agency AperiData. The collaboration combines OneID’s customer authentication capabilities with AperiData’s financial and risk insights to enhance decision-making for lenders. Paula Sussex joined OneID as CEO in April of last year. The new partnership between digital identity provider OneID and credit reference agency AperiData will empower lenders and other financial institutions to make instant

Global Fintech & Digital Assets

JANUARY 8, 2024

The proposed regulatory framework would create substantive obligations on issuers of fiat-referencing stablecoins to safeguard the public. By Simon Hawkins and Adrian Fong On 27 December 2023, the Financial Services and the Treasury Bureau (FSTB) and the Hong Kong Monetary Authority (HKMA) released a consultation paper on their legislative proposal for a regulatory regime governing stablecoin issuers in Hong Kong (Consultation Paper).

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Finextra

JANUARY 8, 2024

Paymob, the leading financial services enabler in the Middle East, North Africa, and Pakistan (MENA-P) has announced its partnership with Tamara, the leading shopping and payments platform in the GCC region.

The Fintech Times

JANUARY 8, 2024

Financial inclusion has taken centre stage in Mali as a new partnership between Orange Finances Money Mali , an electronic money establishment and subsidiary of Orange Mali , and TerraPay , global cross-border payments network, has been signed. The new partnership will see 12 million Malians have greater communication with other African countries as well as the rest of the world.

Finextra

JANUARY 8, 2024

AbbeyCross, a wholesale FX platform focused on improving the payment market infrastructure for emerging market currencies, has raised US$6.5 million in a seed funding round.

The Fintech Times

JANUARY 8, 2024

A new year means new year’s resolutions. Although some people may look to better their health at the gym or choose to read more in 2024, research from Loqbox , the financial wellbeing business, has found that 84 per cent of its members are looking to establish new financial goals this year, as financial health becomes a bigger priority. A 2022 study from the UK’s Financial Conduct Authority (FCA) reported that 24 per cent of adults surveyed expressed low confidence in handling their mone

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Finextra

JANUARY 8, 2024

Orange Finances Money Mali, a leading Electronic Money Establishment and subsidiary of Orange Mali, is proud to announce a groundbreaking partnership with TerraPay, a global cross-border payments network with an extensive reach.

FloQast

JANUARY 8, 2024

The accounting profession is dynamic and ever-evolving, requiring professionals to stay abreast of the latest regulations, standards, and industry trends. Continuing Professional Education (CPE) credits are essential for certified public accountants (CPAs) and other accounting professionals to maintain their competence and licenses. These CPE standards are established jointly by the AICPA (American Institute of Certified Public Accountants) and NASBA (National Association of State Boards of Acco

Bank Automation

JANUARY 8, 2024

Citizens Financial Group’s Citizens Pay is developing a new product offering to further enhance the platform’s ability to facilitate secure transactions as demand for contactless payments and digital wallets continues to tick up for e-commerce.

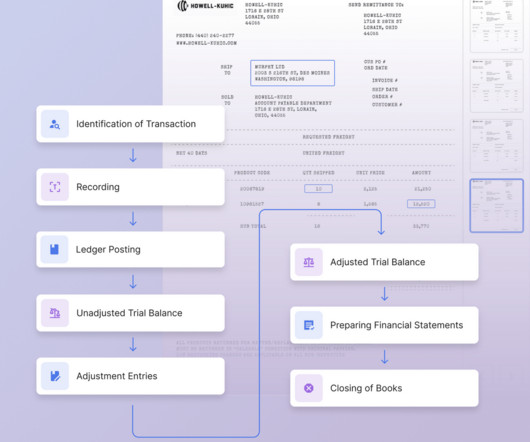

Nanonets

JANUARY 8, 2024

Bank Reconciliation is the process of matching the company's cash books to the bank statement. The aim is to ensure all transactions are accurately recorded in the company's cashbooks and to find any errors or fraud. Reconciliation includes matching the company’s balance sheet, income statement, bank statements, and expenses. Having an accurate set of financial statements is essential, or it can lead to complications in financial planning, tax compliance, and legal matters.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Let's personalize your content